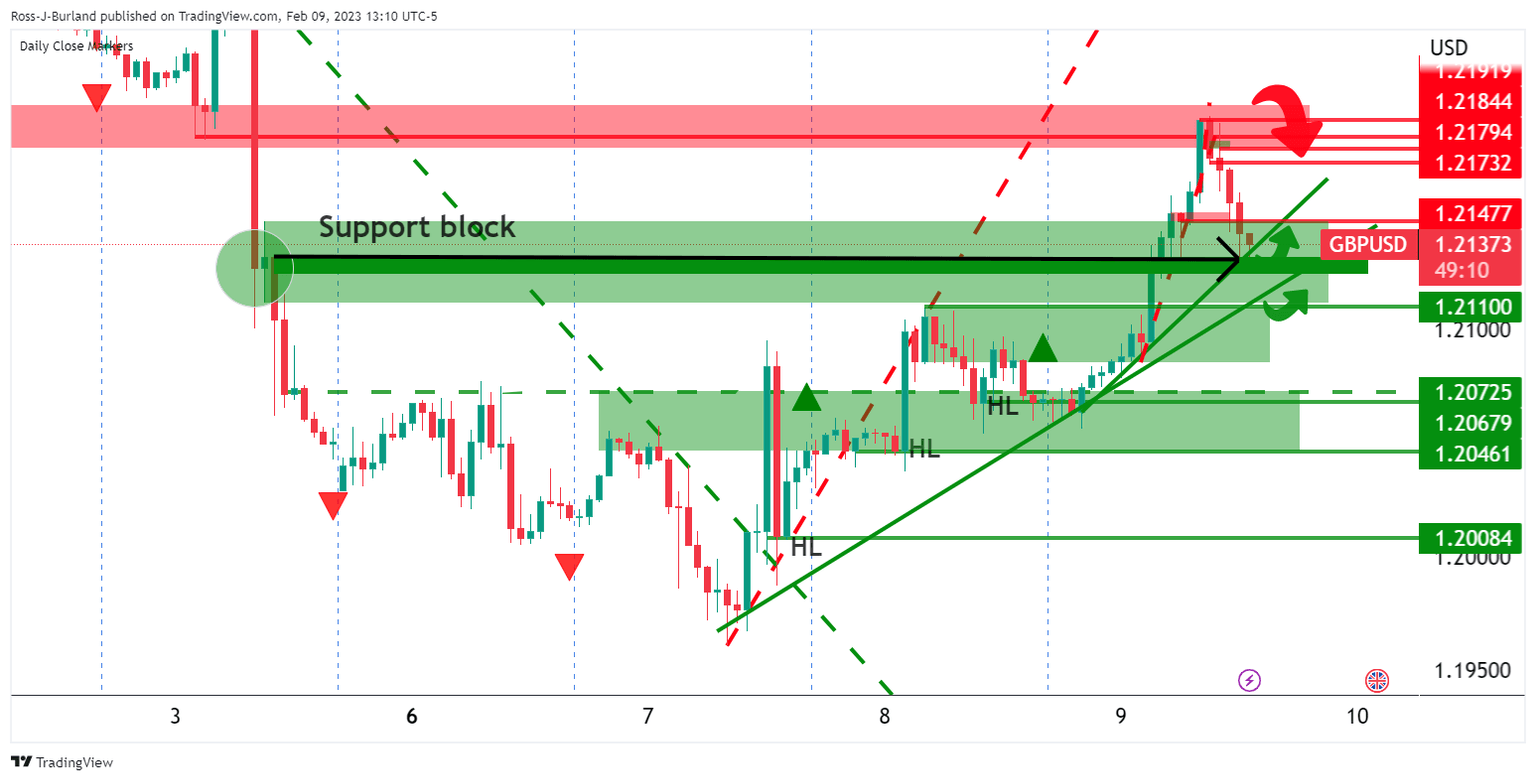

GBP/USD Price Analysis: Sell-off cutting into Day-3 longs, 1.2050 eyed for days ahead

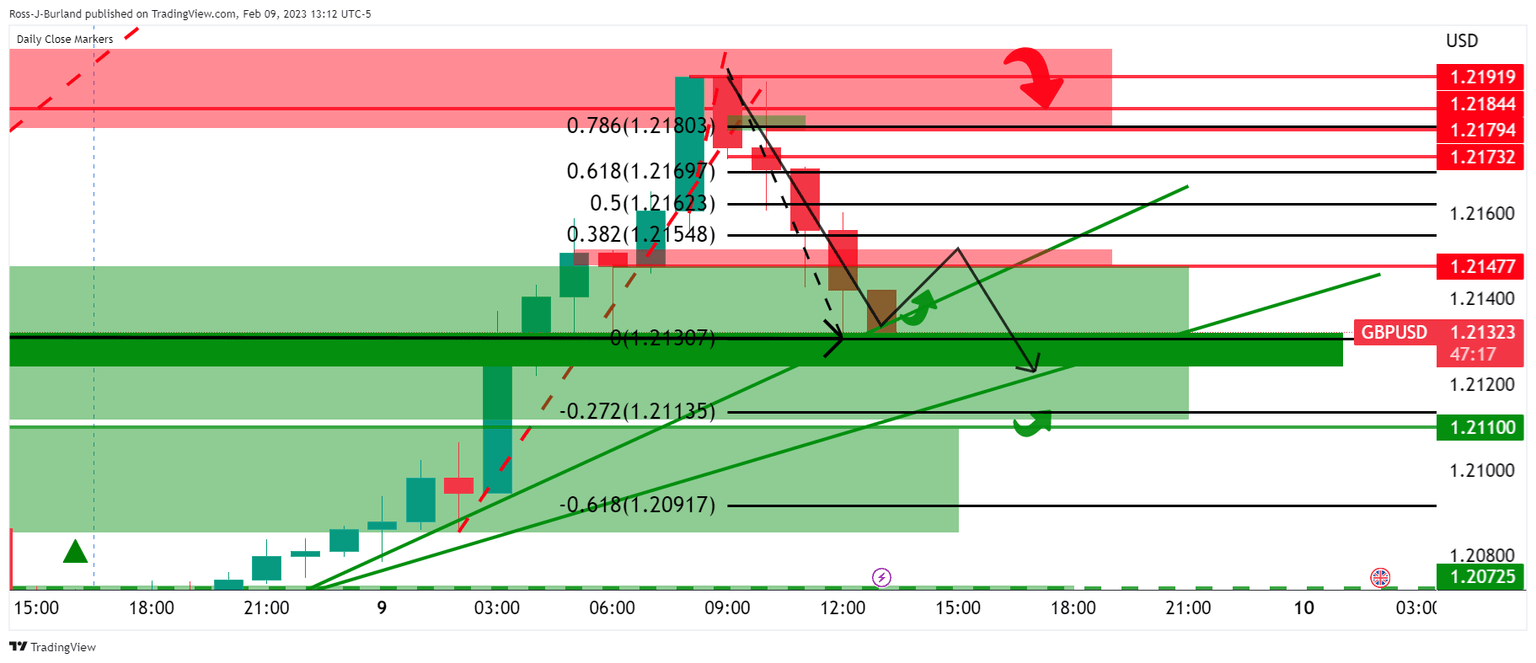

- GBP/USD has sold off from a 50% mean reversion of the prior bearish daily impulse.

- We are seeing the following through with 1.20 eyed but the price is meeting some support at this juncture.

- This opens the risk of a correction before the next move to the downside.

GBP/USD rallied in a parabolic fashion on Thursday on the third day of demand for the British Pound. The pair travelled from a low of 1.2056 to a high of 1.2194 before reversing back to test the midpoint of the 1.21 area and recently reaching a sell-off low of 1.2130.

The US Dollar broke structure on the downside in the late London session and extended the move into the New York open only to reverse. Risk-off kicked in and sent the US bourses packing and cable off a cliff as the following illustrates:

DXY H1 chart

US500 H1 chart

GBP/USD technical analysis

GBP/USD has dropped into the parabolic rally and the length that had been building up into a climax. We had three levels of rise since the day opened in Asia in a massive pump-up that has concluded in a dump in the New York session. this coincided with the cash opening hour on Wall Street, 1730 GMT and at the London fix of 1600 GMT.

We are seeing the followthrough with 1.20 eyed but the price is meeting some support at this juncture:

This opens the risk of a correction before the next move to the downside with the ATR of 117 pips for the day already done within the 137 pip range so far:

A bullish close on the day will be giving us three bullish closes in a row and leaves the risk of another sell-off on Friday:

The price has already corrected to a 50% mean reversion of the prior bearish daily impulse.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.