Gold price falls further towards $2,160 on firm US Dollar

- Gold price fails to hold all-time highs around $2,220 as the US Dollar strengthens.

- The US Dollar capitalizes on the strong US economic outlook.

- The Fed’s rate-cut campaign could be less aggressive than other central banks in developed nations.

Gold price (XAU/USD) extends its downside to near $2,160 in Friday’s early American session after failing to sustain close to its all-time highs above $2,220. The precious metal faces a sharp sell-off as the US Dollar strengthens on an upbeat United States economic outlook, reinforced by robust Existing Home Sales data released on Thursday. The US Dollar Index (DXY) refreshes a monthly high at 104.41.

Greenback-denominated Gold tends to face liquidity outflows when the US Dollar strengthens. The outlook for the US economy improved after the Federal Reserve upwardly revised growth forecasts for 2024. The Fed sees the US Gross Domestic Product (GDP) growing by 2.1%, up from the 1.4% it projected in December.

10-year US Treasury yields fall to 4.24% as the Fed reiterated on Wednesday that it expects three interest-rate cuts this year. Fed officials stuck to their outlook from December even though the consumer and producer price inflation remained sticky in February. US bond yields remain inside Thursday’s trading range, awaiting a fresh trigger for further guidance.

Daily digest market movers: Gold price slumps amid firm US Dollar

- Gold's price is pressured by the US Dollar’s strength. The appeal for the Greenback strengthened after the Swiss National Bank (SNB) emerged as leading the global rate-cut cycle. The SNB surprisingly reduced interest rates by 25 basis points (bps) to 1.50% on Thursday. This has increased optimism among market participants about other central banks following the same pattern, particularly in economies where inflation is decelerating and risks of a recession are high.

- The European Central Bank (ECB), the Bank of England, and the Bank of Canada (BoC) are also expected to start considering rate cuts soon. Due to their poor economic outlook, rate cuts could be aggressive in the longer term.

- Like other central banks, market participants anticipate that the Federal Reserve will also begin cutting interest rates this year. However, the Fed is not expected to rush for rate cuts as the US inflation is sticky and the US economic outlook is upbeat. The US economy exhibits a firm footing on the grounds of consumer spending and the labor market, providing time for the Fed to observe more data before moving to cuts.

- This week, the Gold price saw a strong rally after the Fed stuck to projections of three rate cuts for 2024. Fed Chair Jerome Powell said in his monetary policy statement that the story of easing price pressures is intact despite recent hot inflation readings.

- Though the Fed maintained its view of three rate cuts, it was clear from its side that rate cuts would be appropriate only if it gains greater confidence that inflation will sustainably come down to the 2% target. Assets that pay no interest, such as Gold, face downside pressure when the Fed keeps interest rates higher for a longer period.

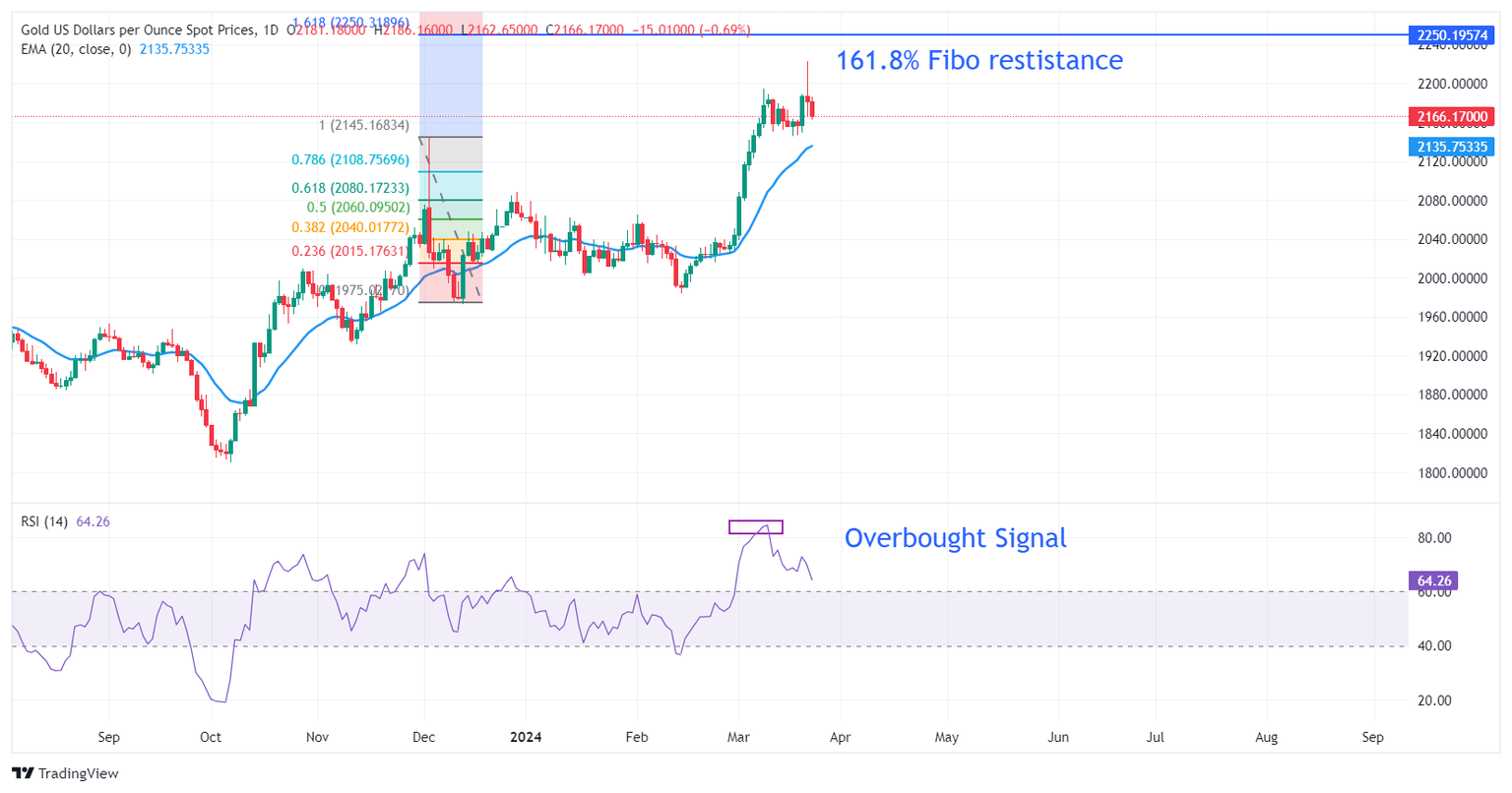

Technical Analysis: Gold price falls as oscillators turn overbought

Gold price drops significantly to $2,162 from its all-time high of $2,222. Profit-booking dragged the Gold price as momentum oscillators turned extremely overbought on the daily time frame. This doesn’t exhibit a bearish reversal as the asset could rebound after oscillators cool down. The 14-period Relative Strength Index (RSI) drops after reaching a little above 84.00. The RSI (14) is considered extremely overbought when it climbs above 80.00.

The near-term demand for the Gold price remains strong as the 20-day Exponential Moving Average (EMA) at $2,137 is sloping higher.

On the upside, the Gold price could face resistance near the 161.8% Fibonacci extension at $2,250. The Fibonacci tool is plotted from December 4 high at $2,144.48 to December 13 low at $1,973.13. On the downside, December 4 high at $2,144.48 will support the Gold price bulls.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.