GBP/USD oscilates in low volumes around Friday's high but bears are lurking

- GBP/USD bears could be about to make a move.

- The multi-time frame structures are dominating the technicals and make for a bias to the downside.

GBP/USD corrected from the low 1.19s on Friday, denting the bear's dominance ahead of a US holiday on Monday as traders squared up into the long weekend. At the time of writing, GBP/USD is trading near 1.2050 and remains in consolidation between the day's low of 1.2014 and 1.2056.

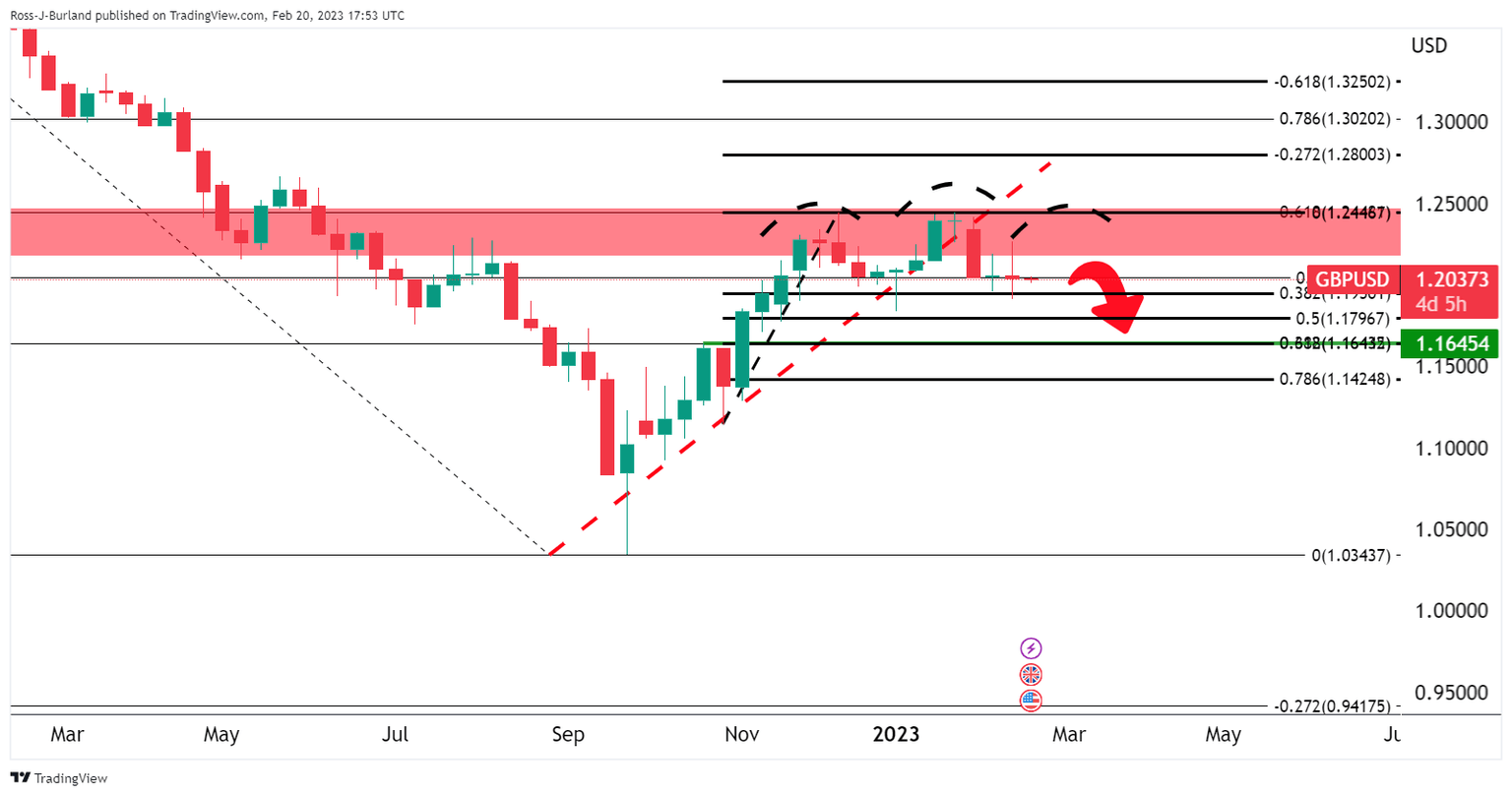

For some background, the pair has been capped where equal highs were put in near 1.2450 between mid-December and late January whereby the price corrected a strong monthly bearish impulse to a 61.8% Fibonacci of the range:

GBP/USD monthly chart

Given the steepness of the correction, while the downside bias is coming to the fore, a gradual decline could be in order and the bears have already made their first move, breaking the old monthly support:

GBP/USD weekly chart

From a weekly perspective, a bearish head and shoulders could be forming:

While on the backside of the prior bullish trend's support line, the bears will be looking for a solid structure to lean against for a move to target the prior resistance in the bullish leg that has the confluence with the 61.8% Fibonacci retracement near 1.1650.

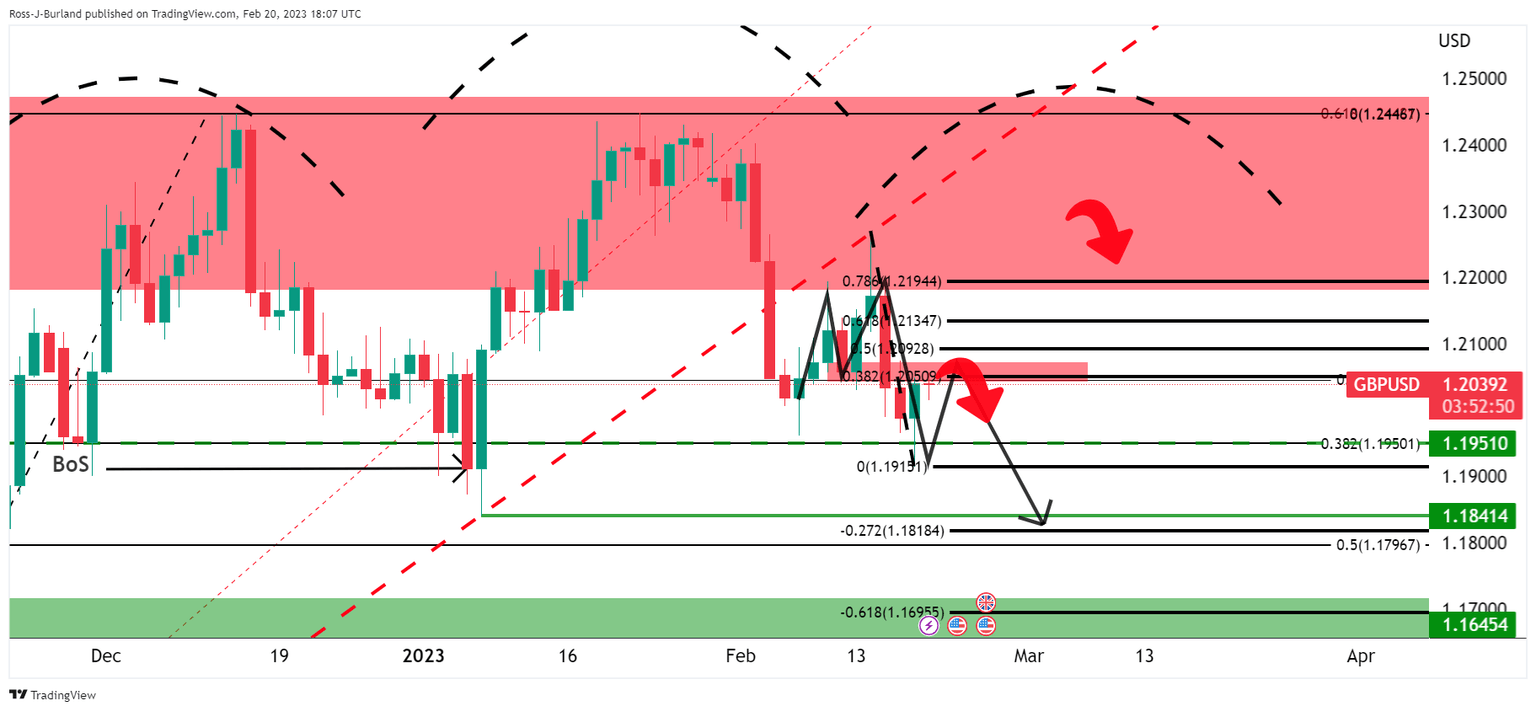

GBP/USD daily chart

For structure, the bears can look to the lower time frames:

While it is too early in the right-hand shoulder's formation phase, a move lower could still be in order for the meantime as the price discovery plays out.

Currently, within the right-hand shoulder's formation, there is an M-pattern on the daily chart that is formed above where there was a break of structure, BoS, at the start of the year. The price has corrected the bearish leg of the pattern to a 38.2% Fibonacci level near 1.2050 and should this hold as resistance, at the neckline of the pattern, then a downside extension would be in order for a run to test 1.1850 territory for the days ahead.

GBP/USD H1 chart

From a 1-hour perspective, the bears could be active on a break of the 1.2015 level and prior support which is a neckline of the current hourly head and shoulders:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.