- GBP/USD sinks into critical demand territory as the dollar finds demand on a spike in US yields.

- A break below 1.3530 opens risk to the January 3 low a cent lower near 1.3430.

At 1.3574, GBP/USD has fallen some 0.51% on Tuesday from a high of 1.3661 to a fresh low of 1.3573. The surge in US Treasury yields has lifted the US dollar out of the doldrums while UK politics weighs on the tainted British currency as well.

Firstly, benchmark US Treasury yields jumped to two-year highs and major equity market indexes dropped more than 1% on Tuesday as traders braced for the Federal Reserve to be more aggressive in tightening monetary policy to tackle inflation.

The US dollar struck a six-day high following the jump in Treasury yields. The US 10-year yield also hit a two-year peak of 1.866% overnight. In line with Treasury yields, the dollar strengthened against a basket of currencies, hitting a one-week high of 95.83 DXY.

UK politics in focus

The UK's prime minister Boris Johnson is caught up in the ''Partygate'' scandal for which he has denied any wrongdoing and has lied to parliament about a lockdown party. His premiership is under threat. The uncertainty is a negative factor for the pound which is already pressured over European politics in the Brexit saga.

However, in the coming few months ahead, Johnson's popularity and sterling's robustness will be scrutinised once again when local elections are held across England, Scotland and Wales on May 5. A civil investigation in Partygate is underway but it is broadly accepted across the party that removing Johnson before this date would be extremely dangerous, as no one could be certain what the consequence would actually be. This could bring some solace to the pound.

Meanwhile, Brexit is a potentially bigger risk for the pound. despite Truss’ first meeting with EU officials seeming to indicate somewhat of a less confrontational approach, the discussions over the Northern Ireland protocol are still set to prove challenging.

As for UK economic data, British employers added a record number of staff in December failed to prop up sterling, despite the Unemployment Rate that fell slightly to 4.1% (vs. expectations: 4.2%). Both headline and ex-bonus wage growth continued to fall as more base effects disappear from the data, with headline wage growth falling slightly.

''Employment data for the three months ending in November continued to confirm the MPC's view that the transition from the furlough scheme went relatively smoothly,'' analysts at TD Securities explained.

''Moreover, vacancies rose to a record high, further highlighting the tightness of the labour market, and flash December PAYE data shows further signs of strength as it registered +184k despite effects from Omicron.''

''The Bank of England will now turn to tomorrow's inflation release, but as it stands, this labour report should pave the way for another rate hike in February—in line with our expectations—especially as Omicron appears to have had a relatively benign impact on the economy compared to previous waves.''

Casting minds back, in December, the BoE became the first major central bank to raise interest rates since the pandemic took hold in 2020. In response, the cable managed to rally over 4% from its December lows, but has lost ground in the last three sessions.

"Expectations have already run quite far," wrote Commerzbank analyst You-Na Park-Heger.

BoE eyed

She explained that there will be attention paid to what the BoE governor Andrew Bailey has to say on Wednesday when speaking to the Treasury Select Committee when inflation data is also due.

Traders will have noted that Gross Domestic Product data on Friday showed that the UK economy was better off than before the first COVID-19 lockdown which can help to underpin the pound as traders wait to see what will come of the BoE's monetary policy decisions in the coming months.

However, the latest positioning data shows that GBP net short positions have dropped back sharply from their recent highs following the 15 bps December rate hike from the BoE.

''The money market is still positioned for a fair amount of tightening next year though the fact that speculators are still net short of GBP still suggests that some types of investors remain sceptical of its outlook,'' analysts at Rabobank explained.

On the other hand, as analysts at Brown Brothers Harriman point out in a note today, ''WIRP suggests over 90% odds of another hike February 3, followed by hikes at very other meeting that would take the policy rate to 1.25% by year-end.'

The analysts at BBH said that they ''think this pricing overstates the BOE’s need to tighten, as headwinds abound from Brexit, higher energy costs, and fiscal tightening. ''

''Along the way, Quantitative Tightening will also kick in as the policy rate moves higher. The hawkish BOE outlook that had helped sterling outperform is getting crowded out a bit lately by the more hawkish Fed outlook. ''

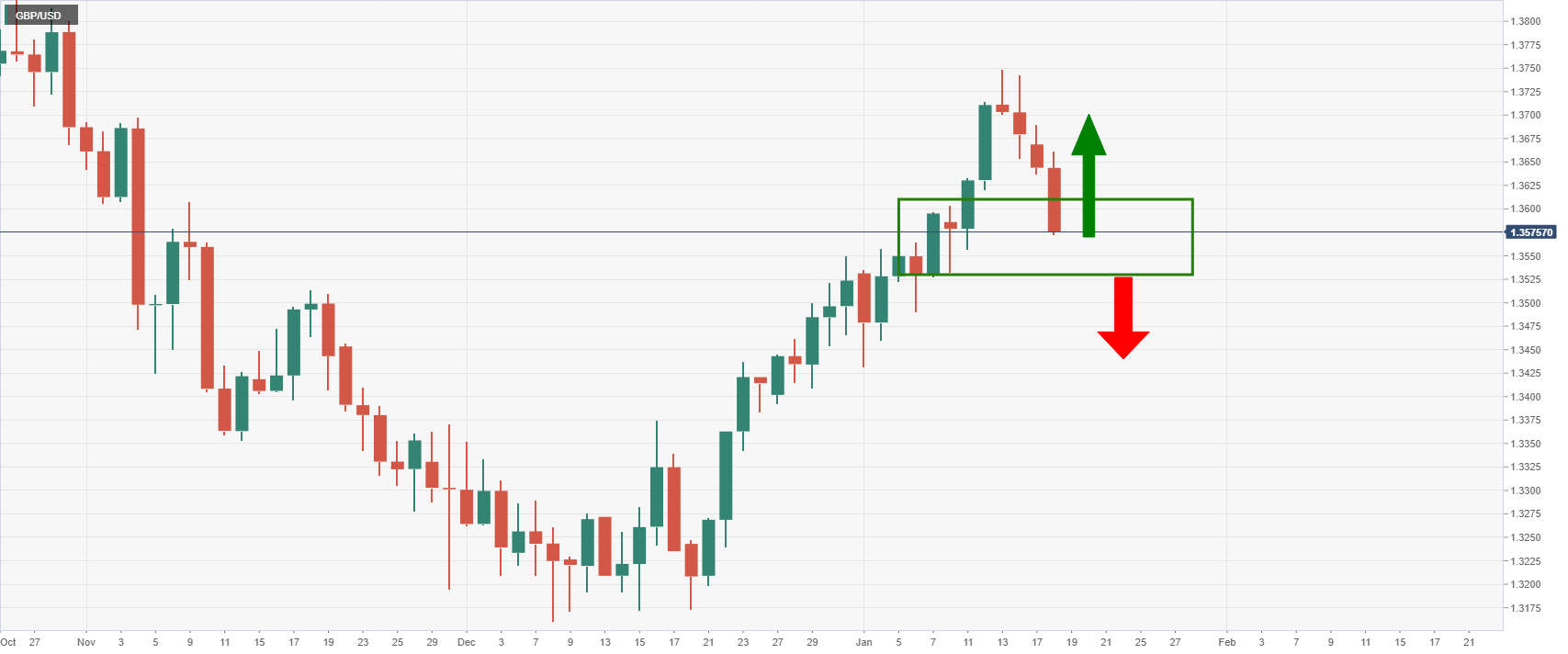

GBP/USD technical analysis

Cable is down three straight days:

A break below 1.3530 opens risk to the January 3 low a cent lower near 1.3430.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

USD/JPY holds above 155.50 ahead of BoJ policy announcement

USD/JPY is trading tightly above 155.50, off multi-year highs ahead of the BoJ policy announcement. The Yen draws support from higher Japanese bond yields even as the Tokyo CPI inflation cooled more than expected.

AUD/USD extends gains toward 0.6550 after Australian PPI data

AUD/USD is extending gains toward 0.6550 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.