Gold price sticks to modest gains; upside seems limited ahead of FOMC Minutes

- Gold price turns positive for the second straight day and draws support from a combination of factors.

- Trade war fears and geopolitical risks lend support to the XAU/USD amid a modest USD downtick.

- The Fed’s hawkish stance and elevated US bond yields might cap the upside ahead of FOMC Minutes.

Gold price (XAU/USD) sticks to modest intraday gains through the first half of the European session on Wednesday, albeit it lacks bullish conviction and remains below the $2,665 resistance zone retested the previous day. The uncertainty surrounding US President-elect Donald Trump's tariff plans, trade war fears, geopolitical tensions and a softer risk tone turn out to be key factors acting as a tailwind for the safe-haven bullion.

That said, the Federal Reserve's (Fed) hawkish shift, which keeps the US Treasury bond yields elevated near a multi-month top, along with the emergence of some follow-through US Dollar (USD) buying, caps the non-yielding Gold price. Traders also seem reluctant ahead of the US labor market reports – the ADP report on private-sector employment and Weekly Initial Jobless Claims – and FOMC meeting Minutes due later today.

Gold price bulls seem non-committed ahead of FOMC meeting Minutes

- The US Treasury bond yields and the US Dollar jumped on Tuesday after strong US data reaffirmed market expectations that the Federal Reserve will slow the pace of its rate-cutting cycle this year.

- The Institute for Supply Management reported that its Non-Manufacturing Purchasing Managers' Index (PMI) rose to 54.1 in December and the Prices Paid component rose to a nearly two-year high.

- Separately, the Job Openings and Labor Turnover Survey, or JOLTS report, showed that job openings unexpectedly increased to 8.098 million by the last day of November from the 7.839 million previous.

- The data pointed to a still resilient US economy and support prospects for fewer Fed rate cuts in 2025, lifting the yield on the benchmark 10-year US government bond to its highest level since April.

- Atlanta Fed President Raphael Bostic said that the central bank should be cautious with policy decisions amid the uneven progress on lowering inflation and err on the side of keeping rates elevated.

- US President-elect Donald Trump denied a Washington Post story that his administration will pursue a less aggressive tariff regime and target certain sectors critical to US national or economic security.

- Trump hinted at possible military intervention if Israeli captives held in Gaza are not released before he takes office, raising the risk of a further escalation of geopolitical tensions in the Middle East.

- Traders now look to Wednesday's US economic docket – featuring the release of the ADP report on private-sector employment and the usual Weekly Initial Jobless Claims – for short-term opportunities.

- The focus, however, remains on FOMC meeting Minutes, which will play a key role in influencing the USD price dynamics and providing a fresh impetus to the Gold price later during the US session.

Gold price remains below $2,665 pivotal resistance, bullish bias remains

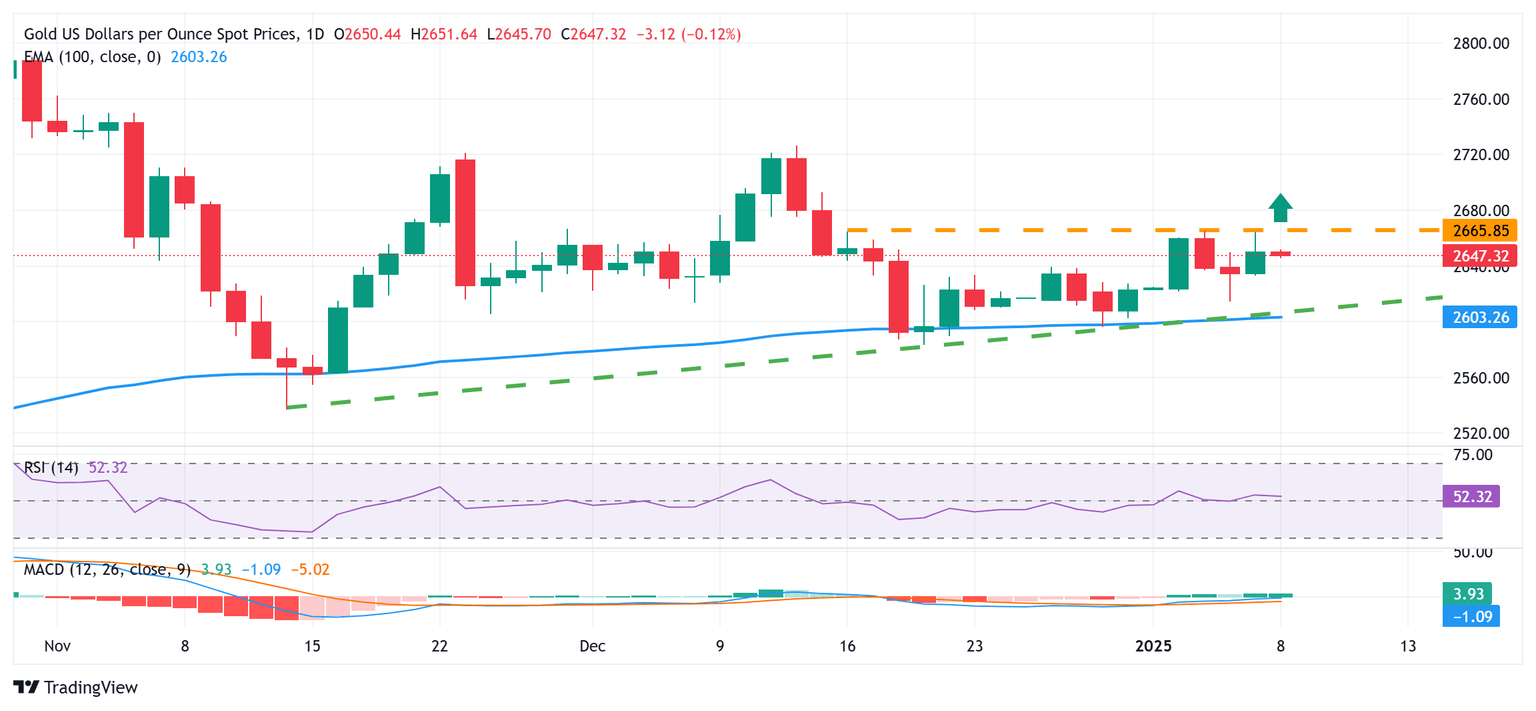

From a technical perspective, the $2,665 horizontal zone now seems to have emerged as an immediate strong barrier. Given that oscillators on the daily chart have just started moving in positive territory, a sustained strength beyond the said barrier will be seen as a fresh trigger for bulls and pave the way for additional gains. The subsequent move up might then lift the Gold price to an intermediate resistance near the $2,681-2,683 zone en route to the $2,700 mark.

On the flip side, weakness below the $2,635 area might continue to find some support near the weekly swing low, around the $2,615-2,614 region touched on Monday. This is followed by the $2,600 confluence, comprising the 100-day Exponential Moving Average (EMA) and a short-term ascending trend line extending from the November monthly trough. A convincing break below could expose the December swing low, around the $2,583 area, which if broken will shift the near-term bias in favor of bearish traders.

Economic Indicator

FOMC Minutes

FOMC stands for The Federal Open Market Committee that organizes 8 meetings in a year and reviews economic and financial conditions, determines the appropriate stance of monetary policy and assesses the risks to its long-run goals of price stability and sustainable economic growth. FOMC Minutes are released by the Board of Governors of the Federal Reserve and are a clear guide to the future US interest rate policy.

Read more.Next release: Wed Jan 08, 2025 19:00

Frequency: Irregular

Consensus: -

Previous: -

Source: Federal Reserve

Minutes of the Federal Open Market Committee (FOMC) is usually published three weeks after the day of the policy decision. Investors look for clues regarding the policy outlook in this publication alongside the vote split. A bullish tone is likely to provide a boost to the greenback while a dovish stance is seen as USD-negative. It needs to be noted that the market reaction to FOMC Minutes could be delayed as news outlets don’t have access to the publication before the release, unlike the FOMC’s Policy Statement.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.