Gold continues correction after US factory-gate inflation surprises higher

- Gold is pulling back after the stellar gains made on Thursday following the surprise fall in the US inflation rate in June.

- Cooling inflation implies a greater chance that interest rates will fall, making non-interest-bearing Gold more attractive.

- XAU/USD takes on a range-bound aspect as it climbs back up to the all-time highs.

Gold (XAU/USD) corrects back on Friday after a blowout rally on Thursday following the release of US CPI inflation data. The precious metal extends its pull back, however, after the release of US factory-gate inflation for June – the Producer Price Index (PPI) – surprises to the upside. Gold is seen trading down in the $2,390s during the US session as the weekend approaches.

Gold falls after US factory-gate inflation data release

Gold extends its correction after the release of US Producer Price Index for June comes out at 2.6% year-over-year, beating expectations of 2.3% from a revised up 2.4% in the previous month. On a monthly basis the PPI shows a rise of 0.2% in June, running away from expectations of 0.1% and the previous month's upwardly revised 0.0% (up from a negative 0.2% estimate). Producer Prices ex Food and Energy also rose more than expected on both a yearly and monthly basis too, according to data from the US Bureau opf Labor Statistics.

The PPI is seen as a precrusor to wider inflationary forces as it calculates the price of goods leaving the fatcory conveyor belt so there is a lag before it becomes more distributed in the wider economy. The higher-than-forecast result partly undos the progress made by the Consumer Price Index released on Thursday, which showed a deeper-than-expected cooling of inflation in June.

Surge following CPI release

Gold surged after the release of the US CPI data on Thursday showed a slowdown in inflation, thereby increasing bets that the Federal Reserve (Fed) will start to cut interest rates sooner than previously thought.

Markets now fully price in a 0.25% cut of the Fed Funds rate in September and over 0.60% of cuts by the end of the year, from 0.50% previously. This, in turn, increases the attractiveness of Gold as an investment by reducing the opportunity cost of holding a non-interest-bearing investment.

Thursday’s data showed US headline inflation cooling to 3.0% year-on-year in June, below estimates of 3.1% and the previous month's 3.3%.

On a monthly basis, CPI fell by 0.1% in June – the biggest outright decline in prices since May 2020 during the Covid-19 pandemic, according to Deutsche Bank’s Global Head of Macro Research, Jim Reid.

Meanwhile, core CPI – which excludes volatile food and energy components – slowed to 3.3%, falling below expectations of 3.4% from 3.4% previously. On a 3-month annualized basis, moreover, core inflation is now just above the Fed’s 2.0% target.

Hopes were raised “that it wasn’t simply one good month. In fact, on a 3-month annualized basis, core CPI is up just +2.1% now, which is the lowest since March 2021,” said Deutsche Bank’s Reid.

Thursday’s CPI data – especially for the last three months – suggests the Fed must now be very close to cutting interest rates. When Fed Chairman Jerome Powell was asked by a lawmaker at his two-day testimony to Congress this week whether the Fed would wait until PCE inflation had fallen to its 2.0% target before cutting interest rates, Powell answered that that would be leaving it too late, because “inflation has a certain momentum.”

This, and Powell’s expressed concerns regarding the state of the employment market, which showed the Unemployment Rate rising to 4.1% in June’s Nonfarm Payrolls figures, might indicate further pressure to cut interest rates – in order to stimulate jobs growth. In fact, Powell said unemployment was the thing “keeping him awake at night”, during his testimony.

That said, the chances of the Fed cutting rates at its July 30-31 meeting remain low, with September now the first viable date, according to economists at Brown Brothers Harriman (BBH).

“Even another month of improved inflation data won’t get the Fed to cut this month. After the July 30-31 meeting, the Fed will see July and August readings for jobs, CPI, PPI, and retail sales and the July PCE reading ahead of the September 17-18 FOMC meeting. By that point, the Fed should have a much better idea of where the economy is going and will feel more comfortable making an explicit policy pivot,” said Dr. Win Thin, Global Head of Markets Strategy at BBH.

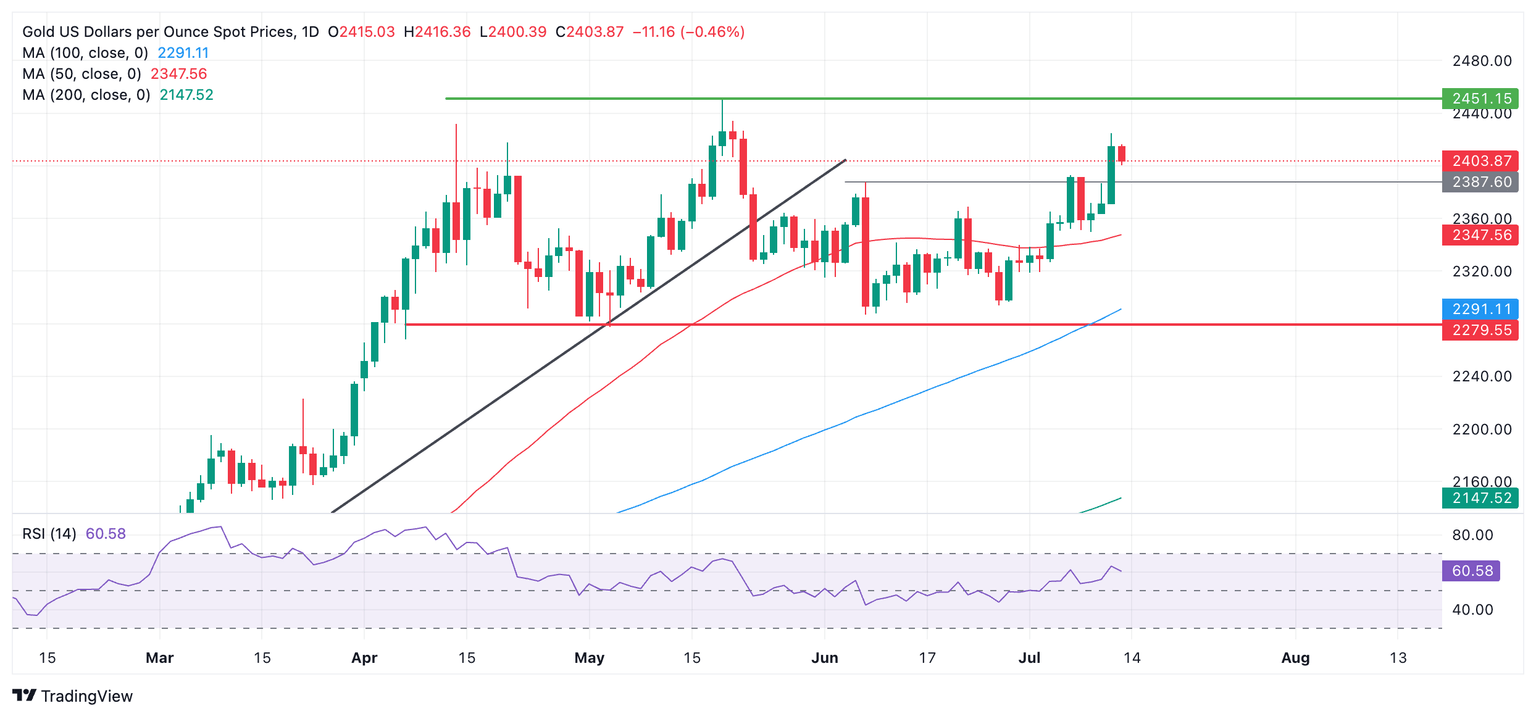

Technical Analysis: Gold rallies toward all-time-high

Gold is rallying within a range, approaching its May 20 all-time high of $2,450. Rather than forming a topping pattern as was previously possible, Gold may now be in a sideways consolidation – a pause within a broader uptrend.

XAU/USD Daily Chart

On a short-term trend basis, Gold appears to be in a sideways trend as it extends a leg higher within a range that has unfolded since April. The sideways trend has a floor at roughly $2,280 and a ceiling at $2,450.

Since the break above the June 7 peak of $2,388 last Friday, the precious metal has received bullish confirmation, unlocking the next upside target at the $2,451 all-time high.

In the long term, Gold remains in an uptrend, suggesting odds favor an eventual breakout to the upside of the range.

A decisive break above the $2,450 high – which is also the range ceiling – would unlock a target at $2,555, calculated by extrapolating the 0.618 Fibonacci ratio of the height of the range higher.

Economic Indicator

Producer Price Index (YoY)

The Producer Price Index released by the Bureau of Labor statistics, Department of Labor measures the average changes in prices in primary markets of the US by producers of commodities in all states of processing. Changes in the PPI are widely followed as an indicator of commodity inflation. Generally speaking, a high reading is seen as positive (or bullish) for the USD, whereas a low reading is seen as negative (or bearish).

Read more.Last release: Fri Jul 12, 2024 12:30

Frequency: Monthly

Actual: 2.6%

Consensus: 2.3%

Previous: 2.2%

Source: US Bureau of Labor Statistics

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.