Gold Price Forecast: XAU/USD rebound eyes $1,753, focus on recession, US employment data

- Gold Price portrays a corrective pullback from the lowest levels since September 2021.

- Oversold RSI favors recovery moves targeteeing 78.6% Fibonacci Retracement level.

- Fears of global economic slowdown, hawkish Fed bets weigh on the prices but a lack of catalysts triggers rebound.

- US ADP Employment Change, ECB Minutes will be crucial for intraday directions, NFP is the key.

Gold Price (XAU/USD) consolidates the recent losses around a 10-month low, picking up bids near $1,742 during Thursday’s Asian session.

The yellow metal’s recent rebound could be linked to the lack of major data/events during the Asian session, as well as the trader’s anxiety ahead of today’s ECB Monetary Policy Meeting Accounts (mostly known as ECB Minutes), as well as the US ADP Employment Change for June, expected 200K versus 128K prior.

Also likely to have favored the XAU/USD could be the US Treasury yields as they reverse the previous day’s recovery from a five-week low. That said, the US 10-year Treasury yields declined one basis point (bp) to 2.90% by the press time.

It’s worth noting that the 2-year bond coupon retreats to 2.96% while showing the inverse gap between the 10-year and 2-year yields, which in turn hints at the global recession fears. International Monetary Fund (IMF) Managing Director Kristalina Georgieva also said, per Reuters, “Global economic outlook has 'darkened significantly' since last economic update.” the IMF chief also added, “Cannot rule out the possible global recession in 2023.”

Additionally, softer US data could also be blamed for the gold’s latest rebound. US ISM Services PMI for June dropped to 55.3 versus 55.9 in May. The actual figure, however, came in better than the market expectation of 54.5. It’s worth noting that the US JOLTS Job Opening for May declined to 11.25 million versus 11.00 million expected and 11.68 million prior.

However, the Federal Open Market Committee (FOMC) Minutes favored the Fed hawks as the Fed policymakers appear determined to announce another 75 basis points (bps) of a rate hike. That said, the latest Fed Minutes highlighted the need for the “restrictive stance of policy” while also saying, “even more restrictive stance could be appropriate if elevated inflation pressures were to persist”.

Amid these plays, the Wall Street benchmarks closed with mild gains whereas the S&P 500 Futures print mild losses at around 3,850 by the press time.

Moving on, gold traders should pay attention to the monthly print of the US ADP Employment Change for June, expected 200K versus 128K prior, as it becomes the early signal for Friday’s Nonfarm Payrolls (NFP). Additionally important will be the recession signals and other second-tier US data, like weekly jobless claims and monthly trade numbers.

Technical analysis

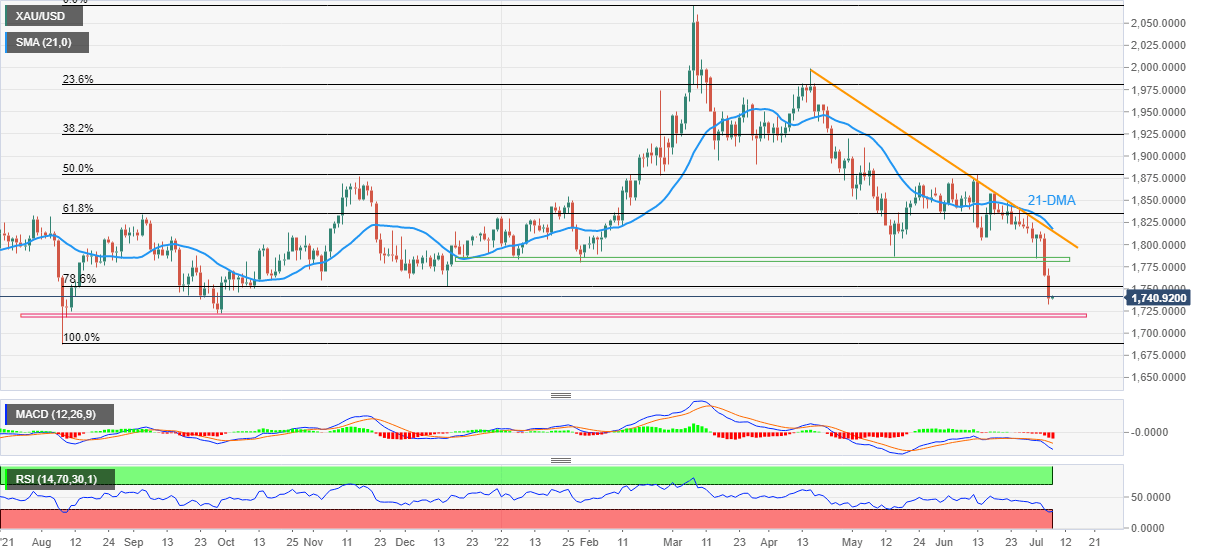

Gold Price justifies oversold RSI (14) to portray a corrective pullback towards the 78.6% Fibonacci retracement of August 2021 to March 2022 upside, near $1,753.

It should be noted, however, that the XAU/USD upside past $1,753, could challenge the previously key horizontal support from late 2021, now resistance around $1,780-85. Following that, a convergence of the 21-DMA and a downward sloping resistance line from April 14, near $1,817, will be important to watch.

Alternatively, a horizontal area comprising lows marked since August 2021, near $1,720, restricts the immediate downside of the Gold Price.

Should the quote remains below $1,720, the odds of its slump to the late 2021 low surrounding $1,687 can’t be ruled out.

Gold: Daily chart

Trend: Further recovery expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.