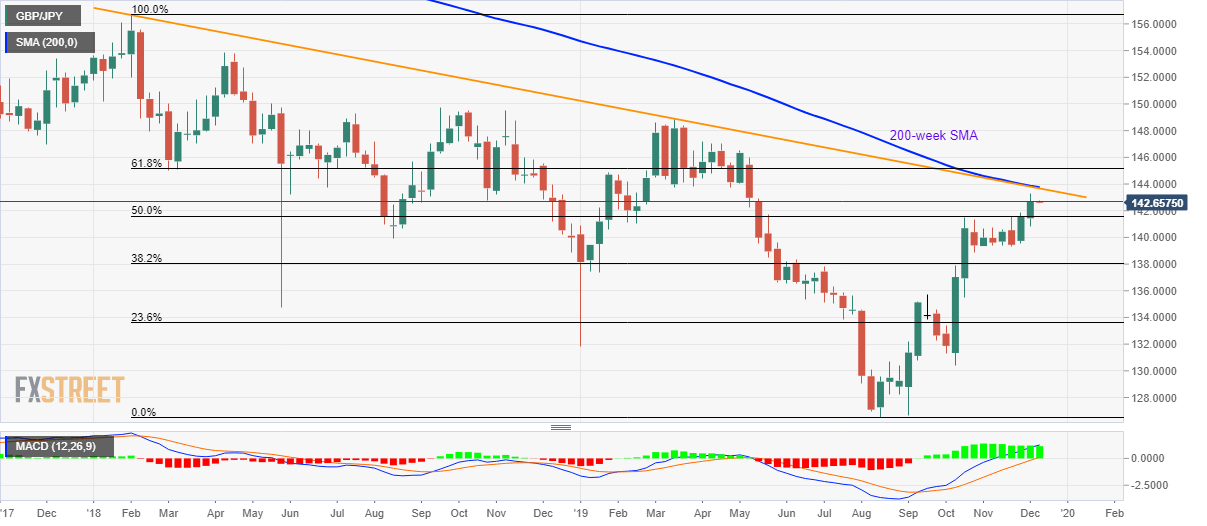

- GBP/JPY stays positive around seven months’ high.

- 200-week SMA, multi-month-old resistance line limit the pair’s upside.

- 50% of Fibonacci retracement acts as immediate key support.

GBP/JPY takes the bids to 142.70 during Monday’s Asian session. The pair extends the late Friday's recovery while running towards the recent highs surrounding 143.30.

Even so, 200-week Simple Moving Average (SMA) and a downward sloping trend line since February 2018 could keep buyers in check near 143.65/80. Should bulls clear 143.80, 61.8% Fibonacci retracement level of 2018 peak to June 2019 trough, around 145.15/20, will be their next target.

It’s worth mentioning that pair’s run-up beyond 145.20 enables it to take aim at the year 2019 top near 148.90.

Alternatively, a weekly closing below 50% Fibonacci retracement level of 141.58 can trigger fresh pullback towards 1400.00 and then the late-October bottom close to 138.50.

GBP/JPY weekly chart

Trend: Pullback expected

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD approaches 0.6900 ahead of Australian inflation

The Aussie is among the best performers against the Greenback this week, trading at fresh 2024 highs, not far from the 0.6900 mark. Australian inflation data taking centre stage in the Asian session.

EUR/USD extend recovery amid persistent USD weakness

The Euro benefited from the broad US Dollar’s weakness on Tuesday, trimming weekly losses and looking to retest the 1.1200 level. Additional gains out of the table amid discouraging European data.

Gold's unstoppable run extends beyond $2,650

Gold price keeps posting record highs on a daily basis, now comfortable above $2,650. Poor United States data fueled speculation the Federal Reserve will trim rates by another 50 bps when it meets in November.

Crypto Today: Bitcoin, Ethereum and XRP consolidate as SUI continues impressive run

Bitcoin traded around $63,600 on Tuesday, as prices appear to be consolidating within the $62,000 and $64,700 key levels. On-chain data shows that the consolidation may be due to profit-taking by holders and mild Bitcoin ETF net inflows of $4.5 million, per Farside Investors data.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.