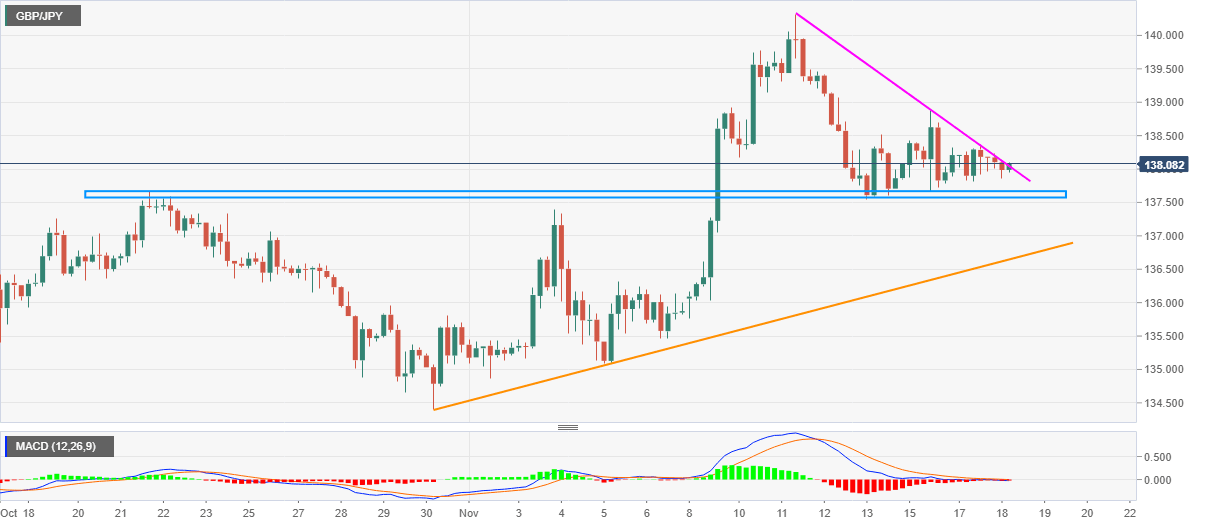

GBP/JPY Price Analysis: Battles weekly resistance line ahead of UK CPI

- GBP/JPY keeps recovery moves from intraday low amid Brexit hopes, risk-off mood.

- One-month-old horizontal support can probe short-term bears.

- UK inflation data likely to improve YoY, disappoint on MoM in October.

GBP/JPY extends corrective pullback from 137.85 to around 138.08 during the pre-London open trading on Wednesday. While hopes of a Brexit deal favor the pair buyers, cautious sentiment ahead of the UK CPI for October and the coronavirus (COVID-19) woes probe the immediate upside momentum.

Also challenging the GBP/JPY bulls is a falling trend line from November 11, at 138.05 now, as well as bearish MACD signals.

Considering the expected weakness in the British CPI on MoM, mainly due to the national lockdown, coupled with the pair’s inability to cross the immediate resistance line, GBP/JPY sellers stay directed towards revisiting an area including late-October high and the last week’s low near 137.55/65.

Read: When are the UK CPIs and how could they affect GBP/USD?

During the quote’s extended weakness past-137.55, an upward sloping trend line from October 30, currently around 136.65, will gain the market attention.

Meanwhile, a clear upside break of the immediate resistance line will escalate the latest recovery moves toward the 139.00 round-figure. However, the 140.00 psychological magnet and the monthly peak surrounding 140.30 can challenge the GBP/JPY bulls then after.

GBP/JPY four-hour chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.