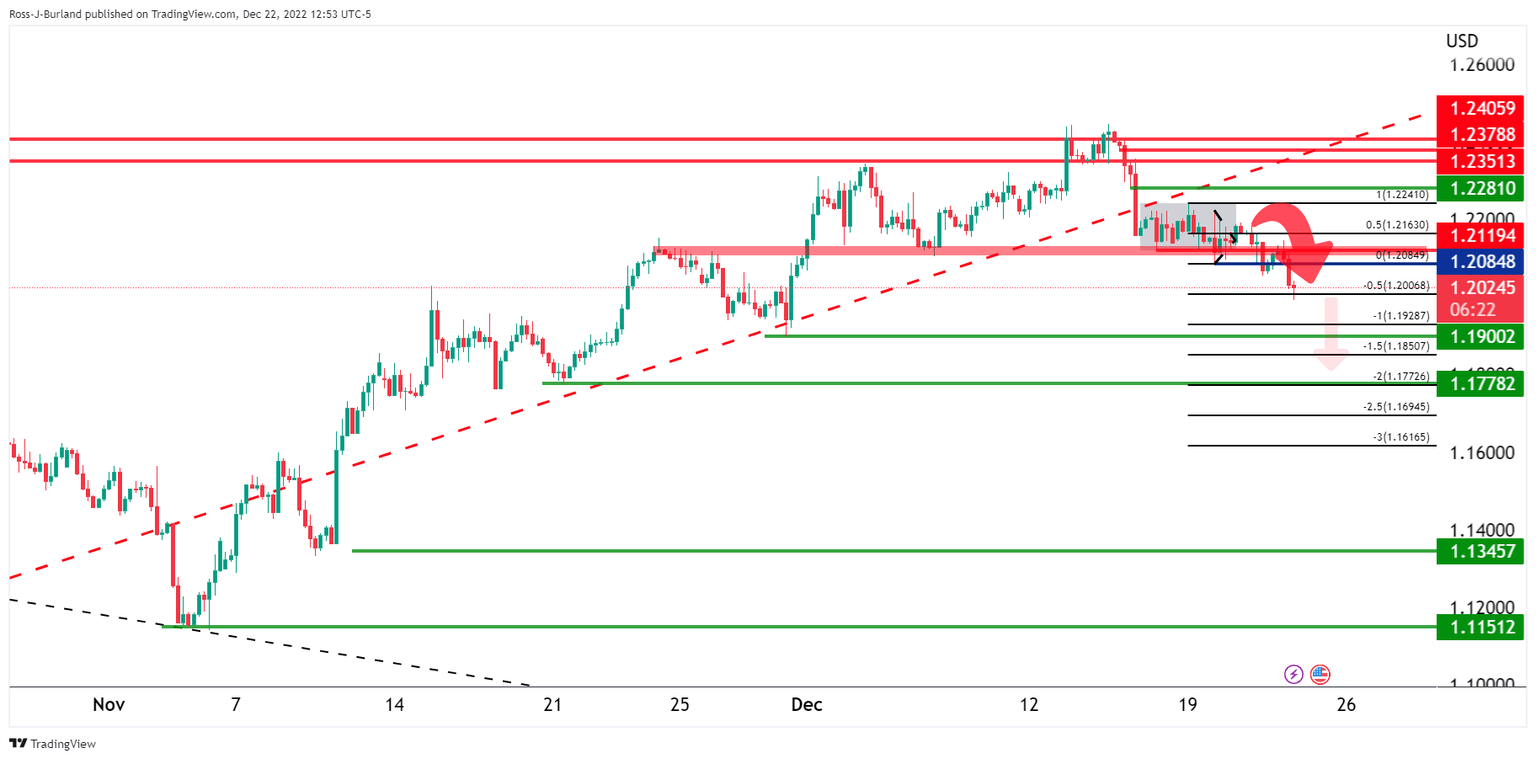

GBP/USD bears move in and eye further downside towards 1.1900

- GBP/USD broke out of a coil and there are eyes on a move towards 1.1900 and 1.1778 thereafter.

- US Dollar is in demand due to prospects of a higher for longer from the Fed in 2023.

GBP/USD is pressured by a resurgence in the US dollar that is getting a boost from stronger-than-forecast data, underpinning the hawkish Federal Reserve outlook and higher rate expectations for 2023. DXY, an index that measures the greenback against a basket of currencies has rallied into the 104.50s from a low of 103.75 although remains well below the highs for the month near 107.20.

The data on Thursday showed weekly jobless claims in the US rose less than expected. The Department of Labor said seasonally adjusted numbers of initial unemployment claims rose by 2,000 to 216,000 in the week ended Dec. 17. The consensus on Econoday was for a 225,000 print. The previous week's level was revised up by 3,000 to 214,000. The four-week moving average tallied 221,750, sliding by 6,250 from the previous week's revised average of 228,000. Unadjusted claims declined 4,064 on a weekly basis to 247,867.

Federal Reserve hawkish for longer

The greenback was in demand following the numbers as these are the type of data that could keep the Federal Reserve hawkish for longer. The Fed last week projected at least an additional 75 basis points of increases in borrowing costs by the end of 2023. Meanwhile, analysts at Brown Brothers Harriman noted that the current consensus for Nonfarm Payrolls stands at 208k vs. 263k in November, with the Unemployment Rate seen steady at 3.7% and average hourly earnings falling a tick to 5.0% YoY. ''While job growth is clearly slowing, it’s not by enough to materially impact unemployment and so we continue to believe that the Fed will have to do more than the market is expecting.''

BoE tightening expectations subdued

Meanwhile, domestically, the UK reported third-quarter current account and final Gross Domestic Produce data. The QoQ growth rate was marked down a tick to -0.3%, while the YoY was revised to 1.9% vs. 2.4% preliminary. Private consumption, government spending, and investment were all marked down significantly, but this was partially offset by stronger net exports. ''This offset is unlikely to be sustained while domestic activity will continue to weaken under the weight of fiscal and monetary tightening,'' the analysts at BBH argued. ''We see downside risks'' the analysts added. ''Bank of England tightening expectations remain subdued. WIRP suggests a 50 bp hike on February 2 is about 80% priced in, with no odds of a larger 75 bp hike.''

GBP/USD technical analysis

GBP/USD broke out of the coil and while being on the backside of the bull cycle trend and below 1.2100, there are eyes on a move towards 1.1900 and 1.1778 thereafter.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.