Gold holds shallow recovery on Fed rate-cut bets

- Gold continues to snake higher on Thursday as markets price in higher probabilities of the Fed cutting interest rates in December.

- A softening of Trump’s rhetoric on tariffs is a possible factor in the falling interest rate expectations.

- XAU/USD is technically crawling up a major trendline but remains vulnerable to further breakdowns.

Gold (XAU/USD) extends its shallow recovery from Tuesday’s lows as it trades in the $2,640s on Thursday. The yellow metal is seeing gains on the back of cementing market bets that the Federal Reserve (Fed) will go ahead and cut US interest rates at its December meeting. Lower interest rates are positive for Gold as they reduce the opportunity cost of holding the non-interest-paying asset, making it more attractive to investors.

Gold’s gains may be limited, however, by receding geopolitical risks after Israel and Hezbollah agreed on a 60-day ceasefire deal on Tuesday, although sceptics say it will remain unsustainable without an end to hostilities in Gaza, according to Bloomberg News.

Gold recovers as markets see greater chance of Fed cutting before Christmas

Gold is seeing a shallow recovery on Thursday as the probabilities edge up of the Fed making a 25 basis point (bps) cut to US interest rates before Christmas.

The market-based probability of such a decision has risen to 70% on Thursday from previously oscillating between 55% and 66%, according to the CME FedWatch tool. This leaves a 30% chance the Fed will leave interest rates unchanged.

Benchmark US Treasury bond yields are edging lower amid softening rhetoric around trade tariffs, and this could be behind the move in both Gold and US yields.

President-elect Donald Trump’s threat to place 25% tariffs on imports from Mexico and Canada had increased US inflation expectations and, with them, higher interest rates. However, recently Trump softened his tone.

“Just had a wonderful conversation with the new President of Mexico, Claudia Sheinbaum Pardo,” Trump posted on his Truth Social platform on Wednesday.

“She has agreed to stop migration through Mexico, and into the United States, effectively closing our southern border,” Trump added.

“We also talked about what can be done to stop the massive drug inflow into the United States, and also, US consumption of these drugs. It was very productive,” he continued.

At the start of this week, Trump announced he would impose a 25% tariff on Mexican and Canadian imports in an effort to get his neighbors to crack down on illegal immigration and drug smuggling.

Since then, Canada has announced new measures to protect its border, and Mexico has threatened to raise tariffs on US goods entering the country, thereby triggering a trade war that would be as costly from an economic standpoint to the US as Mexico.

However, many analysts now interpret Trump’s 25% threat as more of a negotiating tactic than a concrete pledge.

“We believe Trump's announcement is a tactic to negotiate with these three countries, his main trade partners, from a position of strength, taking into account that imposing tariffs would also be negative for the US economy," Mexican lender CIBanco said in a note.

"As such, the final result of the tariff threat could be less severe once negotiations with the respective parties conclude," the bank added.

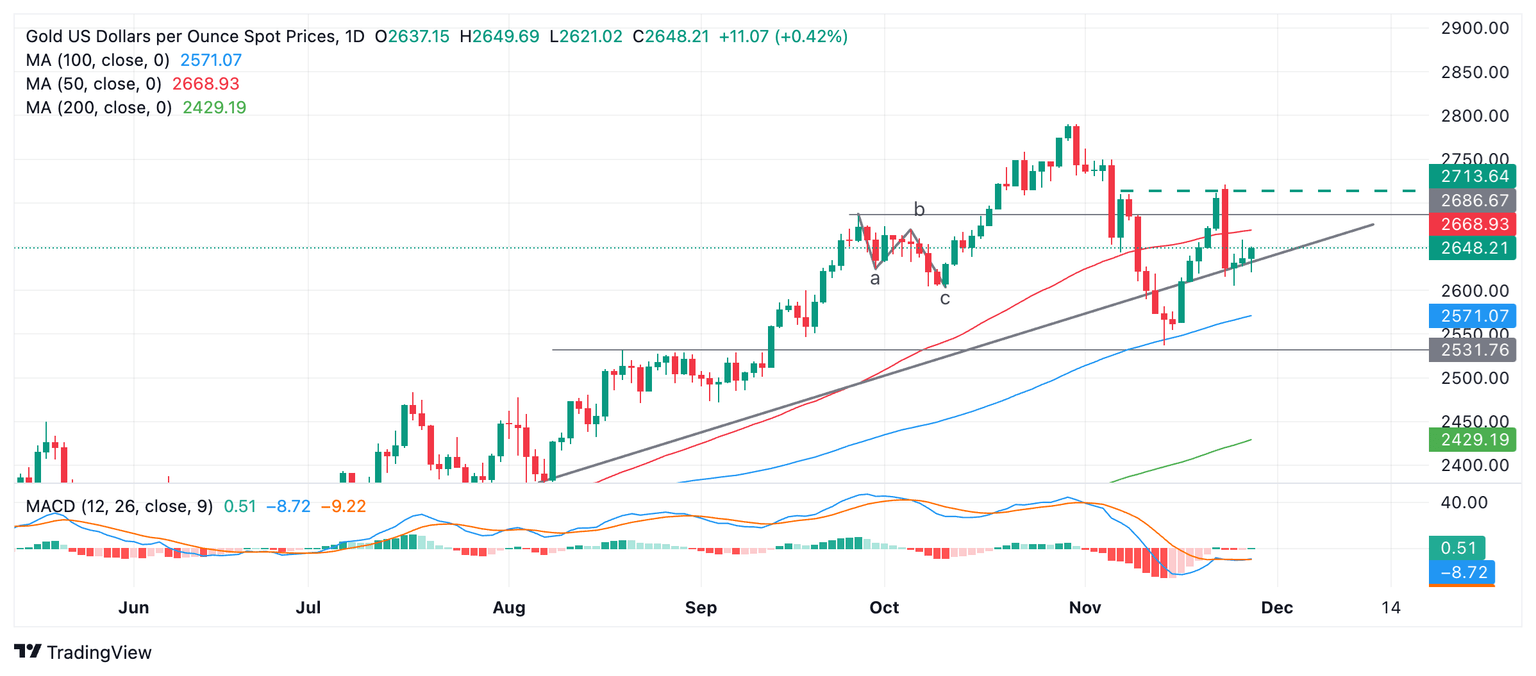

Technical Analysis: XAU/USD keeps above major trendline

Gold trades up the length of a major trendline for the third day in a row on Thursday. The trendline reflects the precious metal’s long-term uptrend.

XAU/USD Daily Chart

Gold’s short-term trend is unclear, but it is in a medium and long-term uptrend. Given the maxim that “the trend is your friend,” the odds still favor an eventual continuation higher.

A break above $2,721 (Monday’s high) would be a bullish sign and give the green light to a continuation higher. The next target would be at $2,790, matching the previous record high.

Alternatively, a decisive break below the major trendline would likely lead to further losses, probably to the $2,536 November lows. Such a move would confirm the short-term trend as bearish.

A decisive break would be one accompanied by a long red candlestick that broke cleanly through the trendline and closed near its low – or three red candlesticks in a row that broke below the line.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.