GBP/JPY Price Prediction: Runaway Gap opens as price leaps higher

- GBP/JPY opens a Runaway Gap on the chart as it vaults higher.

- The gap could be a sign the pair is in a strong uptrend which will probably extend.

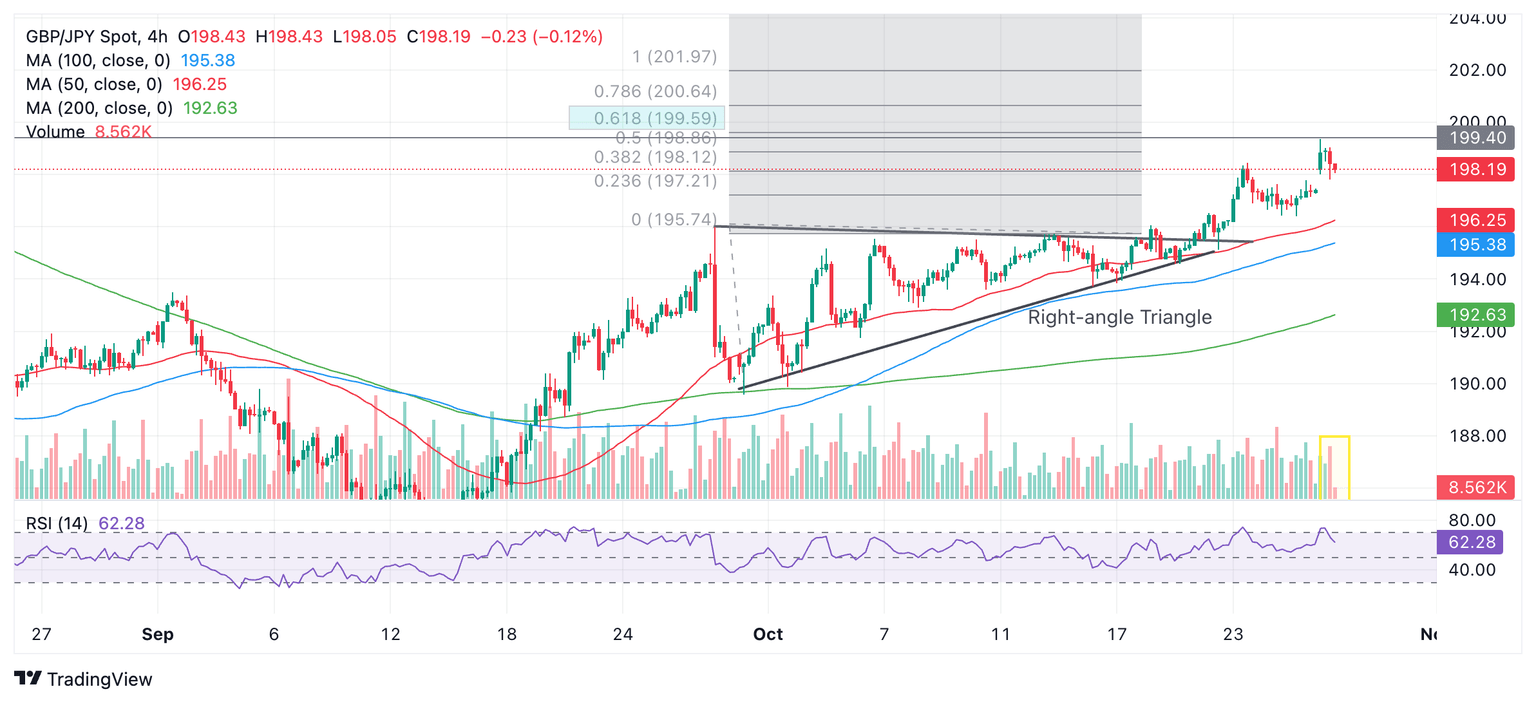

GBP/JPY opens a price gap after the open on Monday as it rallies higher following a breakout move from a Right-Angle Triangle pattern last week.

GBP/JPY 4-hour Chart

The gap on GBP/JPY is probably what is classed as a “Runaway Gap”. These happen during strong rallies.

The lack of volume accompanying this gap (yellow rectangle on volume) indicates this is probably not an Exhaustion Gap at the end of the trend. Price is, therefore, likely to continue rising.

Given GBP/JPY is in an established short and medium term uptrend it will probably extend in line with the dictum that “the trend is your friend”.

GBP/JPY has met resistance at the level of the key July 20 lower high at 199.40 and pulled back temporarily. This is just below the first upside target at 199.59 (blue shaded rectangle), the 61.8% Fibonacci extrapolation of the height of the Right Angle Triangle (at its widest point) higher. Price will probably eventually reach 199.59.

A break above 199.40 would add confirmation of more upside to the target at both 199.59 and 201.97, the 100% extrapolation of the height of the Triangle.

The Relative Strength Index (RSI) momentum indicator has exited the overbought zone (above 70) suggesting the pair will probably pullback for a while before renewing its uptrend.

There is a good chance the price will fall and fully close the Runaway Gap before heading higher again. The bottom of the gap could provide a low risk entry point for traders wishing to enter the uptrend at an optimum point.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.