GBP/USD Price Analysis: Cable bulls stall near 1.2600, pullback hinges on UK GDP, Fed

- GBP/USD retreats from the highest levels in five weeks as UK monthly data dump, Fed decision loom.

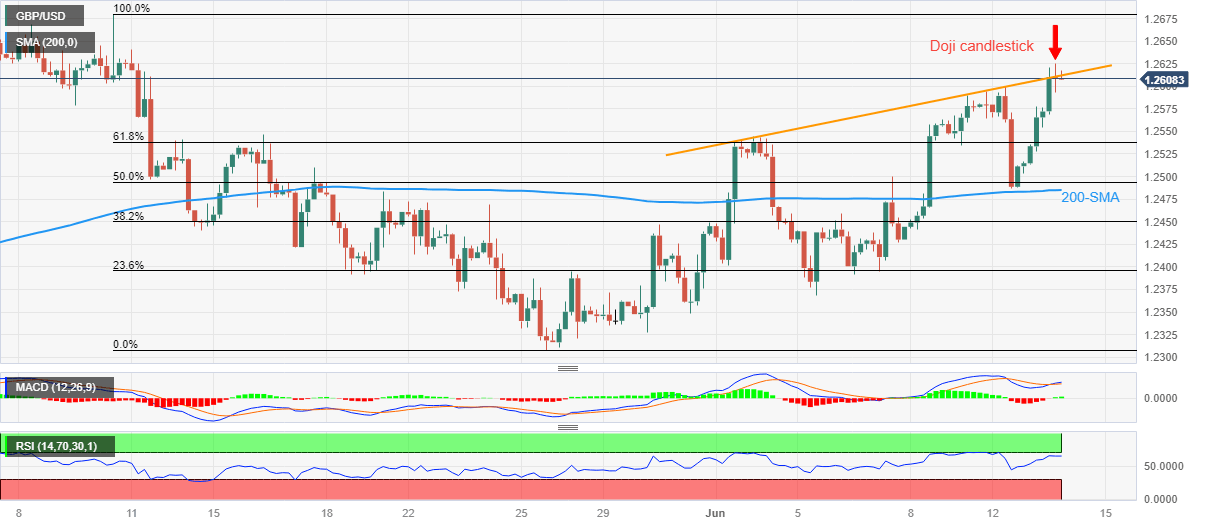

- Overbought RSI, failure to cross fortnight-old resistance line and Doji candlestick challenge the Cable buyers.

- Golden Fibonacci ratio, 200-SMA and bullish MACD signals put a floor under the Pound Sterling prices.

GBP/USD fades upside momentum at a multi-day high on the key day comprising the US Federal Reserve (Fed) verdict and the monthly UK data dump. That said, the Cable pair remains dicey near 1.2600 after rising the most in a week to prod the highest level since May 11 the previous day. Apart from the pre-data/event anxiety, the Pound Sterling also justifies the technical clues to tease the sellers on important data.

That said, overbought RSI conditions and an ascending resistance line from June 01, around 1.2615 by the press time, are the first-tier challenges for the GBP/USD bulls. Also restricting the Cable pair’s upside is the Doji candlestick on the four-hour play marked at the multi-day high, suggesting a pullback in prices.

Hence, the quote is likely to consolidate the latest gains, which in turn highlights the 61.8% Fibonacci retracement level of its May month fall, around 1.2535. It’s worth noting that the said technical level is also known as the golden Fibonacci ratio.

In a case where the GBP/USD drops below the said key Fibonacci support, it can fall to the 50% Fibonacci retracement near the 1.2500 round figure.

It should be noted, however, that the bullish MACD may join the 200-SMA level of 1.2485 to challenge the Cable bears afterward.

On the contrary, a clear upside past the latest peak of near 1.2625 could defy the bearish bias and propel the GBP/USD price towards challenging the previous monthly high of around 1.2680.

GBP/USD: Four-hour chart

Trend: Limited downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.