Gold Price Forecast: XAU/USD bulls step on the gas in Asia

- Gold struggles to extend bounce off four-month-old support, retreats of late.

- Fed fund futures rally despite negative surprise from US NFP.

- Virus woes escalate, Sino-American tensions also underpin risk-off mood.

- Gold, Chart of the Week: Technicals aligned with fundamentals, $1,850 eyed

Update: Gold (XAU/USD) is rising due to the inflation risks that the federal Reserve has clearly highlighted in recent rhetoric, switching from being on the fence to possibly taking action as soon as December. In Asia, the price of XAU/USD has rallied from a low of $1,780.88 to a high of $1,786.65 so far.

The shift towards inflation at the Federal Reserve, despite the new coronavirus Omicron variant and less emphasis on the jobs market, is one that should be favourable to the gold bugs. Higher market volatility came as a consequence of recent Fed rhetoric and that is good for gold, bad for equities, and riskier asset classes.

The higher risk of 'persistent inflation' is where gold should thrive. Meanwhile, the Nonfarm Payrolls, while missing the prior and expectations, the data, in general, remains strong. Prospects of a fast taper can be supportive of the greenback, especially following positive revisions and solid details such as a lower Unemployment Rate at 4.2% vs 4.5% expected and 4.6% prior. However, this does not remove the need for protection against inflation which gold is renowned for.

End of update

Gold (XAU/USD) retreats below $1,800, easing to $1,781 amid Monday’s initial Asian session, following the heaviest daily run-up in over two weeks.

The yellow metal cheered a surprise drop in the US Nonfarm Payrolls (NFP) data for November, 220K versus 550K forecast, the previous day. However, However, a 0.4% fall in Unemployment Rate to 4.2% and Average Hourly Earnings matched the 4.8% YoY forecast. Following the data, the US dollar offered a knee-jerk reaction before resuming the north-run as Fed fund futures rallied.

The odds of the Fed rate hike earlier got fuelled by comments from St Louis Fed President James Bullard who is also a voting member in 2022. The policymakers said, “Could look at raising interest rates before completing the taper.”

Other than the Fed-linked chatters, the risk-off mood also took clues from the spread of the South African covid variant, dubbed as Omicron, as well as talks surrounding the US-China tussles. After initially hitting Europe and the UK, the virus strain tightens its grip towards reaching the key global nations like the US and China. It should be noted, however, that global scientists are optimistic over the cure. Recently, US top Medical Officer Anthony Fauci backed Pfizer’s drug to be effective against Omicron while the news of chewing gum to stop the virus spread and the UK’s push for treatment also keeps traders hopeful.

Elsewhere, news that China’s Premier Keqiang promised a Reserve Requirement Ratio (RRR) cut to the International Monetary Fund (IMF), without specifying the date, per the ANZ, also weigh on sentiment. On the same line were the recent headlines from the Wall Street Journal (WSJ) saying, “China wants to put its first Atlantic military base in Equatorial Guinea, U.S. intelligence shows. The prospect has set off alarm bells in Washington.”

Against this backdrop, Wall Street closed negative and the US 10-year Treasury yields slumped to the lowest since late September on Friday. That said, the S&P 500 Futures lick its wounds with 0.15% intraday gains at the latest.

Moving on, a light calendar and cautious sentiment ahead of next week’s Federal Open Market Committee (FOMC) meeting may challenge gold price moves. Though, Friday’s US Consumer Price Index (CPI) for November will be crucial to watch, not to forget coronavirus headlines and central bank comments.

Technical analysis

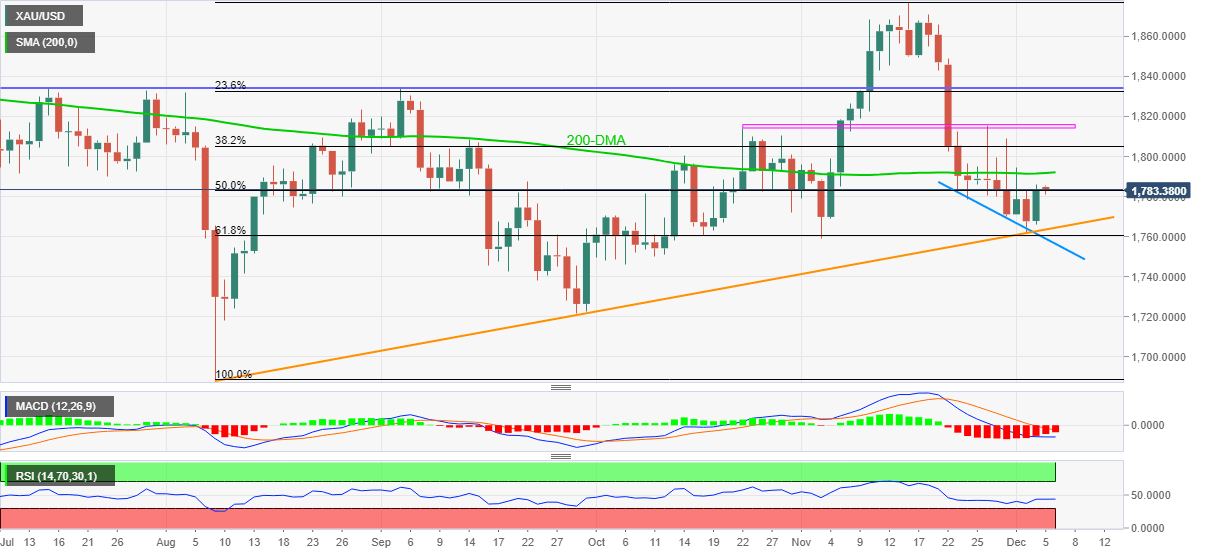

A four-month-old support line joined a softer-than-expected US NFP to trigger gold’s corrective pullback from the monthly low. However, bearish MACD signals and downbeat RSI line challenge the recovery moves below the key 200-DMA level surrounding $1,792.

While a clear upside past $1,792 will give a free hand to the gold buyers targeting the $1,800 threshold, a six-week hold horizontal area near $1,814-16 and a horizontal line comprising tops marked in July and September, surrounding $1,834, will test any further advances.

Meanwhile, a downside break of the stated support line from August, near $1,765, isn’t a green signal for the gold bears as 61.8% Fibonacci retracement (Fibo.) level of August-November upside and a two-week-old support line, close to $1,760-59 region, will challenge the south-run.

Should gold prices drop below $1,759, an extended fall towards September’s low of $1,721 can’t be ruled out.

Gold: Daily chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.