Gold rises towards $2,750 on US election woes, risk aversion

- Gold price surges to an all-time high, nearing the $2,750 mark, supported by geopolitical tensions and expectations of further Fed rate cuts.

- Despite rising US Treasury yields, risk aversion and fears of a Trump presidency drive safe-haven demand for Gold.

- Traders are pricing in 42 bps of Fed rate cuts by year-end with 89.6% odds of a 25 bps cut at the November meeting.

Gold prices extended their gains for the fifth day out of the last six and reached an all-time high (ATH) at $2,748, just shy of the psychological $2,750 mark. Geopolitical tensions and expectations that the Federal Reserve (Fed) would continue to lower borrowing costs are tailwinds for the yellow metal. Therefore, XAU/USD trades at $2,744, gaining almost 1%.

Risk aversion keeps the non-yielding metal underpinned, ignoring soaring US Treasury yields. Since the Fed cut rates by 50 basis points (bps) at the September 18 meeting, the US 10-year Treasury note has risen 62 bps to 4.20%, indicating that traders are pricing in a less dovish Fed.

Fears of a Donald Trump presidency have pushed the golden metal higher. The former President has stated that he would impose tariffs and restrict undocumented immigration.

US bonds were sold off on Monday, which, according to TD Securities analysts, “was partly driven by the prediction markets' pricing in higher odds of a Trump victory.”

Aside from this, Fed officials crossed the wires. San Francisco Fed President Mary Daly said she supports further easing and hasn’t seen any reason not to continue lowering rates. Later, Kansas City Fed President Jeffrey Schmid took a more cautious stance, stating his preference to avoid outsized rate cuts and noting that the labor market is experiencing normalization rather than deterioration.

Traders are now pricing in 42 basis points of cuts by year-end, indicating a less than certain chance that the Fed will make 25 basis point cuts at each of its coming two meetings.

Meanwhile, tensions in the Middle East remain high as Israel prepares to retaliate against Iran following the 200-missile raid.

Despite that, the Fed is heavily expected to lower interest rates by 25 basis points at the November meeting. Odds remained at 89.6%, according to CME FedWatch Tool data.

Daily digest market movers: Gold price rises, ignoring higher US yields

- On Thursday, US Initial Jobless Claims for the week ending October 19 are foreseen rising from 241K to 242K.

- October’s S&P Global Manufacturing PMI is expected to improve from 47.3 to 47.5. The Services PMI for the same period is estimated to dip from 55.2 to 55.

- Data from the Chicago Board of Trade, based on the December Fed funds rate futures contract, indicates that investors estimate 47 basis points (bps) of Fed easing by the end of the year, which is slightly lower compared to a week ago.

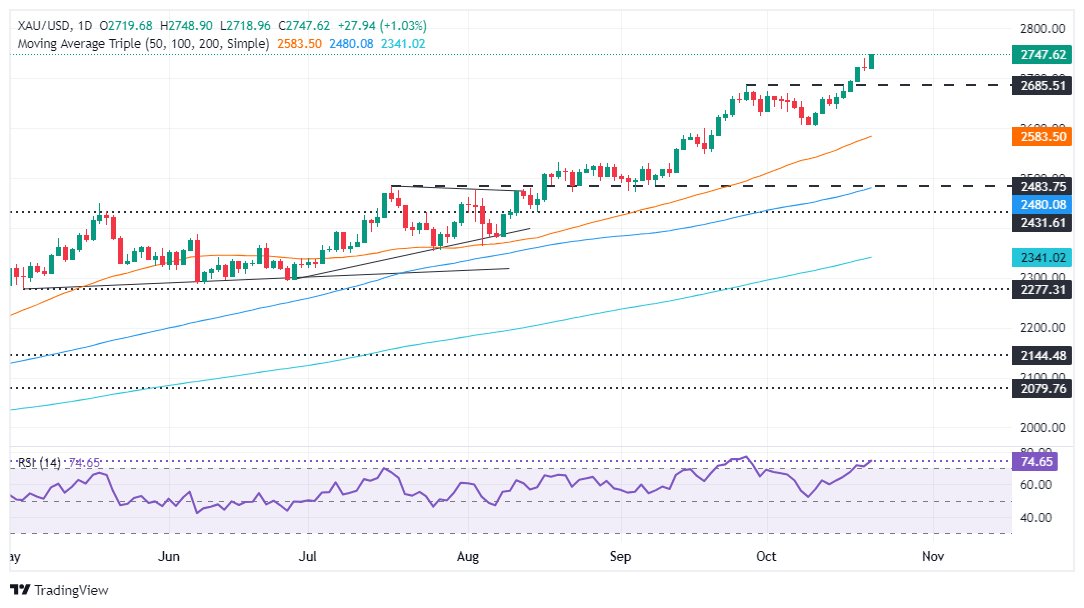

XAU/USD technical outlook: Gold price climbs toward $2,750

Gold price ignored the formation of a Gravestone Doji candlestick pattern on Monday and extended its rally to new record highs, just shy of $2,750. Momentum shows buyers remain in charge, as depicted by the Relative Strength Index (RSI). Even though the RSI has turned overbought, its most extreme reading, following a steeper advance, would be 80. Therefore, further Bullion upside is seen.

If XAU/USD clears today’s high at $2,748, the next stop would be $2,750, followed by $2,800.

Conversely, if XAU/USD retreats from record highs below $2,700, it could pave the way for a pullback. The first support would be the October 17 high at $2,696, followed by the October 4 high at $2,670.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.