GBP/USD muted after Fed’s hold rates, pushes back against easing

- GBP/USD fluctuates, registering modest losses after Fed's decision to hold rates steady.

- Fed emphasizes no rate cuts until inflation sustainably nears 2%, maintaining balance sheet reduction.

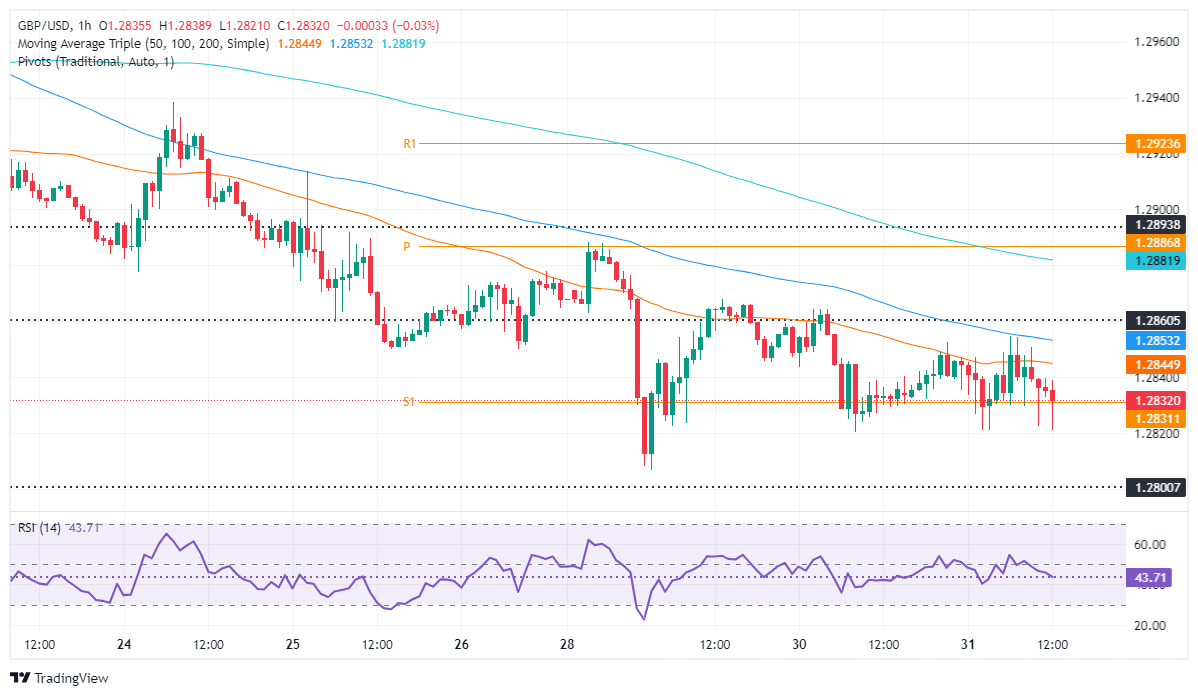

- Key resistance at 1.2843 (50-hour SMA), 1.2855 (100-hour SMA), and 1.2873 (200-hour SMA); support at 1.2800, 1.2778, and 1.2750.

The GBP/USD whipsawed during the North American session after the Federal Reserve (Fed) decided to keep rates unchanged yet pushed back against easing policy, noting, “The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.” The major trades are volatile, around 1.2800-1.2850, and register modest losses.

GBP/USD dips slightly on Fed’s hawkish hold

The Federal Reserve acknowledged that inflation has eased somewhat over the year yet “remains somewhat elevated.” Policymakers noted that the dual mandate risks became more balanced, and “the Committee is attentive to the risks to both sides of its dual mandate.”

Regarding its balance sheet reduction, “the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage‑backed securities” and the Fed reinforced its commitment to returning inflation to its 2% objective.

GBP/USD Reaction to Federal Reserve’s decision

The 1-hour chart witnessed the GBP/USD diving to a new day low of 1.2819 yet has recovered some as market participants await Powell’s press conference, for any hints to ease policy.

Key resistance lies at the 50-hour SMA at 1.2843, the 100-hour SMA at 1.2855 and further resistance at the 200-hour SMA at 1.2873. Once cleared the next resistance would be 1.2900.

On further weakness, the GBP/USD could test 1.2800, followed by the the July 9 low at 1.2778 and the psychological 1.2750. A further downside is seen at the 100-day moving average (DMA) at 1.2682.

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.05% | 0.02% | -1.09% | -0.27% | 0.22% | -0.58% | -0.16% | |

| EUR | -0.05% | -0.01% | -1.16% | -0.33% | 0.16% | -0.62% | -0.22% | |

| GBP | -0.02% | 0.00% | -1.18% | -0.32% | 0.15% | -0.61% | -0.20% | |

| JPY | 1.09% | 1.16% | 1.18% | 0.93% | 1.35% | 0.55% | 1.01% | |

| CAD | 0.27% | 0.33% | 0.32% | -0.93% | 0.46% | -0.32% | 0.10% | |

| AUD | -0.22% | -0.16% | -0.15% | -1.35% | -0.46% | -0.78% | -0.38% | |

| NZD | 0.58% | 0.62% | 0.61% | -0.55% | 0.32% | 0.78% | 0.41% | |

| CHF | 0.16% | 0.22% | 0.20% | -1.01% | -0.10% | 0.38% | -0.41% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.