Gold plummets on rumors of Israel–Hezbollah ceasefire

- Gold declines over $50 on Monday after Axios news reports that Israel and Hezbollah have reached a ceasefire agreement.

- Gold had already fallen after Donald Trump chose Scott Bessent to be his US Secretary of the Treasury.

- Bessent is a seasoned Wall Street professional and is viewed as a safe pick by markets, reducing haven flows to Gold.

- Technically, XAU/USD pulls back after peaking and risks forming a bearish candlestick pattern on a daily close.

Gold (XAU/USD) falls off a cliff during the US session on Monday to trade down almost two and a half percent in the $2,640s, after Axios News reported that according to a US official, Israel and Hezbollah had agreed to a ceasefire.

Gold had already declined substantially after markets breathe a sigh of relief at the appointment of a “safe pair of hands” to take over from Janet Yellen as the next US Treasury Secretary.

President-elect Donald Trump has chosen hedge fund manager Scott Bessent to be in charge of the US Treasury when he becomes President in January 2025. Gold is losing ground because of Bessent’s reputation as a cautious operator who is likely to curb some of President Trump’s more radical economic and trade policies. This has likely calmed markets and reduced safe-haven demand for the precious metal.

Gold falls on Bessent appointment

Gold is traded lower on Monday after President-elect Donald Trump announced Wall Street tycoon and founder of Key Square Group – a global macro investment firm – Scott Bessent as the US’s new Treasury Secretary.

Although Bessent supports the thrust of Trump’s protectionist and tax-cutting policy agenda, markets expect him to probably soften the blow from Trump’s tariffs and counterbalance inflation by reducing government spending. Based on his prior comments, the two things Bessent is passionate about are cutting the US’s debt pile and thwarting competition from China.

“This election cycle is the last chance for the United States to get out from under a mountain of debt without becoming some kind of European-style socialist democracy," Vijesti News quoted Bessent as telling Bloomberg in August.

Bessent has advocated a “three-threes” policy in which he will try to reduce the US Budget Deficit to 3% of annual Gross Domestic Product (GDP) from a current estimated 6% in 2024, achieve a 3% annual GDP growth rate, and raise US Crude Oil production by 3 million barrels-a-day, according to Bloomberg News.

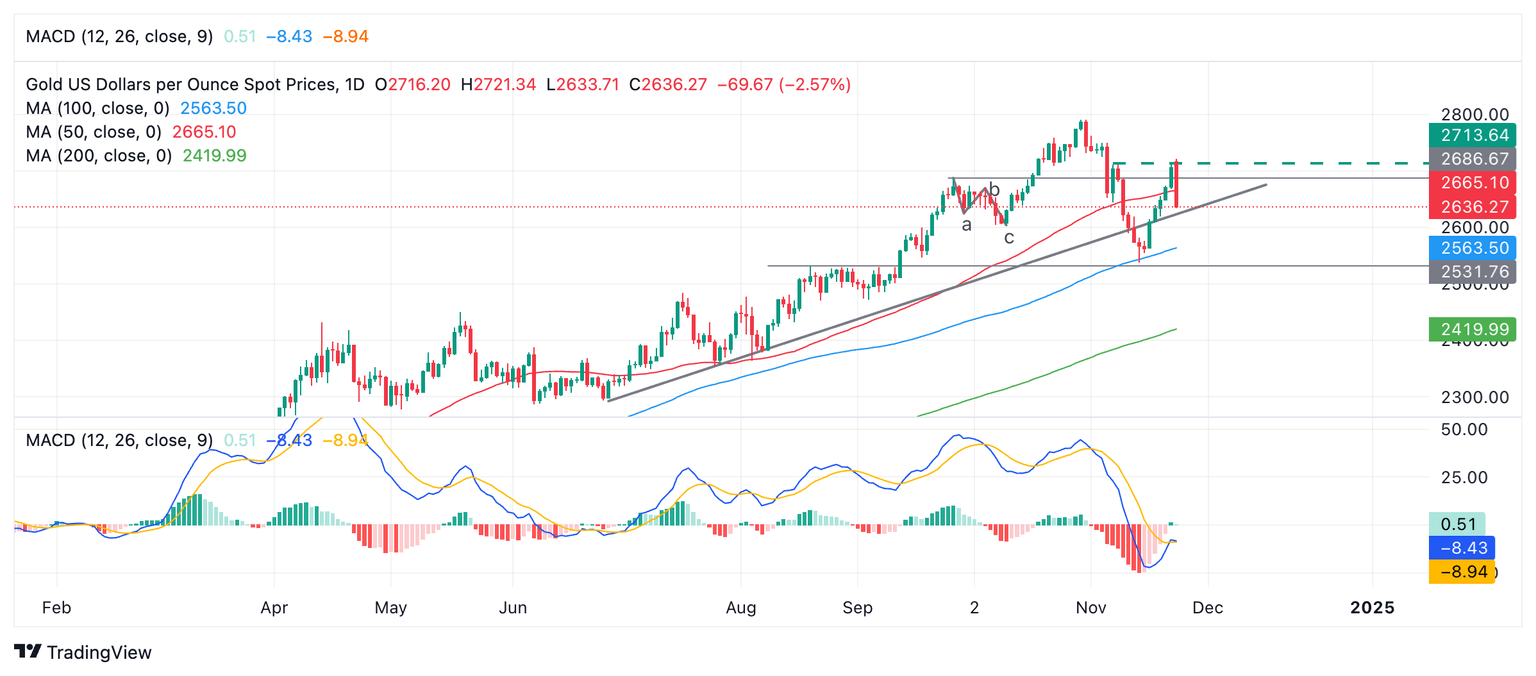

Technical Analysis: XAU/USD pulls back down to 50-day SMA

Gold pulls back down to below the (red) 50-day Simple Moving Average (SMA) at around $2,671 on an intraday basis on Monday after peaking at $2,721 in early trade. The steep drop will probably form a Bearish Engulfing candlestick as it looks set to close at or below the level of the 50 SMA.

If the pattern is confirmed and is then followed by a bearish candle tomorrow (Tuesday), this would signal a short-term reversal and more downside ahead.

XAU/USD Daily Chart

That said, the (blue) Moving Average Convergence Divergence (MACD) indicator crossed above its red signal line recently, providing a bullish “buy” signal and suggesting more upside on the cards for the price.

The precious metal’s trend is also bullish, and given the maxim that “the trend is your friend,” the odds still favor a continuation higher.

A break above $2,721 would be a bullish sign and give the green light to a continuation higher. The next target would be at $2,790, matching the previous record high.

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.