Gold attempting to break through 50-day SMA following Powell speech

- Gold is breaking above the 50-day SMA following a dovish speech by Fed Chairman Jerome Powell.

- Multiple geopolitical factors suggest a broadly bullish backdrop for the precious metal.

- XAU/USD trades above $2,340, increasing bullish bets of a recovery in the short term.

Gold (XAU/USD) rallies into the $2,340s on Wednesday as investors continue to digest the contents of Federal Reserve (Fed) Chairman Jerome Powell’s speech from Tuesday and the shift in monetary-policy stance that his words reflected.

Additionally, “bargain hunting” by longer-term investors may further support Gold, as they accumulate before another rally due to multiple global factors that continue to favor the precious metal over the long term.

Gold is attempting to penetrate the important 50-day Simple Moving Average (SMA), which has been capping its gains for several days. A bullish close on Wednesday would signal a fresh upside for the yellow metal.

Gold rising as Fed Chair Powell reinforces early rate-cut hopes

Gold is pushing higher as the words of Fed Chair Powell sink in and reinforce market expectations the Fed will cut interest rates in September. Powell said that “quite a lot of progress” had been made on defeating inflation, in his remarks at the central-banking forum in Sintra, Portugal. It is his first clear acknowledgment that the Fed is closing in on its target.

Powell added the familiar caveat that more data still needed to be seen to confirm the trend towards the Fed’s 2.0% inflation target before the central bank went ahead with rate cuts, yet he also added there was a risk of cutting too late as well as too early.

Heightened expectations of lower interest rates are positive for Gold as they reduce the opportunity cost of holding the non-interest-paying asset. Powell’s speech came after the Fed’s preferred inflation gauge, the Personal Consumption Expenditures (PCE) Price Index, showed a fall to 2.6% both for headline and core inflation in May.

The Fed has been adopting a cautious stance after getting it wrong in Q1 when policymakers expected inflation to fall more rapidly than it did. This led to an embarrassing u-turn, where from first predicting three 0.25% cuts in 2024, the Fed had to shift to a “wait-and-see” data-dependent stance. Markets are now pricing in a 65% probability of a first-rate cut in or before September, according to the CME FedWatch tool.

Gold gains on broader global backdrop

Gold is also rising as wider global factors enhance its value.

Ongoing conflicts in the Middle East and Ukraine and a political lurch right in Europe, are leading wary investors to opt for the safe and secure: enter Gold.

In the US, the Supreme Court’s decision to grant former US President Donald Trump partial immunity from prosecution over the uprising that followed his 2020 defeat, combined with question marks over President Joe Biden, his rival’s fitness for office, have increased the chances of a second Trump presidency materializing – something that would further destabilize global security.

Furthermore, the expansion of the BRICS trading confederation is challenging the dominance of the US Dollar with Gold as the most realistic replacement in international trade for those countries not wishing or denied access to Dollar-denominated markets.

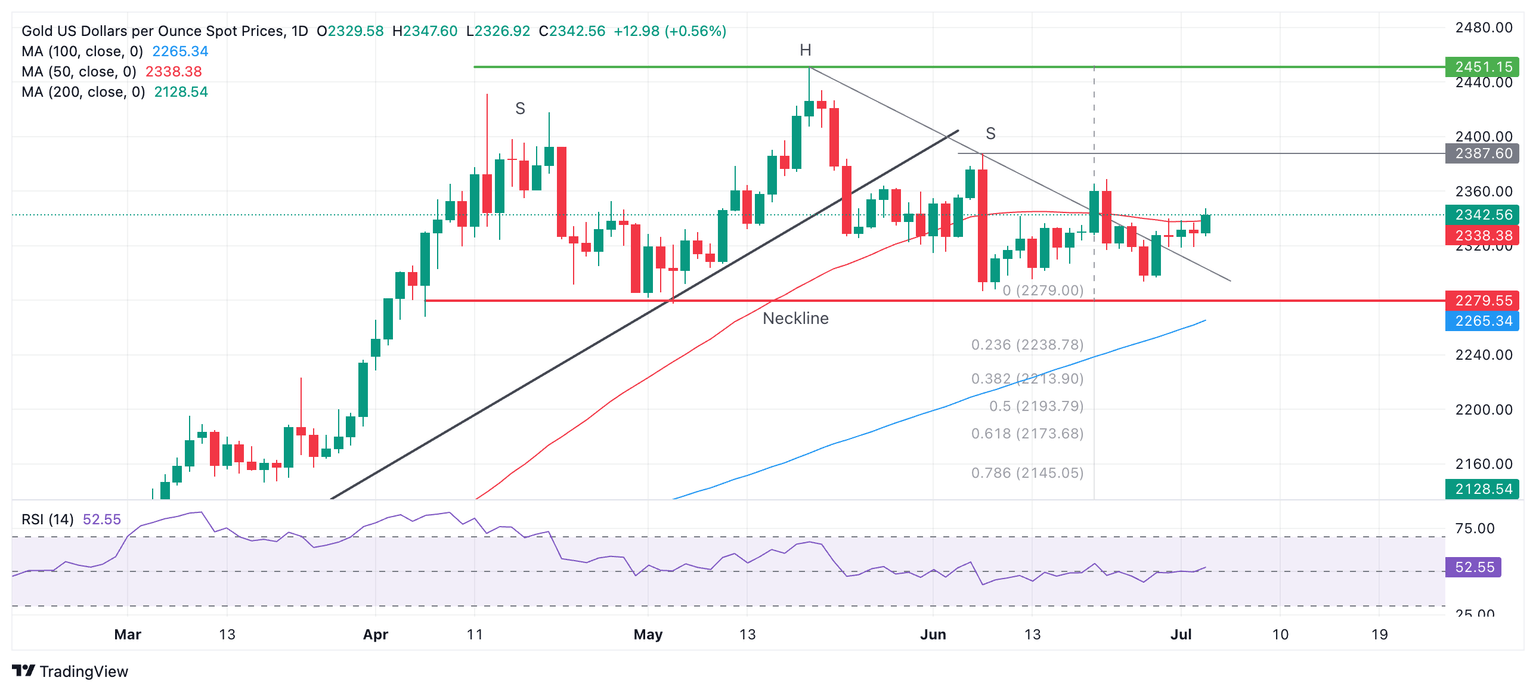

Technical Analysis: Gold attempts to break above 50-day SMA

Gold is pushing higher and piercing the 50-day SMA on an intraday basis. If it manages to close above the key resistance level, it could mark the beginning of a more bullish phase for the precious metal.

XAU/USD has twice now broken above a trendline connecting the “Head” and “Right Shoulder” of what was a Head and Shoulders (H&S) topping pattern with bearish connotations. The breaks invalidate the pattern, although there is still a lesser chance it could be a more complex topping pattern instead.

XAU/USD Daily Chart

Since the break above $2,340, Gold will probably now rise to the $2,369 level (the June 21 high). The next target after that is $2,388, the June 7 high.

Alternatively, assuming the compromised topping pattern’s neckline at $2,279 is broken, a reversal lower may still follow, with a conservative target at $2,171, the 0.618 ratio of the height of the pattern extrapolated lower.

The trend is now sideways in both the short and medium term. In the long term, Gold remains in an uptrend.

Economic Indicator

Fed's Chair Powell speech

Jerome H. Powell took office as a member of the Board of Governors of the Federal Reserve System on May 25, 2012, to fill an unexpired term. On November 2, 2017, President Donald Trump nominated Powell to serve as the next Chairman of the Federal Reserve. Powell assumed office as Chair on February 5, 2018.

Read more.Last release: Tue Jul 02, 2024 13:30

Frequency: Irregular

Actual: -

Consensus: -

Previous: -

Source: Federal Reserve

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.