GBP/USD breaks down as Pound bulls roll over

- GBP/USD backslid 0.55% on Thursday, slipping back below 1.2700.

- Quiet newsflows out of the UK and a limited data docket crimp Cable flows.

- Pound Sterling traders are on the backfoot heading into Friday.

GBP/USD lost its grip on Thursday, easing back below the 1.2700 handle and shedding over half of a percent in the pair’s worst showing in weeks. US Producer Price Index (PPI) inflation rose faster than expected in November, and US weekly Initial Jobless Claims also rose faster than forecasts.

US PPI inflation bucked to 0.4% in November, while October’s print was retroactively adjusted to 0.3% from 0.2% MoM. Markets were expecting a print no higher than 0.2% MoM. Core PPI inflation accelerated to 3.4% on an annualized basis, over and above the expected uptick to 3.2% from the previous 3.1% YoY. US Initial Jobless Claims for the week ended December 6 also rose to a nine-week high of 242K, further bucking investor risk appetite and missing forecasts of 220K.

Investor sentiment froze in its tracks on Thursday post-PPI inflation print, however market expectations for the Fed’s December 18 rate call have hardened around the 25 bps mark. According to the CME’s FedWatch Tool, rate traders are now pricing in over 98% odds of a quarter-point rate cut when the Federal Open Market Committee (FOMC) convenes in December 18.

Friday brings a limited data docket on either side of the Atlantic, leaving Cable traders to focus on Purchasing Managers Index (PMI) figures due early next week for both the US and UK.

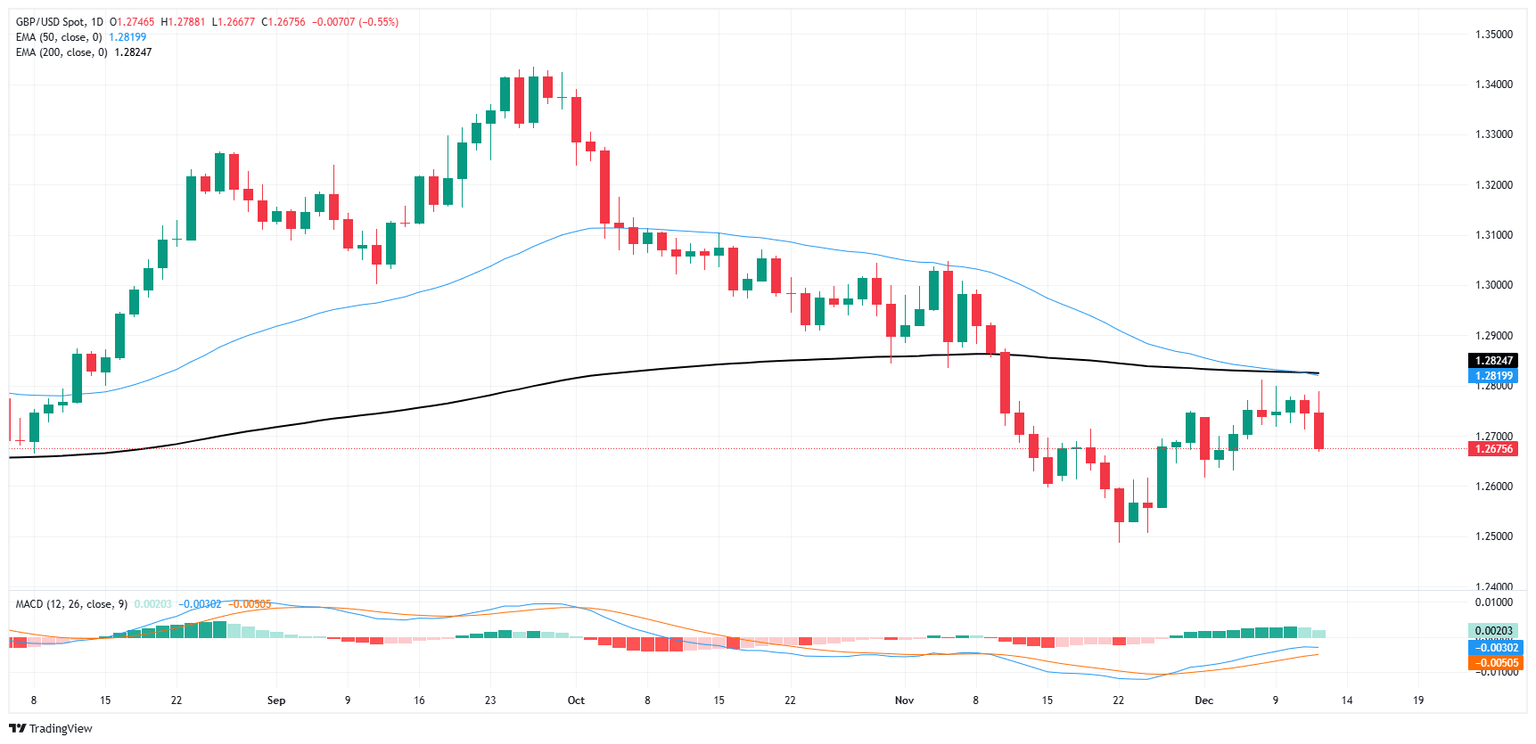

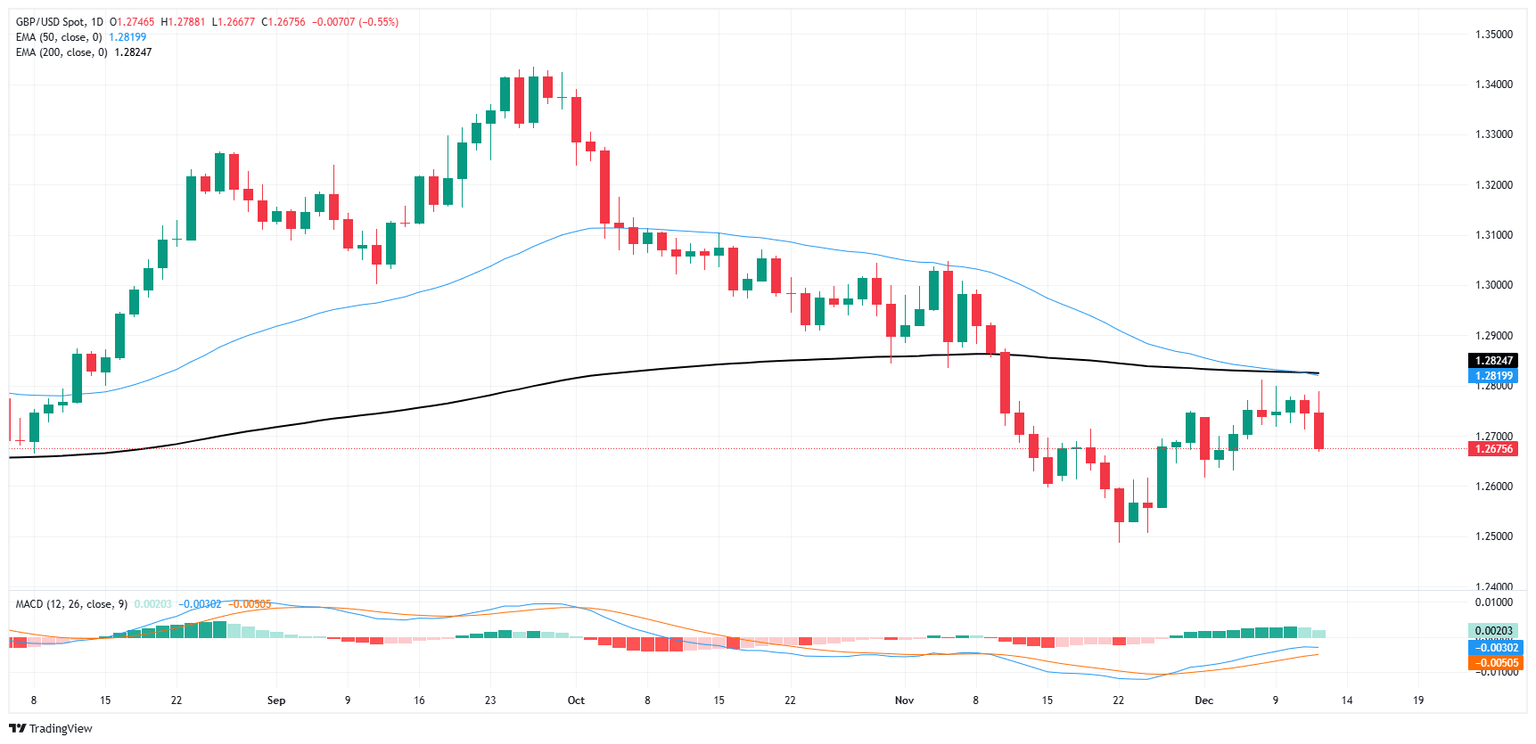

GBP/USD price forecast

The GBP/USD daily chart reveals a clear transition from a prior bullish phase into a more bearish outlook, as the price has recently breached key technical levels. The 50-day Exponential Moving Average (EMA), currently at 1.2819, has been acting as dynamic resistance since mid-November, while the 200-day EMA at 1.2825 reflects a broader bearish bias. The pair's rejection at the 50-day EMA earlier this week underscores persistent selling pressure. Additionally, the downward slope of the Moving Average Convergence Divergence (MACD) histogram and a bearish crossover signal suggest that bearish momentum is intensifying.

The most recent candlestick, a large bearish candle, has decisively closed below 1.2700, signaling that the bears remain in control. This movement invalidates the recovery attempts from late November and positions the pair for further downside. Immediate support is seen near 1.2600, a psychological level, while a breach below this level could expose the August lows near 1.2550. Conversely, should buyers reclaim the 1.2700 handle, the 50-day EMA will remain the primary resistance level to watch, serving as a gauge for a potential shift in sentiment. Until then, the path of least resistance remains to the downside.

GBP/USD daily chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, also known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.