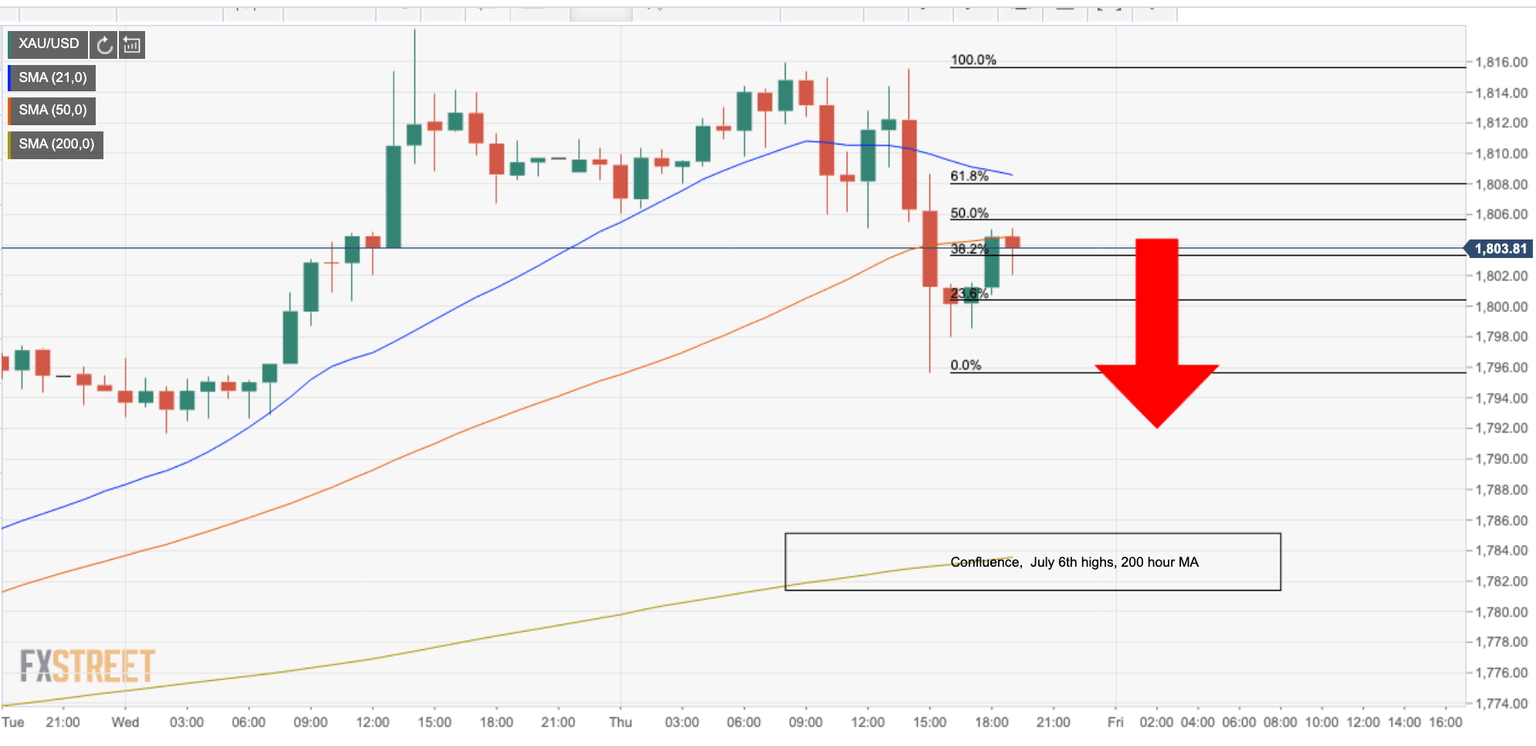

Gold Price Analysis: XAU/USD bears looking for some downside below $1,800 to 200-hour MA

- Gold on the verge of a break below 1800 and bears eye run to 200-hour moving average.

- On the flipside, fundamentals play out and the normalizing inflation expectations underpin the bullish case longer-term.

The price of gold has been on the move on Thursday, taking on bullish commitments just below the psychological $1,800 level.

We have seen a bearish spike from the resistance area between $1,816 and $1,818/16 and a test below the level for a low of $1,795 so far.

The bullish correction is meeting a 38.2% hourly Fibonacci level with the confluence of hourly swing lows/support, More on the technicals outlook below, but the prospects are favouring the bears at this juncture.

From a fundamental standpoint, however, "the yellow metal is torn between its safe-haven bona fides, which are prompting money managers to sell on risk-on behaviour in markets, and its inflation-hedge characteristics, which are driving a swarm of capital to seek refuge in the yellow metal," analysts at TD Securities argued.

Fauci says states with major outbreaks should ‘seriously look at shutting down’ again

Meanwhile, gold is always going to flourish so long as the risks of lockdown persist.

Anthony S. Fauci, the nation’s top infectious-disease official, is advising that some states seriously consider “shutting down” again if they are facing major resurgences of the virus — a warning that conflicts with President Trump’s push to reopen the country as quickly as possible, The Washington Post reported.

Fauci added Thursday that he hopes there’s not a need for new shutdowns, saying it “would not be viewed very, very favourably,” and urged states to pause their reopening process to slow the spread of the virus so that renewed shutdowns are not necessary.

Real rates will continue to drive gold prices higher

Ultimately we anticipate that real rates will continue to drive gold prices higher as normalizing inflation expectations and suppressed rates vol provide fuel for the trade. Meanwhile, the industrial-precious silver could outperform — benefiting from both the positive precious metals environment and its industrial characteristics, at a time when its supply may remain constrained,

the analysts at TD Securities explained.

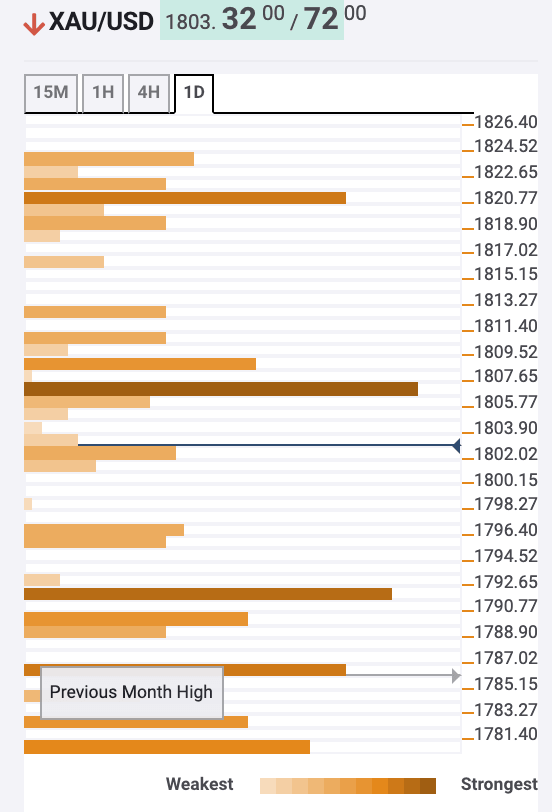

Gold levels

As per the introduction to technical mentioned above, the price is on the verge of another bearish impulse to the downside.

If the hourly 21 and 50 moving averages can hold the price down, then the path of least resistance is likely a break to the downside towards the 200-hour moving average and the previous month's high.

FXStreet Technical Confluences Indicator

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.