GBP/CAD falls over one percent on Monday as markets till expect a rate cut from the BoE

- GBP/CAD weakens over a percent at the open on Monday due to markets still expecting the Bank of England to cut interest rates.

- This comes despite substantially higher inflation forecast for 2025 due to the government’s autumn Budget.

- Canadian data improves mildly helping to reduce losses for the currency ahead of BoC meeting on Tuesday when more cuts are expected.

GBP/CAD, which measures the purchasing power of a single Pound Sterling (GBP) in Canadian Dollars (CAD), trades in the 1.8020s on Monday, about a one percent drop from its closing price on Friday.

Sterling’s steep decline against the Canadian Dollar over the space of a single weekend is partly due to an easing in the Pound’s volatility following the UK autumn Budget, and glimmers of hope offered by recent Canadian economic data releases, which might show green shoots of renewal after a prolonged period of weakness.

GBP/CAD fell immediately following the UK Budget on Wednesday as investors sold the Pound due to the increase in government borrowing implied by the Budget. UK government borrowing has already oustripped forecasts by 7 billion (GBP) in the first six months of 2024, according to Reuters, and the Budget will add another 32 billion (GBP) in borrowing per year, according to the Office of Budgetary Responsibility (OBR).

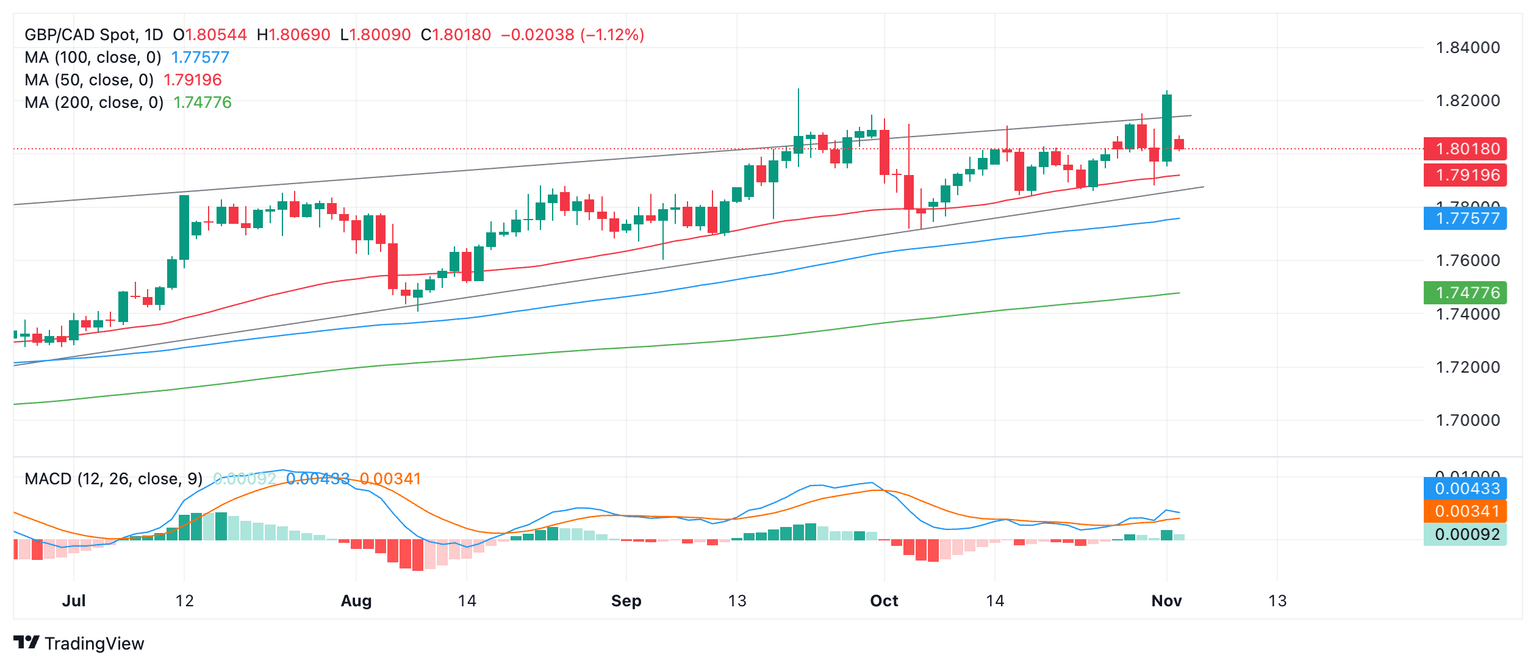

GBP/CAD Daily Chart

On Friday, however, GBP/CAD rebounded as the Chancellor and her deputy reassured markets via media interviews of the soundness of their figures, and the Pound recovered.

The OBR forecasts higher inflation due to the Budget, mainly as a result of an increase in the minimum wage and substantial government spending, and this makes it likely the Bank of England (BoE) will need to keep interest rates higher for longer. This, in turn, is positive for the Pound as it increases foreign capital inflows. This contributed to GBP/CAD rallying to a six-week high on Friday.

On Monday the Pound is falling once again, however, amid continued expectations that although inflation is likely to rise – to 2.6% in 2025 from 1.5% previously, according to the OBR – this will not prevent the BoE from cutting interest rates by 25 basis points (bps) at their meeting on Thursday. Such a cut would be negative for Sterling as it lowers capital inflows.

The recent weak flow of macroeconomic data for the UK is the reason the BoE is likely tp press ahead with a 0.25% cut to interest rates at its meeting on Thursday.

“Next week, the BoE meeting will take center stage. Weaker-than-expected data should see the MPC cut by 25 bps. Still, as a result of the budget, the MPC is likely to maintain its gradual easing message,” said Klaus Baader, Global Chief Economist, Societe Generale, in a note on Friday.

The Canadian Dollar (CAD) has seen substantial weakness in recent months due to the Bank of Canada (BoC) aggressive easing policy. The BoC has slashed its cash rate from 5.00% in May 2024 to 3.75%. This includes a double-dose 50 bps (0.50%) cut in October. Markets are further betting the BoC might cut by another 50 bps at its meeting on December 11. At the same time CAD may gain some support from the view that the worst might be over for the Canadian economy and that after the next interest rate cut the BoC will take a more relaxed approach to easing.

Canadian data has shown a mild improvement over recent months, arguably because of the timely action taken by the central bank to reduce interest rates. The S&P Global Canada Manufacturing PMI rose to 51.1 in October from 50.4 in the previous month, “the second consecutive expansion in Canadian factory activity after 17 consecutive monthly contractions,” according to Trading Economics. Canadian GDP has shown modest growth over recent months and Small Business Optimism has also bounced.

That said, not all analysts are optimistic about the outlook for the Canadian economy.

“We think Friday’s Canadian employment report should tell a familiar story—that the labor market has continued to weaken in October amid slowing hiring demand. Employment is still expected to increase, but not by much. We expect 15,000 jobs were added, but that would again undershoot growth in the labor force and population, and push the unemployment rate back up to 6.6% after a tick lower to 6.5% in September,” says Nathan Janzen, Assistant Chief Economist at RBC.

A further factor is Crude Oil, which is rebounding from its recent multi-month lows in the $60s (WTI Crude Oil) and is trading back above $70 per barrel again amid OPEC constraints. This impacts demand for CAD because Oil is the country’s largest export.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.