GBP/JPY Price Forecast: Slumps as UK Retail Sales misses estimates

- GBP/JPY declines to near 196.00 as higher number of BoE officials voted for an interest rate reduction on Thursday than what market participants had anticipated.

- UK Retail Sales rose at a slower-than-expected pace in November.

- Hotter Japan National CPI data for November has boosted BoJ hawkish bets.

The GBP/JPY pair is down almost 0.4% to 196.00 in Friday’s North American session. The asset faces selling pressure after the release of the United Kingdom (UK) Retail Sales data for November, which came in slower than projected due to weak demand at clothing stores.

The Retail Sales data, a key measure of consumer spending, rose by 0.2%, slower than estimates of 0.5%. Weak Retail Sales data weighed on the Pound Sterling (GBP). However, the major reason behind the British currency’s underperformance across the board on Friday is the dovish buildup for the UK interest rates outlook by the Bank of England (BoE).

The BoE left its key borrowing rates at 4.75%, as expected, in which three of nine Monetary Policy Committee (MPC) members proposed cutting interest rates by 25 basis points (bps) to 4.5%. However, market participants anticipated that only one policymaker would vote for a dovish interest rate decision.

Meanwhile, the Japanese Yen (JPY) ticks higher on Friday on the hotter-than-expected inflation report for November. As measured by the National Consumer Price Index (CPI), the headline inflation accelerated to 2.9% from 2.3% in October. The National CPI, excluding Fresh Food, rose by 2.7%, faster than estimates of 2.6% and the former release of 2.3%.

Accelerating price pressures have boosted expectations of more interest rate hikes by the Bank of Japan (BoJ) in upcoming policy meetings.

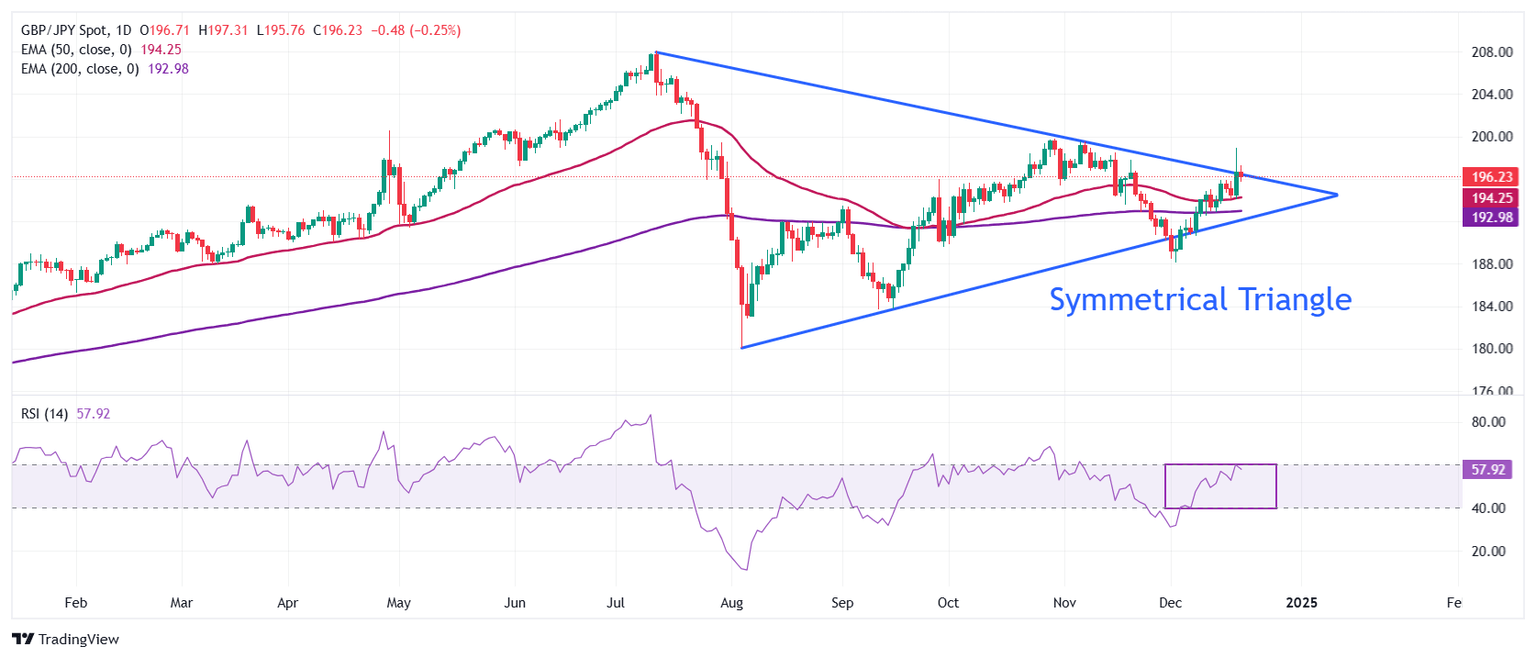

GBP/JPY wobbles near the upper portion of the Symmetrical Triangle formation on a daily timeframe, which suggests a sharp volatility contraction. The outlook of the pair is bullish as it trades above the 50- and 200-day Exponential Moving Averages (EMAs), which are around 194.25 and 193.00, respectively.

The 14-day Relative Strength Index (RSI) hovers near 60.00. A bullish momentum would trigger if it breaks above this level.

A fresh upside towards the October high of 200.00 and the June 14 high of 201.60 would appear if the asset breaks above Thursday’s high of 199.00.

On the flip side, a downside below the December 9 low of 190.60 will expose it to a December 3 low of around 188.00, followed by a September 18 low of 185.80.

GBP/JPY daily chart

Economic Indicator

National CPI ex Fresh Food (YoY)

Japan’s National Consumer Price Index (CPI), released by the Statistics Bureau of Japan on a monthly basis, measures the price fluctuation of goods and services purchased by households nationwide excluding fresh food, whose prices often fluctuate depending on the weather. The YoY reading compares prices in the reference month to the same month a year earlier. Generally, a high reading is seen as bullish for the Japanese Yen (JPY), while a low reading is seen as bearish.

Read more.Last release: Thu Dec 19, 2024 23:30

Frequency: Monthly

Actual: 2.7%

Consensus: 2.6%

Previous: 2.3%

Source: Statistics Bureau of Japan

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.