Gold Price Analysis: XAU/USD eyes $1740 as the next upside target – Confluence Detector

Having found strong support at $1700 on Friday, Gold (XAU/USD) is looking to extend the bounce this Monday amid fears about a potential rise in inflation, thanks to the massive US $1.9 trillion stimulus. However, the reflation trade-backed fresh lift in the US Treasury yields keeps the gains in check.

The benchmark 10-year rates on the US Treasuries are back above 1.60%, as we head into the FOMC week, with investors awaiting President Joe Biden’s COVID-149 rescue plan for fresh impetus. In the meantime, the focus will continue to remain on the Treasury yields.

How is gold positioned on the technical graphs?

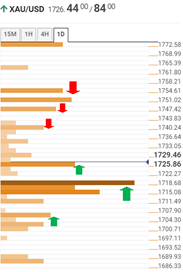

Gold Price Chart: Key resistance and support levels

The Technical Confluences Detector shows that gold is looking to recapture the previous week high at $1740 amid a lack of healthy resistance levels.

Above that level, the XAU bulls would test the confluence of the Fibonacci 161.8% one-day and pivot point one-day R2 at $1747.

An immediate cap around $1751 could challenge the bullish commitment, where the pivot point one-week R1 is placed.

The next relevant barrier is seen at $1754, the Fibonacci 23.6% one-month.

To the downside, if the selling pressure resumes, gold could drop below the immediate cushion seen at $1723.50, which is the confluence of the Fibonacci 23.6% one-week, the previous low on four-hour and SMA10 one-hour.

The bears need to crack crucial support at $1720/$1717 to unleash the downside. That level is the meeting point of the Fibonacci 61.8% one-day, the previous month low and Fibonacci 38.2% one-week.

The convergence of the SMA10 and 5 one-day at $1713 would limit the losses. Sellers would then aim for the $1705 support, where the Fibonacci 23.6% one-day coincides with the pivot point one-day S1.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.