Gold Price Analysis: Holding onto $1862 pivotal for sustained recovery – Confluence Detector

The optimism over US fiscal stimulus and a thaw in the US dollar’s rally helped Gold (XAU/USD) recover nearly $30 from two-month lows of $1849. Meanwhile, the yellow metal also cheered concerns about the strength of the US economic recovery, in the wake of the stubbornly high Jobless Claims.

In the day ahead, it remains to be seen if the metal sustains the pullback, as the focus shifts back to the fundamentals, with major central banks’ on-hold and the coronavirus resurgence. Let’s see how gold is positioned technically heading into the weekly closing.

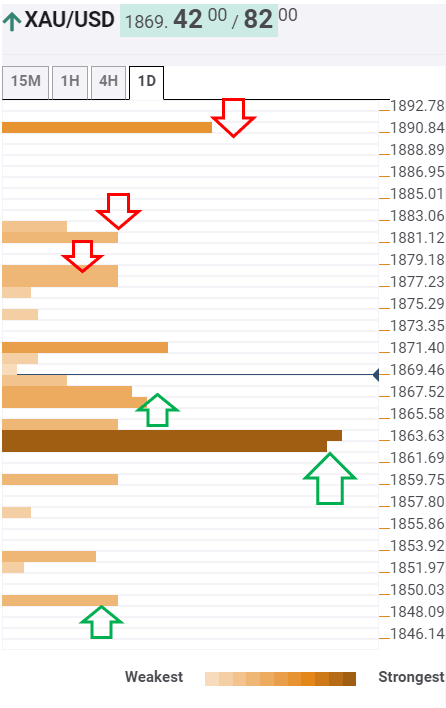

Gold: Key resistances and supports

The Technical Confluence tool shows that gold is looking to test a dense cluster of resistances around $1877, which is the convergence of the previous day high and Bollinger one-day Lower.

The next resistance sits at $1881, the pivot point one-day R1. Further north, the confluence of the pivot point one-week S3 and SMA100 one-hour at $1890 could be put to test.

To the downside, a minor cushion is seen at $1871.50, where the Fibonacci 23.6% one-day intersects the previous high on four-hour.

A failure to defend the latter, the bears could try taking out the next downside target at $1868, the SMA5 four-hour and Fibonacci 38.2% one-day meeting point.

However, the last straw for the bulls remains the critical support at $1862, below which the near-term recovery momentum could fade. The level is the confluence of the previous month low, pivot point one-month S1 and SMA10 four-hour.

Thursday’s low at $1949 could be back in play should the aforesaid support give way.

Here is how it looks on the tool

About the Confluence Detector

The TCI (Technical Confluences Indicator) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Learn more about Technical Confluence

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.