- GBP bulls gather strength for further upside, with eyes set on 1.40.

- Fed-led USD weakness offsets Brexit chaos amid an upbeat mood.

- Inverse H&S to get confirmed on a daily closing above 1.4009.

GBP/USD is attempting another run towards the 1.4000 round number, looking to extend its winning streak into a fifth day on Thursday.

Fed Chair Powell’s rejection of taper calls keeps the sentiment under the US dollar undermined. Meanwhile, the UK’s higher vaccination rates overshadow the negative vibes around the renewed Brexit chaos.

It’s worth noting that Goldman Sachs predicted the British economy to grow by a “striking” 7.8% this year, which also offers support to the pound.

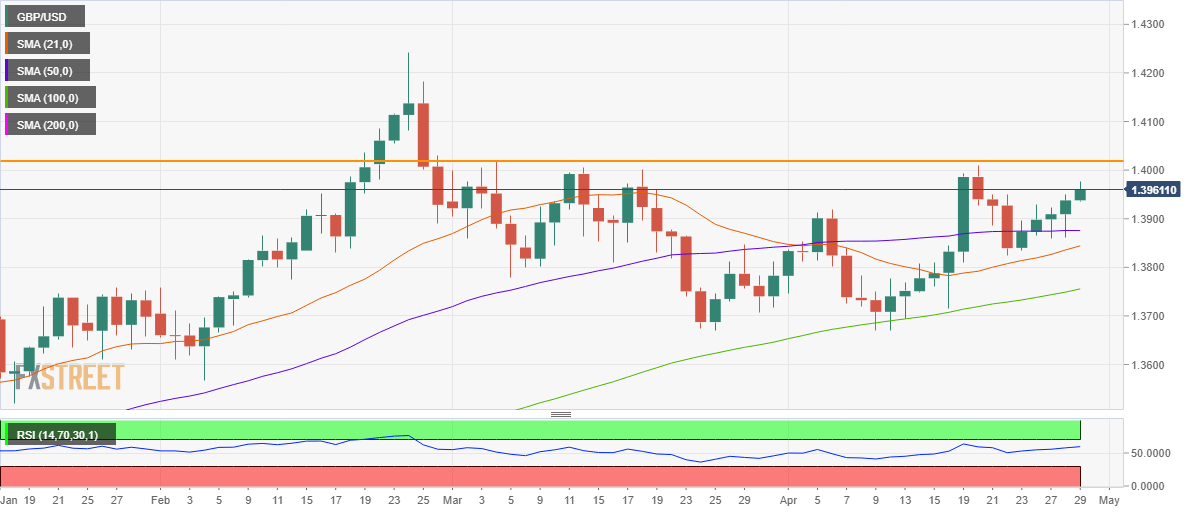

From a near-term technical perspective, the cable is on track to chart a perfect inverse head and shoulders formation on the daily sticks, if the pattern neckline (orange) at 1.4009 is taken out on a closing basis.

GBP/USD daily chart

The bullish confirmation will open doors for a test of the pattern target at 1.4348. However, it's unlikely to be a smooth ride for the buyers, as they need to scale the February 25 high of 1.4182 before.

Also, the 2021 high of 1.4243 will come into play, testing the bulls’ commitments.

The 14-day Relative Strength Index (RSI) points higher above 50.00, allowing room for more gains.

Alternatively, any pullbacks could draw demand at the 50-daily moving average (DMA) at 1.3875, below which the 21-DMA at 1.3844 could be probed by the GBP sellers.

GBP/USD additional levels to watch

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD rises toward 1.0800 on USD weakness

EUR/USD trades in positive territory above 1.0750 in the second half of the day on Monday. The US Dollar struggles to find demand as investors reassess the Fed's rate outlook following Friday's disappointing labor market data.

GBP/USD closes in on 1.2600 as risk mood improves

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold gathers bullish momentum, climbs above $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Three fundamentals for the week: Two central bank decisions and one sensitive US Premium

The Reserve Bank of Australia is set to strike a more hawkish tone, reversing its dovish shift. Policymakers at the Bank of England may open the door to a rate cut in June.