GBP/JPY continues slow grind back into decade-plus highs

- GBP/JPY testing highest bids since August 2008 as Yen flounders.

- Slumping UK data trims Sterling gains, but GBP march continues.

- BoE rate call due Thursday, expected to hold rates steady.

GBP/JPY is holding staunchly on the high side, trading into the 201.00 handle in thin Wednesday action and keeping pinned close to 16-year highs near 201.60. The Guppy trailed into fresh peaks last week and continues to roil close to the top end despite a near-term knockback below 199.00.

UK economic data mostly missed the mark in the front half of the trading week, with headline Consumer Price Index (CPI) inflation and the Retail Price Index both slightly flubbing forecasts. However, GBP traders will be pivoting to face down Thursday’s upcoming Bank of England (BoE) rate call. The BoE’s Monetary Policy Committee (MPC) is broadly expected to vote seven-to-two to keep rates held at 5.25%, with two members of the MPC expected to vote in favor of a rate cut, inline with the previous meeting.

Japanese National Consumer Price Index (CPI) inflation is also due early Friday, with annualized Core National CPI inflation expected to tick upwards to 2.6% from 2.2%. Japanese national-level CPI inflation tends to have a muted effect as the data event is previewed by Tokyo CPI inflation several weeks ahead of time.

Friday will follow up with UK Retail Sales, which are expected to rebound in May, forecast to print at 1.5% MoM versus the previous month’s -2.3% decline. S&P Global Purchasing Managers Index (PMI) activity figures will round out the UK’s economic calendar this week. The UK Manufacturing PMI is expected to tick up to 51.3 from 51.2, wit the Services component expect to make a similar move, forecast to rise to 53.0 from 52.9.

GBP/JPY technical outlook

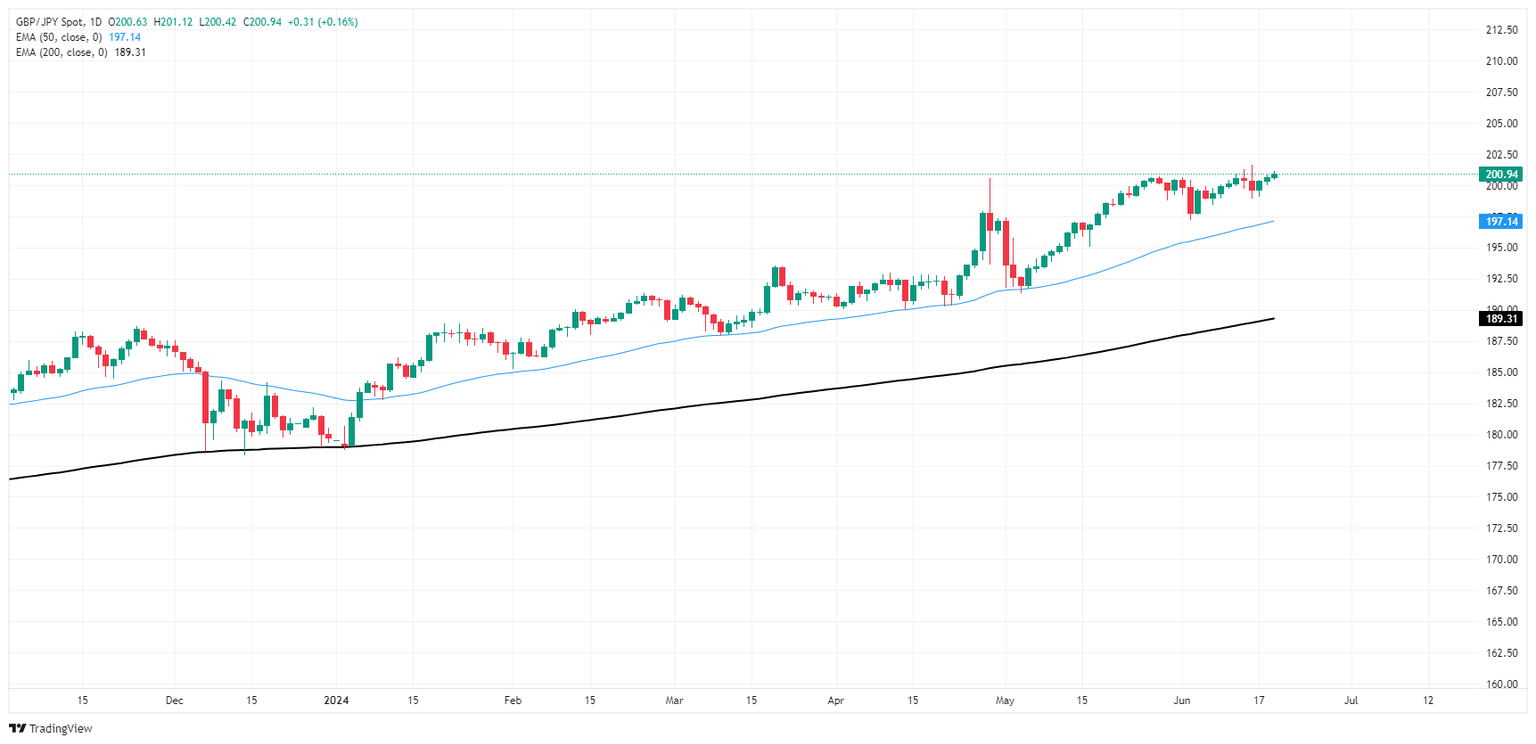

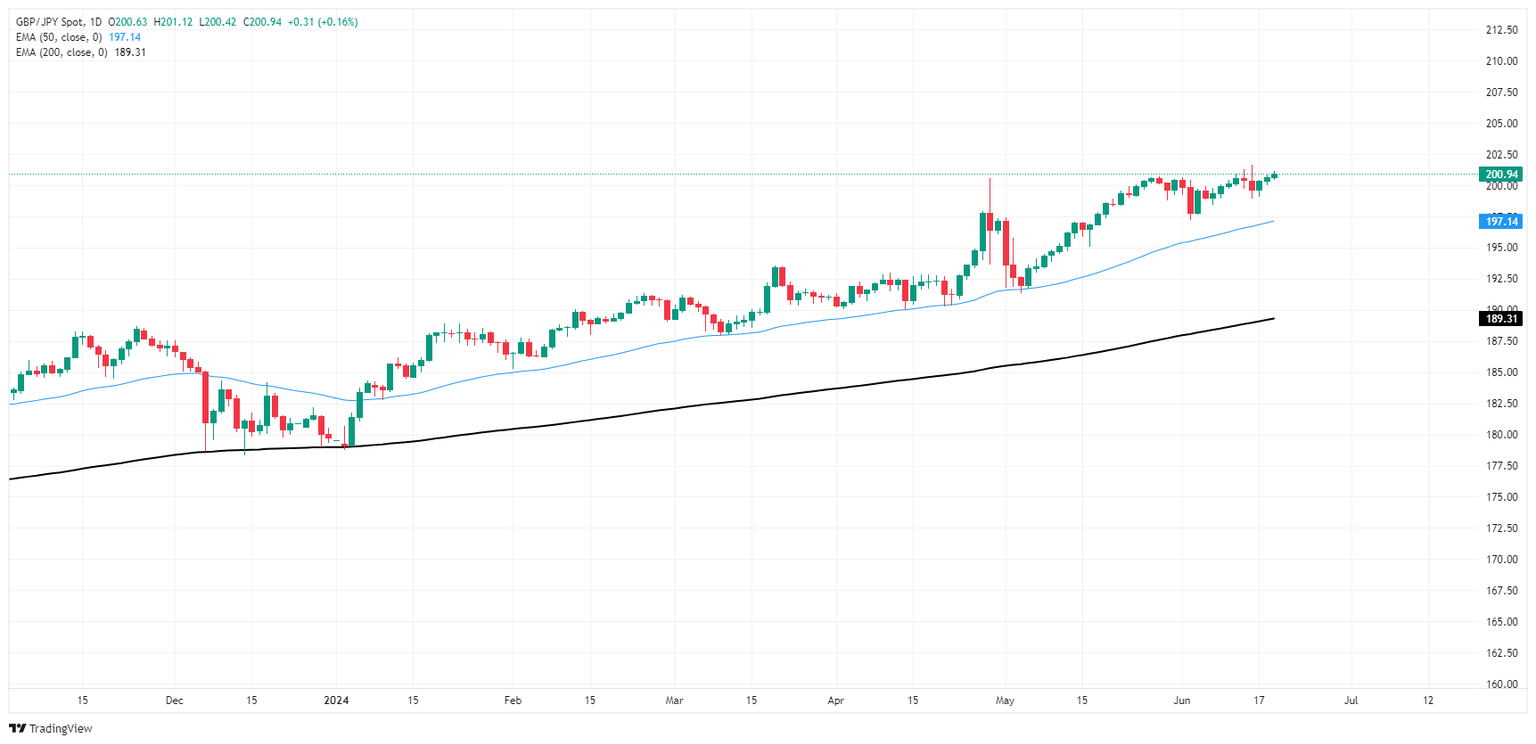

GBP/JPY pulled itself back upwards after a brief dip below the 200-hour Exponential Moving Average (EMA) at 200.20, but the pair is still trudging through chart paper below last week’s fresh 16-year peak above 201.60.

Bullish momentum is firmly planted front and center, with GBP/JPY trading well north of the 200-day EMA rising towards 190.00. The pair has trading on the high side of the long-term moving average since bouncing from the key technical indicator at the beginning of 2024, and the Guppy is up 12% for the year.

GBP/JPY hourly chart

GBP/JPY daily chart

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.