Gold Price Analysis: XAU/USD eyes key $1922 upside level amid US election chaos – Confluence Detector

Gold (XAU/USD) is looking for a clear direction while holding above $1900. The metal witnessed wild swings in choppy trading on Wednesday, in light of the chaotic and long US election. As it stands, Democrat Joe Biden is closer towards the US Presidency following a tighter race but the Trump campaign has filed a legal battle to contest the elections.

Meanwhile, prospects of Republicans taking over the Senate point towards a continued stimulus deadlock on a Biden win and keep markets unnerved. The risk-off flows amid election and policy uncertainty will likely keep a floor under gold prices, as attention turns towards the FOMC decision and US NFP report.

How is gold positioned technically?

Gold: Key resistances and supports

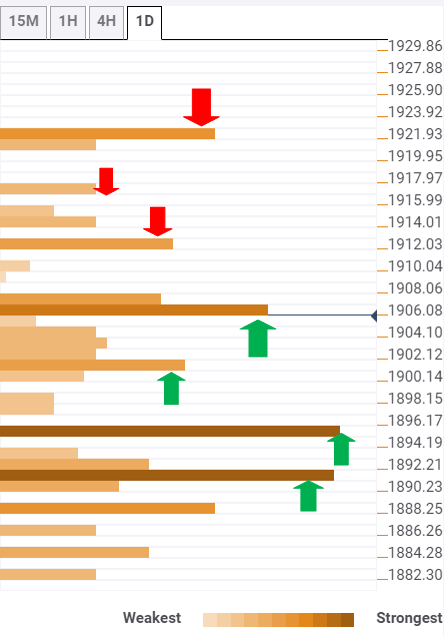

The Technical Confluences Indicator shows that the yellow metal is holding firmer so far this session, looking to test immediate resistance at $1912, the confluence of the previous week high and Bollinger Band one-hour Upper.

Further up, a dense cluster of resistance is seen around $1916, which is the intersection of the previous day high and SMA50 one-day.

Acceptance above the latter could open doors towards the next relevant barrier at $1922, where the pivot point one-month R1 is located.

Alternatively, a breach of the major support at $1906, the convergence of the Fibonacci 61.8% one-month and previous high on four-hour, could prompt the sellers to regain control.

The next downside target is aligned at $1901, the SMA5 on four-hour. A failure to defend the last would expose the powerful support at $1895, which is the meeting point of the Fibonacci 38.2% one-day, SMA100 one-day and SMA10 one-day.

Bears need a sustained break below the critical cushion at $1891 to unleashing further losses. That level is the confluence of the SMA100 one-hour and SMA5 one-day.

Here is how it looks on the tool

About Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.