Gold ascends as US yields climbed, eyes on US Core PCE

- Gold registers gains of over $0.20 following the Fed's less dovish approach.

- Economic data shows US economic growth at 3.1% YoY in Q3.

- Potential US government shutdown looms, enhancing Gold's appeal as a safe-haven asset amidst uncertainty.

On Thursday, the Gold price trimmed some of its losses from Wednesday, posting a timid advance of 0.20%. Thursday’s minor gain follows the Federal Reserve’s (Fed) decision to adopt a more gradual stance, pushing against three interest rate cuts for 2025. The XAU/USD trades at $2,588 after reaching a daily high of $2,626.

The US economic docket on Thursday witnessed a drop in Americans asking for unemployment benefits. In the meantime, US GDP grew 3.1% YoY in Q3 in its final release, according to the US Bureau of Economic Analysis.

Despite this, the financial markets are focused on deciphering what will happen in 2025. Fed Chair Jerome Powell and the Federal Open Market Committee (FOMC) board reduced borrowing costs by 25 basis points. It wasn’t unanimous, however, as Beth Hammack of the Cleveland Fed voted to maintain the “status quo.”

In addition, Fed officials have turned their attention to inflation, as expressed in the dot plot. They forecast two 25 bps rate cuts in 2025 and two more for 2026.

In the meantime, the US government is only days away from being shut down with US President-elect Donald Trump pressuring Republicans in the House of Representatives to increase or eliminate the debt ceiling.

Additionally, Reuters cited Politico sources that US Speaker Johnson and President-elect Trump’s team are encircling a new federal funding stop-gap plan that includes disaster aid, pushing off a debt limit fight for two years, and agreeing to a one-year farm bill extension.

A possible government shutdown would push Bullion prices higher due to its safe-haven status amid political uncertainty, which tends to thrive in a low-interest environment.

Ahead this week, the economic docket will feature the release of the core Personal Consumption Expenditures (PCE) Price Index, the Fed’s favorite inflation gauge, and the University of Michigan (UoM) Consumer Sentiment poll.

Daily digest market movers: Gold price holds to gains below $2,600

- Gold prices climb amid rising US real yields, which are up by three basis points to 2.248%, a headwind for the precious metal.

- The US 10-year Treasury bond yield rose five basis points to 4.568% after the Fed’s decision.

- The US Dollar Index, which tracks the performance of the American currency against six others, surged 0.16% to 108.39.

- Initial Jobless Claims in the US for the week ending December 14 dipped from 242K to 220K, below forecasts of 230K, an indication that the labor market remains solid.

- The Gross Domestic Product in Q3 ended at 3.1%, above estimates of 2.8% and up from 3% in Q2.

- Federal Reserve officials estimate inflation to end 2024 at 2.8% , 2.5% in 2025, and 2.2% in 2026.

- Policymakers project the economy to grow by 2.5% in 2024, 2.1% in 2025, and 2% in 2026.

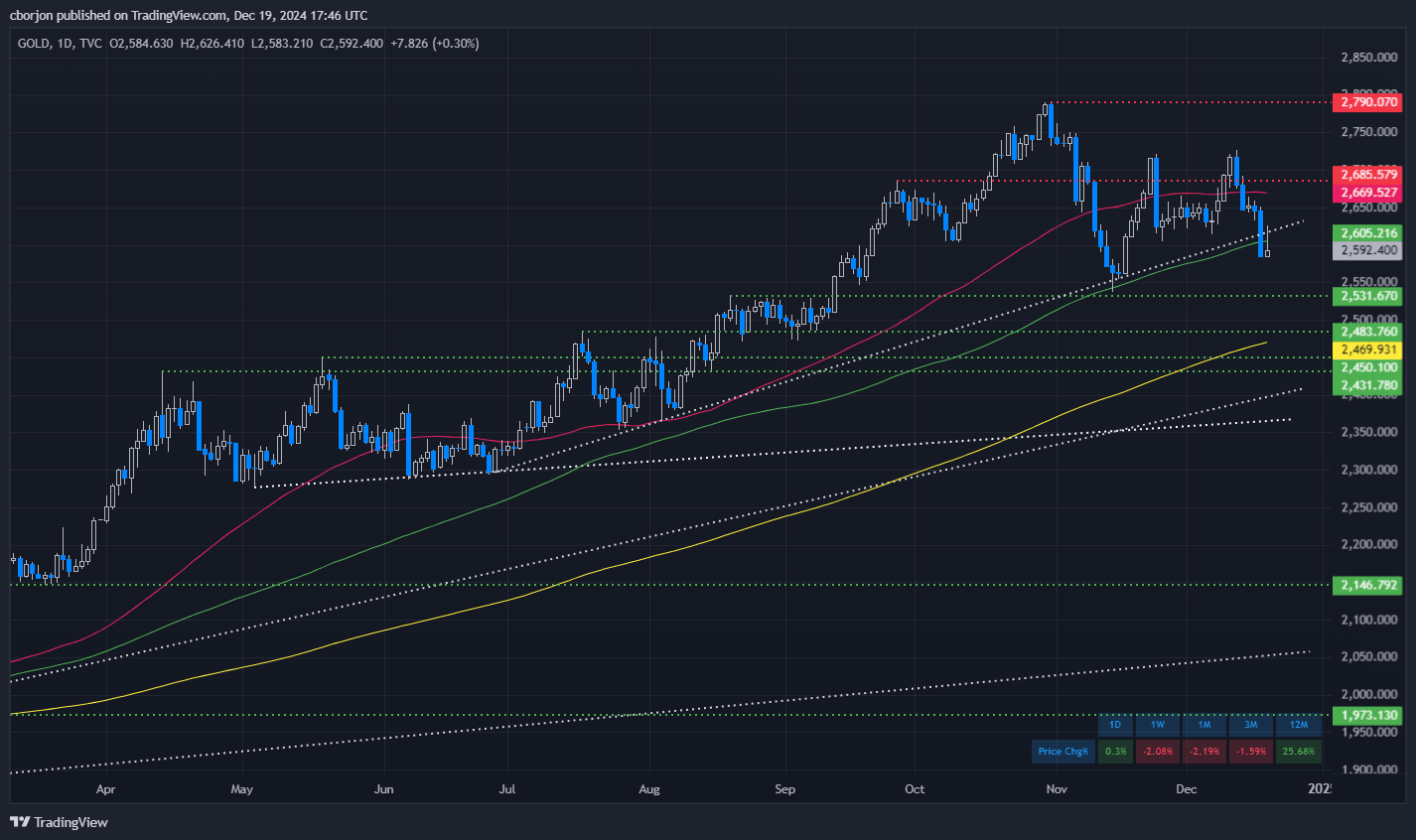

XAU/USD technical outlook: Gold upside limited by 100-day SMA

Gold price uptrend is intact, though it’s facing stir resistance at the 100-day Simple Moving Average (SMA) at $2,605 and the psychological $2,600 figure. In the short term, momentum favors sellers as depicted by the Relative Strength Index (RSI) below its neutral line.

For a bearish resumption, bears need to clear the $2,550 figure, followed by the November 14 swing low of $2,536. If surpassed, the next stop would be the $2,500 level.

For a bullish resumption, the XAU/USD must clear $2,600, then $2,650, and the 50-day SMA at $2,670. Once cleared, the next stop would be $2,700.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.