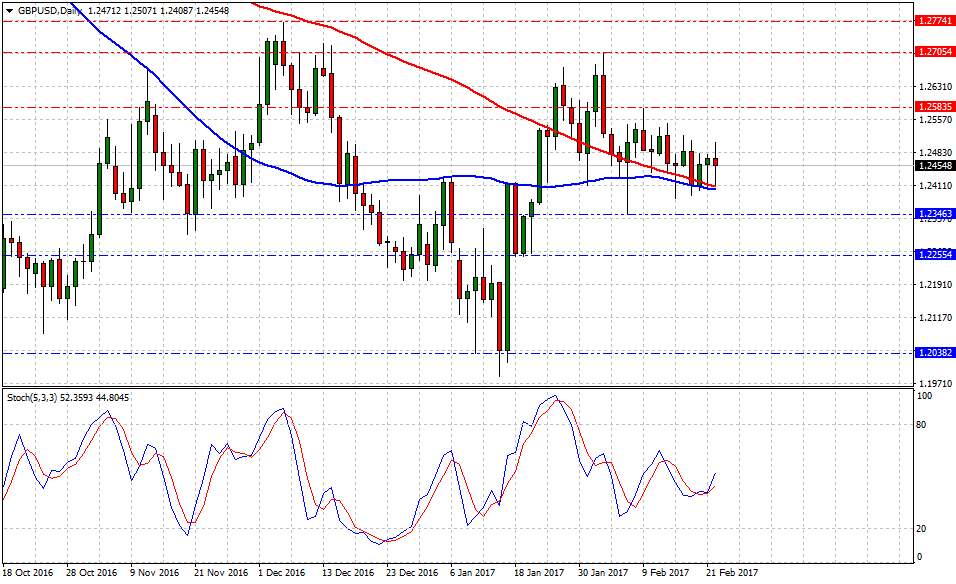

Currently, GBP/USD is trading at 1.2456, down -0.13% or (16)-pips on the day, having posted a daily high at 1.2508 and low at 1.2423.

The British pound vs. American dollar partially erased losses during the NA session as FOMC minutes missed a more hawkish wording to signal a tangible 'fairly soon' rate hike in March; there is no evidence yet to expect such action in the weeks ahead.

Vague Fed speak again, this time from Fed's Powell

Historical data available for traders and investors indicates during the last 8-weeks that GBP/USD pair, also known as the Cable, had the best trading day at +3.01% (Jan.17) or 373-pips, and the worst at -1.19% (Jan.18) or 146-pips. Furthermore, 10-year yield dropped from 2.45% to 2.41% after the Fed’s document.

Technical levels to consider

In terms of technical levels, upside barriers are aligned at 1.2581 (high Feb.9), then at 1.2705 (high Feb.2) and above that at 1.2777 (high Dec.6). While supports are aligned at 1.2345 (low Feb.7), later at 1.2260 (low Jan.20) and finally below that at 1.2010 (Jan.17). On the other hand, Stochastic Oscillator (5,3,3) seems to change course to head north. Therefore, there is evidence to expect further British Pound gains in the near term.

FOMC Minutes: Policymakers thought a rate hike "might be"appropriate "fairly soon"

© 2013 "FXstreet.com. The Forex Market" Todos los Derechos Reservados. Todos nuestros esfuerzos están destinados a proporcionar información precisa y completa. Aún así, con los centenares de documentos disponibles, a menudo publicados con poco margen de tiempo, no podemos garantizar la falta de errores en los mismos. Cualquier publicación o redistribución de contenido de FXstreet.com está absolutamente prohibido sin el consentimiento previo por escrito de FXstreet.com.

Recommended content

Editors’ Picks

EUR/USD falls back toward 1.1150 as US Dollar rebounds

EUR/USD is falling back toward 1.1150 in European trading on Friday, reversing early gains. Risk sentiment sours and lifts the haven demand for the US Dollar, fuelling a pullback in the pair. The focus now remains on the Fedspeak for fresh directives.

GBP/USD struggles near 1.3300 amid renewed US Dollar demand

GBP/USD is paring back gains to trade near 1.3300 in the European session. The data from the UK showed that Retail Sales rose at a stronger pace than expected in August, briefly supporting Pound Sterling but the US Dollar comeback checks the pair's upside. Fedspeak eyed.

Gold hits new highs on expectations of global cuts to interest rates

Gold (XAU/USD) breaks to a new record high near $2,610 on Friday on heightened expectations that global central banks will follow the Federal Reserve (Fed) in easing policy and slashing interest rates.

Pepe price forecast: Eyes for 30% rally

Pepe’s price broke and closed above the descending trendline on Thursday, eyeing for a rally. On-chain data hints at a bullish move as PEPE’s dormant wallets are active, and the long-to-short ratio is above one.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.