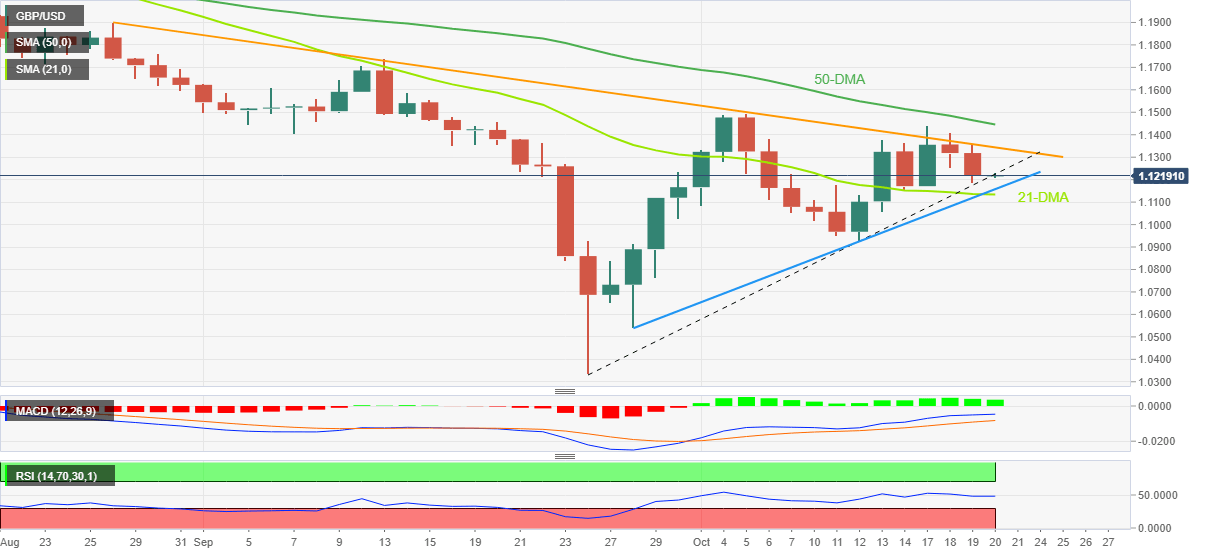

GBP/USD Price Analysis: Remains pressured towards 1.1130 support

- GBP/USD sellers poke three-week-old support line after reversing from multi-day-old resistance.

- Ascending trend line from late September, 21-DMA adds to the downside filters.

- Buyers need validation from 50-DMA to retake control.

- Steady oscillators, pullback from key hurdle favor sellers.

GBP/USD holds lower ground near 1.1220, fading the bounce off 1.1185 after a two-day downtrend. In doing so, the cable pair flirts with a short-term key support line during Thursday’s Asian session after taking a U-turn from the two-month-old resistance line earlier in the week.

In addition to the immediate support of 1.1220, an upward-sloping trend line from September 29, around 1.1155, will precede the 21-DMA level near 1.1130 to also challenge the short-term downside of the Cable pair.

It should, however, be noted that the quote’s weakness past 1.1130 will direct it toward the monthly low of 1.0923 which acts as the last defense of the GBP/USD buyers.

In a case where the Cable pair renews the monthly low, 1.0650 and the recently flashed record low of 1.0339 will be in focus.

Alternatively, a descending resistance line from late August, around 1.1345, restricts the GBP/USD pair’s nearby upside.

Following that, the 50-DMA level surrounding 1.1445 will challenge the buyers before directing them to the monthly high of 1.1495. Also acting as the upside filter is the 1.1500.

GBP/USD: Daily chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.