Gold dips despite dovish expectations for the upcoming Fed interest rate decision

- Gold softer in the US trading session on Wednesday.

- Traders zoon in on the Federal Reserve interest rate decision later in the day.

- A fresh all-time high in bullion could be possible, should the Fed deliver a dovish message.

Gold’s price (XAU/USD) is starting to turn a bit lower on Wednesday in the US trading session after a very whipsaw start to the week. No big moves are expected until later this this Wednesday, as several traders sit on their hands until the Federal Reserve (Fed) interest rate decision later in the day. Lower US rates are often seen as beneficial for Gold to trade higher.

Market expectations show the Fed will likely keep interest rates unchanged in the range of 4.25%-4.50%, so traders will rather focus on Fed Chairman Jerome Powell’s comments on the central bank’s policy outlook. And here, traders might be in for a huge disappointment. Powell is not expected to comment on President Donald Trump's criticism of the Fed or why or how Trump calls for lower rates. Instead, Powell is expected to repeat that the central bank remains independent and data-dependent and will focus on its dual mandate: inflation and the jobs market.

Daily digest market movers: Rate cut expectations

- According to Bloomberg, the market expectation is for Fed Chairman Jerome Powell to deliver a dovish pause. This should see US yields tilt lower, which opens the opportunity for Gold to surge higher and print a possible fresh all-time high.

- Australian hedge funds are clamouring for Gold exposure during the second term of US President Donald Trump. They are betting that his administration will fail to arrest the US economy’s spiralling debt and that Gold will act as an antidote to the bond market’s carnage, Financial Review reports.

- At 19:00 GMT, the Fed will deliver its monetary policy decision, followed by a press conference from Fed Chairman Jerome Powell at 19:30 GMT.

- For now, the CME Fed Futures tool see the biggest odds for a 25 basis point rate cut for June, while May's odds have lost their lead over another rate pause.

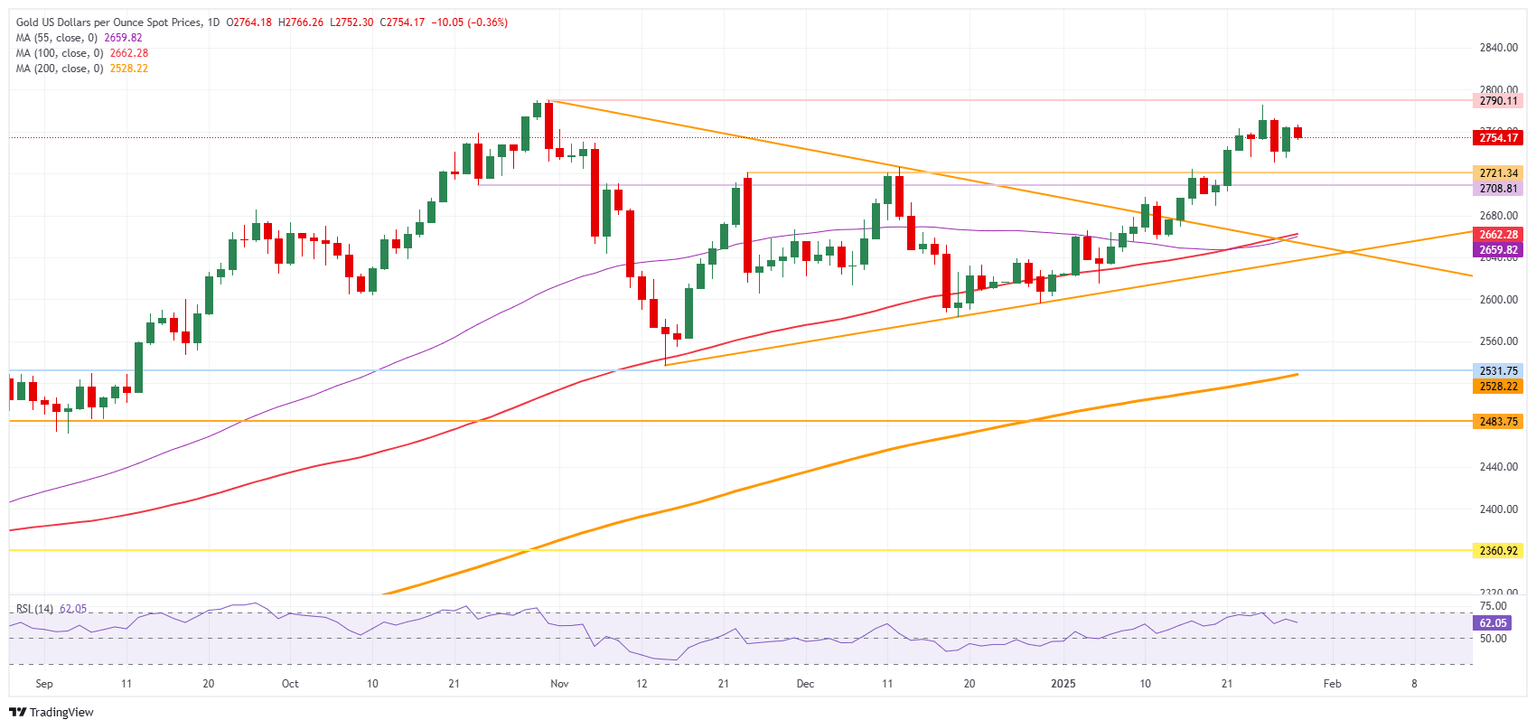

Technical Analysis: It could go quick

Gold’s price has positioned itself at a perfect point for reaching a fresh all-time high should the Fed be rather dovish on Wednesday. The decline earlier this week has nearly recovered, and Gold is trading roughly flat for now. Expect volatility to pick up, with a possible fresh all-time high on the back of comments from Fed Chairman Jerome Powell, who is expected to deliver a dovish rate pause.

The first line of support remains at $2,721, a sort of double top in November and December broken on January 21. Just below that, $2,709 (October 23, 2024, low) is in focus as a second nearby support. In case both abovementioned levels snap, look for a dive back to $2,680 with a full-swing sell-off.

Although the window of opportunity is starting to close, Gold could still hit the all-time high of $2,790, which is around 1% away from current levels. Once above that, a fresh all-time high will present itself. Meanwhile, some analysts and strategists have penciled in calls for $3,000, but $2,800 looks to be a good starting point as the next resistance on the upside.

XAU/USD: Daily Chart

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.