Gold price consolidates below one-month peak; bulls not ready to give up

- Gold price witnesses an intraday turnaround from over a one-month top touched on Thursday.

- Geopolitical risks, trade war fears and December Fed rate cut bets lend support to the XAU/USD.

- Bet for a less dovish Fed and rising US bond yields cap gains for the non-yielding yellow metal.

Gold price (XAU/USD) struggles to capitalize on its intraday bounce from sub-$2,700 levels and holds steady in neutral territory during the first half of the European session on Thursday. The US Consumer Price Index (CPI) report released on Wednesday indicated that the progress in lowering inflation toward the Federal Reserve's (Fed) 2% target has virtually stalled. This, along with speculations that US President-elect Donald Trump's expansionary policies will boost inflation, suggests that the Fed will adopt a more cautious stance on cutting interest rates. The less dovish outlook leads to a further rise in the US Treasury bond yields and acts as a headwind for the non-yielding yellow metal.

The downside for the Gold price, however, remains cushioned in the wake of geopolitical risks stemming from the worsening Russia-Ukraine war and tensions in the Middle East. Moreover, concerns over Trump's tariff plans and bets that the Fed will deliver a third consecutive interest rate cut next week continue to act as a tailwind for the safe-haven XAU/USD. Meanwhile, subdued US Dollar (USD) price action does little to provide any impetus to the commodity. Traders now look forward to the US macro data – the Producer Price Index (PPI) and the usual Weekly Initial Jobless Claims – for short-term impetus. The focus, however, remains glued to the FOMC monetary policy decision on December 18.

Gold price lacks firm intraday direction amid mixed fundamental cues

- The release of the mostly in-line US consumer inflation figures on Wednesday reinforced market expectations that the Federal Reserve will lower borrowing costs again at its upcoming policy meeting next week.

- The US Bureau of Labor Statistics (BLS) reported that the headline Consumer Price Index rose 0.3% in November, marking the largest gain since April, and the yearly rate edged up to 2.7% from 2.6% in October.

- Additional details revealed that the core gauge, which excludes volatile food and energy prices, increased 0.3% during the reported month and was up 3.3% as compared to the same time period last year.

- According to the CME Group's FedWatch Tool, the likelihood of another 25-basis points rate cut by the Fed on December 18 shot to more than 98%, pushing the Gold price to over a one-month high on Thursday.

- The lifts the yield on the benchmark climbs to a two-week high amid expectation that US President-elect Donald Trump's policies will boost inflationary pressures and force the Fed to pause its rate-cutting cycle.

- This, in turn, assists the US Dollar to preserve its recent strong gains to a fresh monthly top, which, along with the prevalent risk-on environment, prompts some profit-taking around the non-yielding yellow metal.

- Meanwhile, geopolitical risk premium remains in play amid the worsening Russia-Ukraine war and the ongoing conflicts in the Middle East. Moreover, trade war fears should help limit losses for the XAU/USD.

- Traders now look to Thursday's US economic docket – featuring the release of the US Producer Price Index and the usual Weekly Initial Jobless Claims data – for some impetus later during the North American session.

- The focus, however, will remain glued to the highly anticipated FOMC monetary policy meeting next week, which will play a key role in determining the next leg of a directional move for the non-yielding commodity.

Gold price bullish potential seems intact while above the $2,700 mark

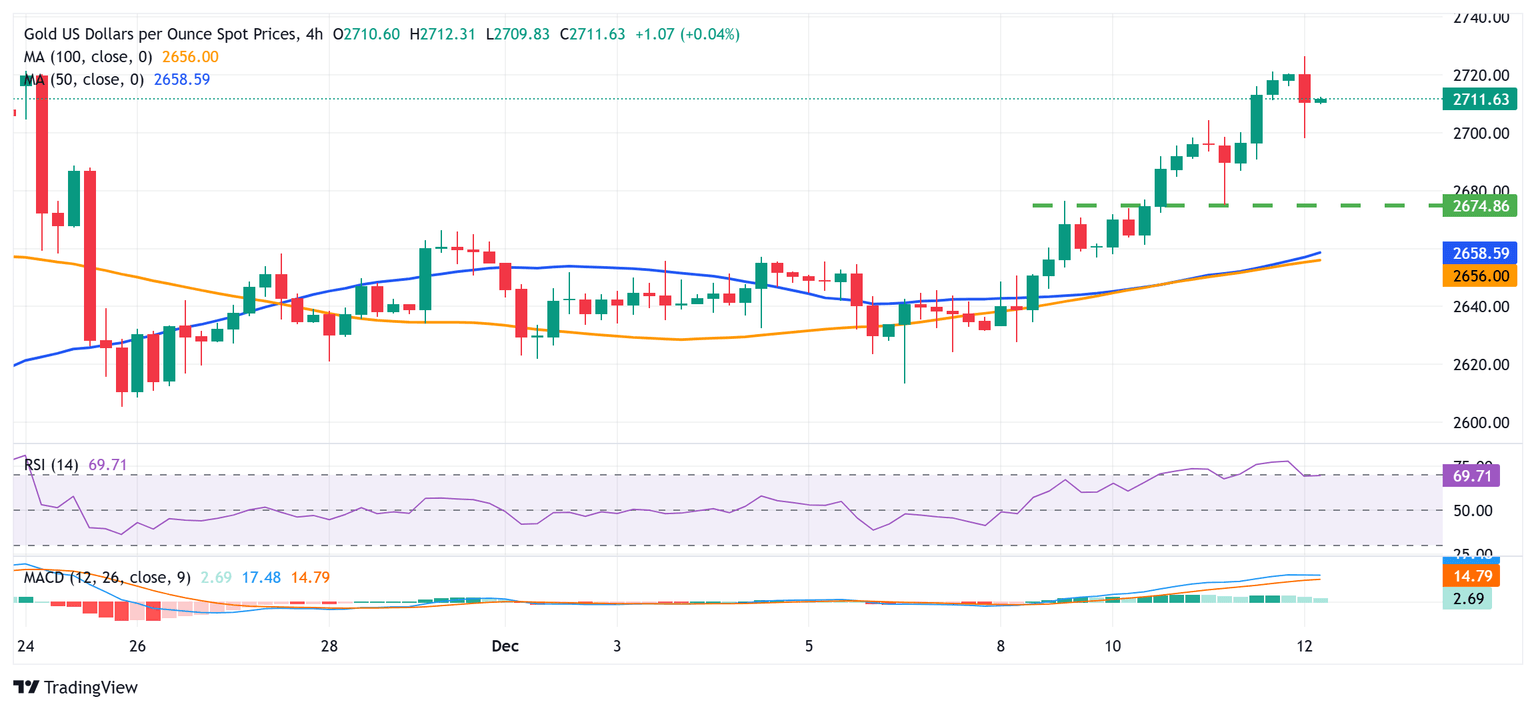

From a technical perspective, the Relative Strength Index (RSI) on hourly charts has eased from slightly overbought conditions. Furthermore, oscillators on the daily chart have just started gaining positive traction, which, in turn, supports prospects for the emergence of some dip-buying around the Gold price. Hence, any further weakness below the $2,700 mark might continue to find some support near the overnight swing low, around the $2,675-2,674 area. Some follow-through selling, however, could pave the way for further losses towards the $2,658-2,656 confluence – comprising 50- and 200-period Simple Moving Averages (SMAs) on the 4-hour chart.

On the flip side, the Asian session high, around the $2,726 area, now seems to act as an immediate hurdle, above which the Gold price could aim to surpass the $2,735 barrier and test the $2,748-2,750 supply zone. A sustained strength beyond the latter will set the stage for a move towards challenging the all-time peak, around the $2,800 neighborhood touched in October, with some intermediate resistance near the $2,775 region.

Economic Indicator

Producer Price Index (YoY)

The Producer Price Index released by the Bureau of Labor statistics, Department of Labor measures the average changes in prices in primary markets of the US by producers of commodities in all states of processing. Changes in the PPI are widely followed as an indicator of commodity inflation. Generally speaking, a high reading is seen as positive (or bullish) for the USD, whereas a low reading is seen as negative (or bearish).

Read more.Next release: Thu Dec 12, 2024 13:30

Frequency: Monthly

Consensus: 2.6%

Previous: 2.4%

Source: US Bureau of Labor Statistics

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.