GBP/JPY soars even further, crosses 206.00 as Yen continues to deflate

- GBP/JPY gains further ground, chalks in a 13-day win streak.

- UK PMI figures improved slightly in June, bolstering GBP.

- UK elections on Thursday to introduce some volatility.

GBP/JPY rose to yet another fresh 16-year high on Wednesday, crossing the 206.00 handle after extending recent gains into a 13-trading-day winning streak. The Japanese Yen (JPY) continues to flounder at the bottom of the Bank of Japan’s (BoJ) hyper easy monetary policy stance. Still, the UK’s upcoming Parliamentary Elections on Thursday could spark fresh volatility in GBP pairs.

The BoJ remains bitterly entrenched in an extremely loose monetary policy stance, and the wide rate differential between the Yen and other major currencies has left the JPY to swirl the drain and steadily decline against broader markets. Despite a steady stream of cautionary statements from Japanese policymakers, Yen action remains firmly one-sided.

The UK’s upcoming Parliamentary Election could introduce a fresh round of volatility into the Pound Sterling on Thursday. The UK’s Labour Party is broadly expected to sweep into a majority government, overturning 14 years of Conservative party leadership. According to the most recent batch of mega polls released on Wednesday, Labour is expected to utterly devastate the Tories, and Labour’s Keir Starmer is expected to replace the Conservative Prime Minister Rishi Sunak. Labour is projected to win 431 seats compared to the Tories' projected win of just 102 according to polling by YouGov.

GBP/JPY technical outlook

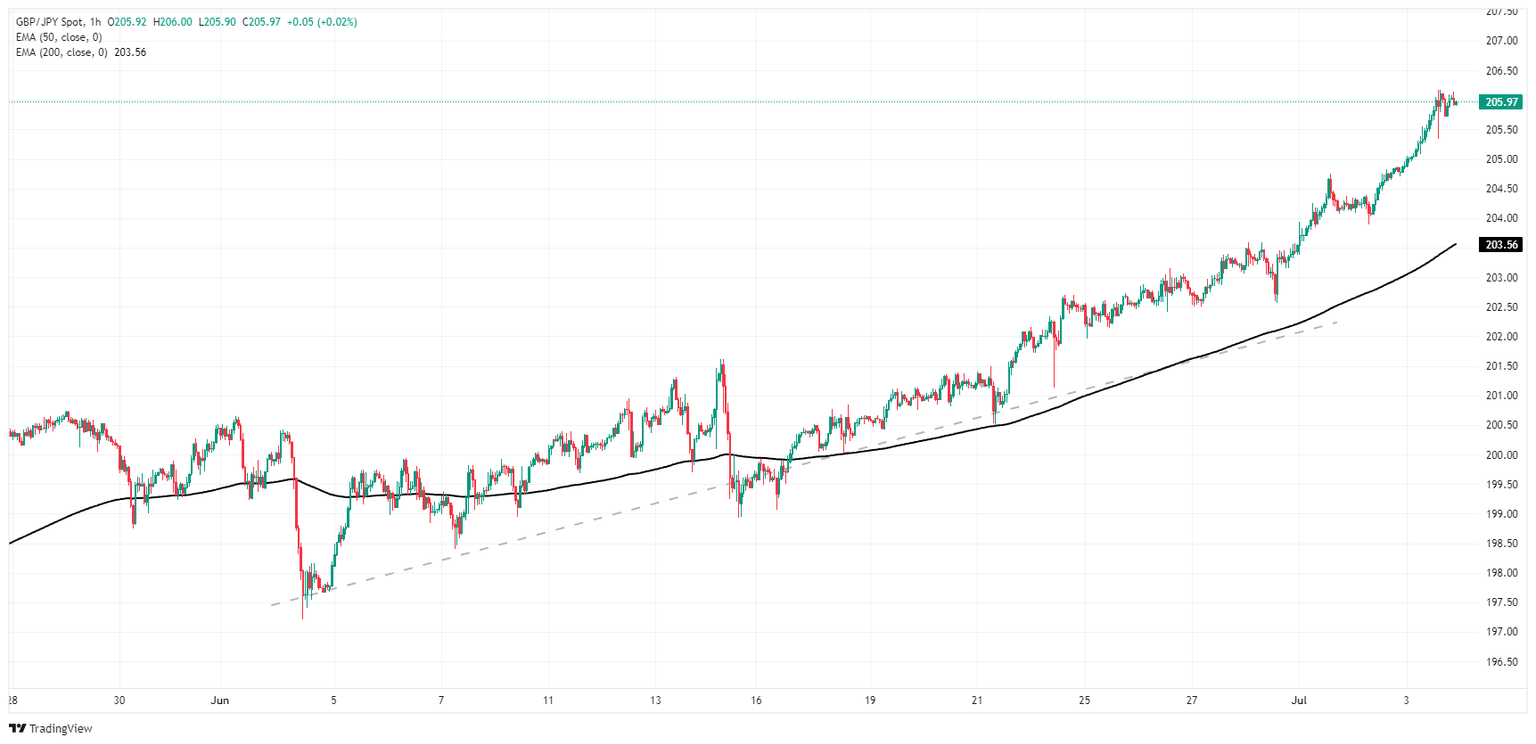

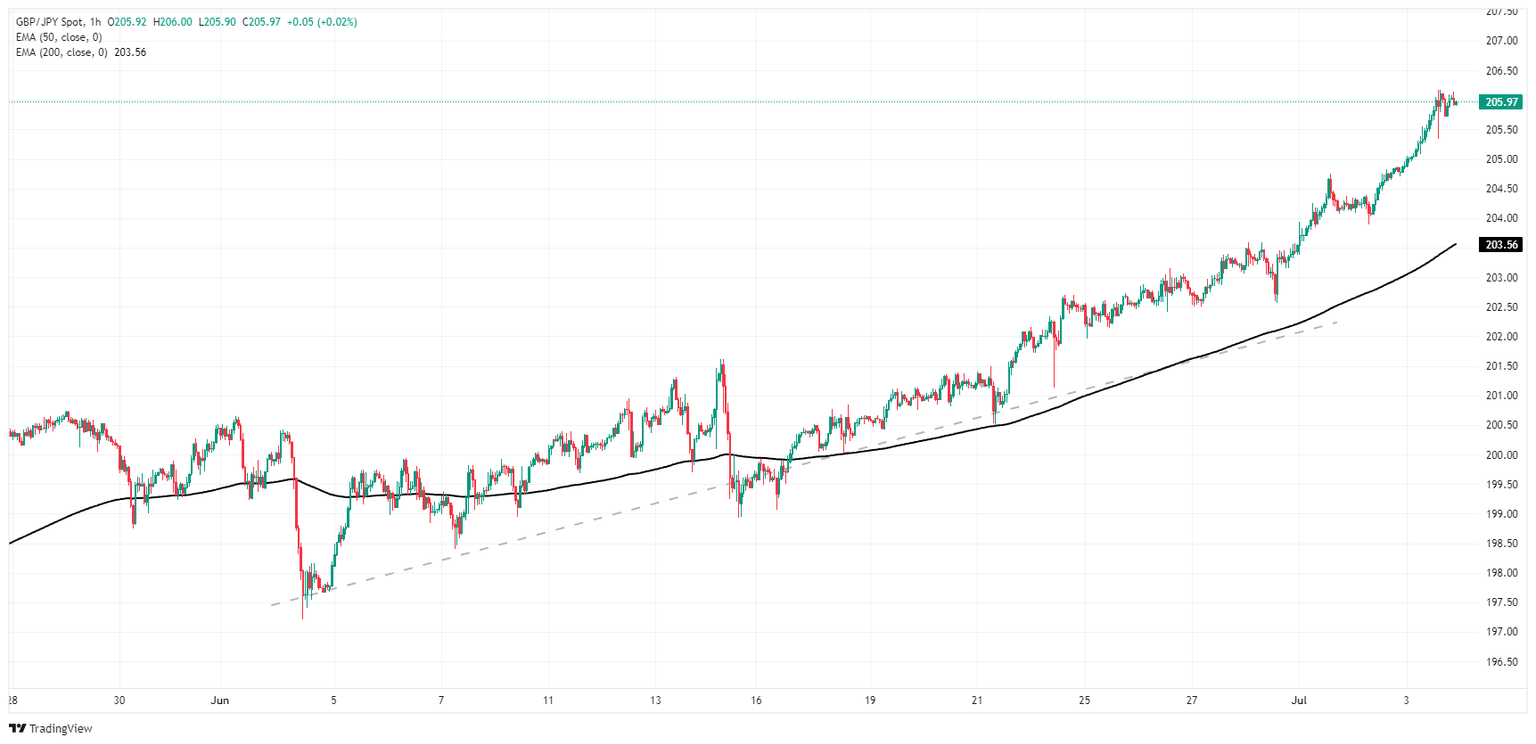

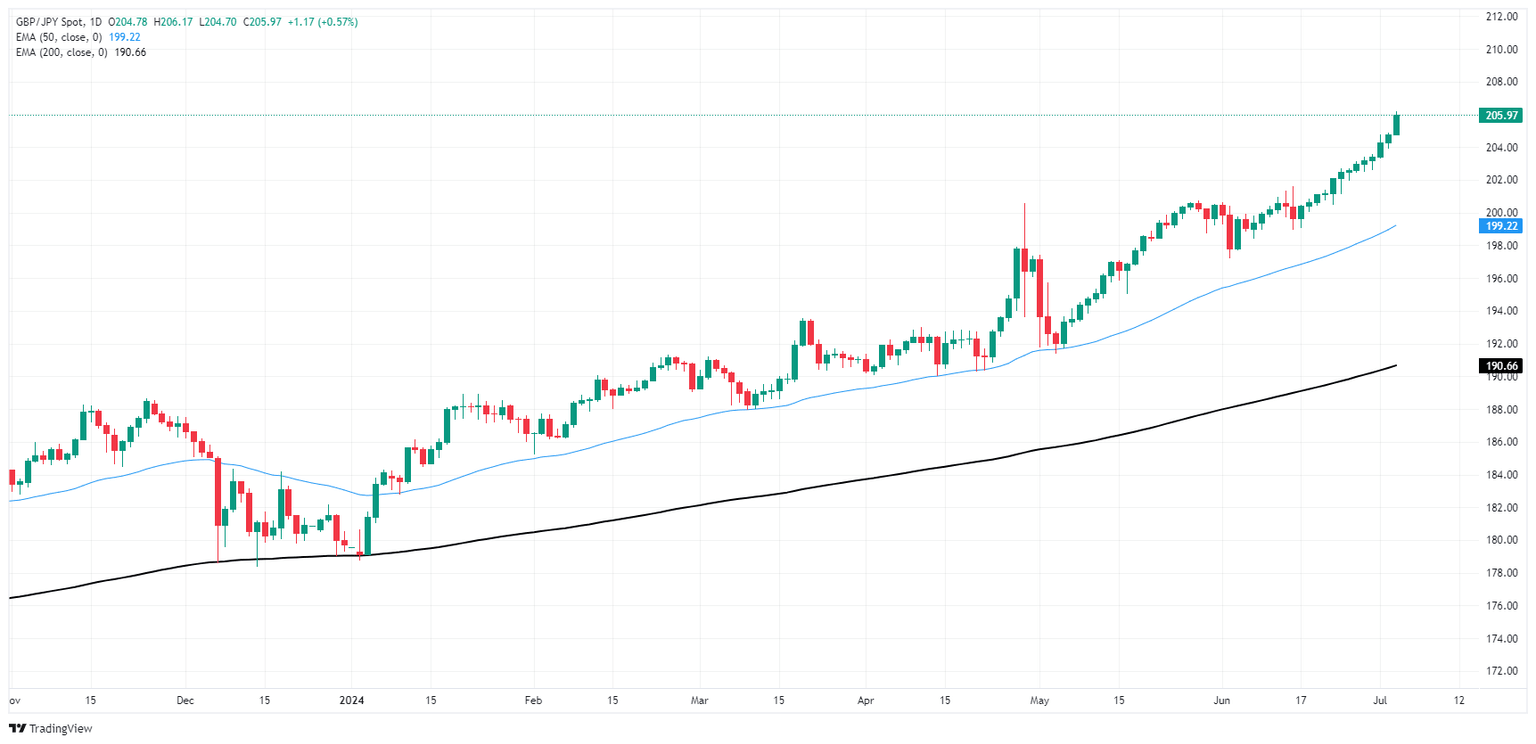

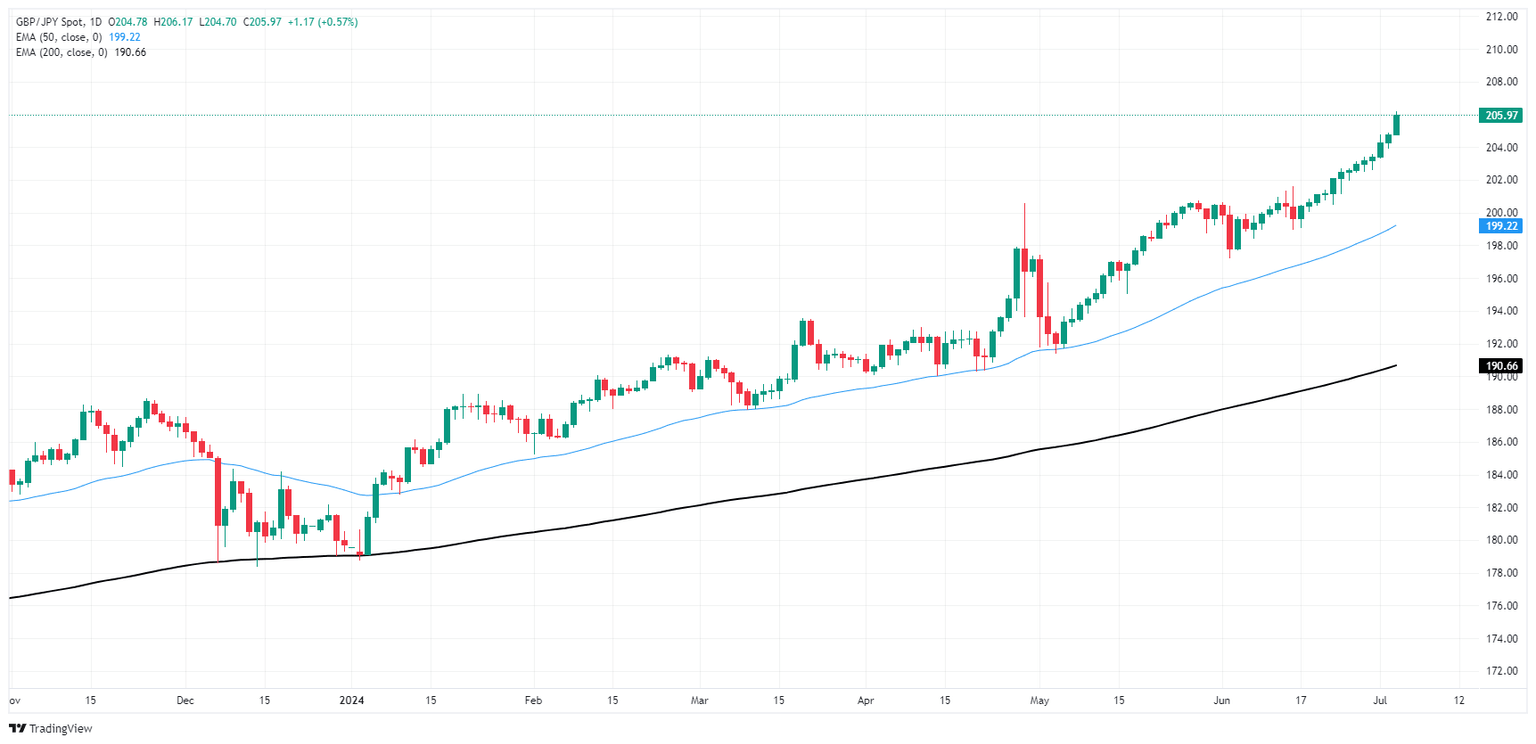

Bullish momentum has accelerated further in the Guppy, dragging the pair over the 206.00 handle on Wednesday and chalking in a thirteenth consecutive trading day ending in the green.

GBP/JPY is up 13.3% from 2024’s early low bids near 178.75, trading deep into bull country above the 200-day Exponential Moving Average (EMA) at 190.65.

GBP/JPY hourly chart

GBP/JPY daily chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, aka ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.