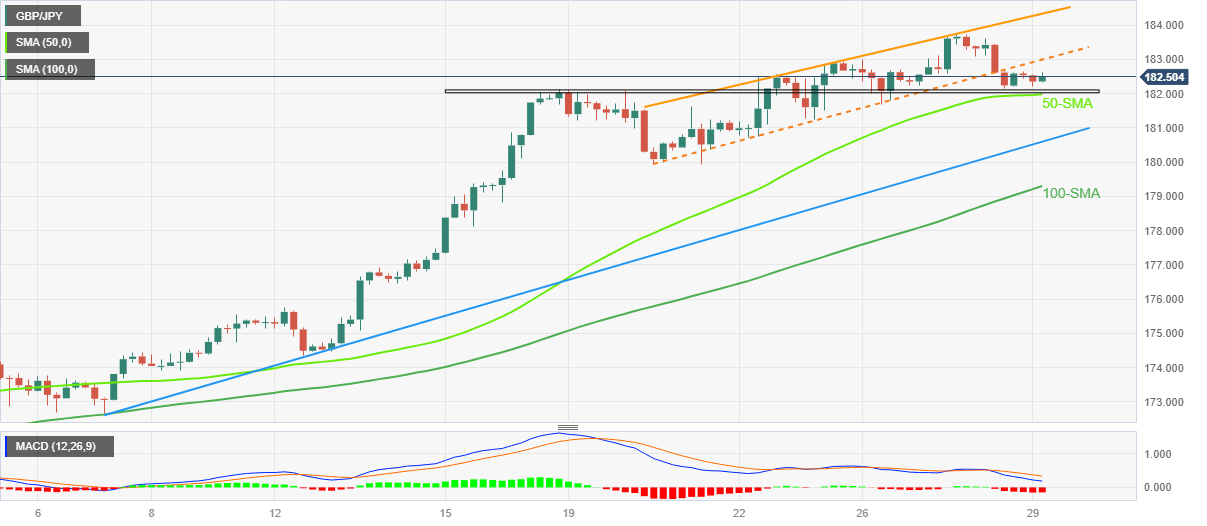

GBP/JPY Price Analysis: Bulls appear tired below 183.00 but not out of the woods

- GBP/JPY pares weekly gains at the highest levels since December 2015, picks up bids to reverse early-day downside of late.

- Convergence of two-week-old horizontal support, 50-SMA challenges intraday bears.

- Bulls may aim for 184.50 during fresh upside, 183.00 caps immediate rise.

GBP/JPY regains the 182.60 level as it consolidates the intraday losses heading into Thursday’s London open. In doing so, the cross-currency pair prints mild gain at the highest levels since late 2015, losing upside momentum of late.

That said, Wednesday’s rejection of a one-week-old bullish channel joins the bearish MACD signals to lure short-term GBP/JPY sellers.

However, multiple tops marked since June 18 join the 50-SMA to restrict the immediate downside of the pair around 182.00-182.10.

Even if the quote breaks the 182.00 support, a three-week-old rising trend line and the 100-SMA, respectively near 180.60 and 179.30, will challenge the GBP/JPY bears. Also acting as the downside filter is the 180.00 psychological magnet.

On the contrary, the pair’s latest recovery appears elusive unless defying the previous day’s channel break, by crossing the 183.000 hurdle comprising the lower line of the aforementioned channel.

Following that, a run-up towards the latest multi-year high near 183.80 and the stated channel’s top line, close to 184.50 could lure the GBP/JPY buyers.

It’s worth noting that the GBP/JPY pair’s run-up beyond 184.50 enables buyers to aim for the November 2015 peak of near 188.80 and then the 190.00 round figure.

Overall, GBP/JPY may remain depressed but the bears are far from home.

GBP/JPY: Four-hour chart

Trend: Further recovery expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.