Forex Today: European inflation data in the barrel

US markets took Thursday off for the Thanksgiving holiday, keeping the Greenback at bay and setting up European-session traders for a fresh round of preliminary pan-European HICP inflation figures for November.

Here’s what you need to know on Friday, November 29th:

The US Dollar Index (DXY) slumped into a flat day on Thursday, trading flatly near the 106.00 handle as holiday-thinned market volumes took the wind out of US market session sails. The Greenback’s broad-market index has eased from year-plus highs set late last week, but rushing too quickly into a bearish USD stance could catch short-term traders off-guard with a snap back into the high side.

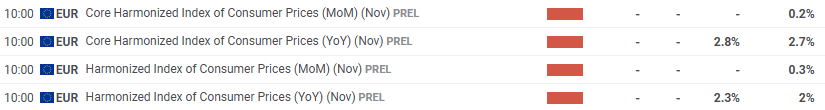

EUR/USD also traded flat through most of Thursday’s market action, hobbled just south of the 1.0600 handle. Euro traders will be looking ahead to Friday’s wide docket of European economic data, but the key figures for Fiber will be pan-EU Harmonized Index of Consumer Prices (HICP) inflation. Core HICP inflation is forecast to tick upwards to 2.8% YoY in November from the previous 2.7%, which will throw a wrench in the works for several European Central Bank (ECB) officials who have hit newswires this week trying to soothe investors with promises of further rate cuts in December and heading into 2025.

GBP/USD struggled to make much progress in either direction, but Cable still managed to inch closer to the 1.2700 handle on Thursday. The UK has a clean data docket on Friday, although the Bank of England (BoE) is expected to release its latest Financial Stability Report.

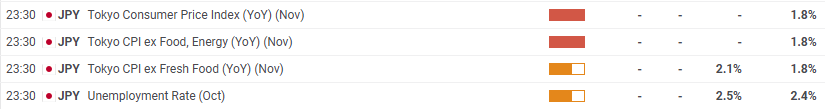

USD/JPY reclaimed some lost ground on Thursday after a clean bounce off of the 200-day Exponential Moving Average (EMA) near 150.50 during the mid-week market session. However, bullish momentum remains absent as Yen traders gear up for Japanese inflation figures early Friday. Core Tokyo Consumer Price Index (CPI) inflation is expected to tick higher to 2.1% for the year ended in November, compared to the previous period’s 1.8%. While rising inflation will help push the Bank of Japan (BoJ) closer to increasing rock-bottom interest rates, investors have noted that Japan’s Unemployment Rate is also expected to tick up to 2.5% in November from 2.4%, a move that will give permadove BoJ policymakers all the fuel they need to continue holding rates in the basement for an undefined period.

AUD/USD remained stuck near the 0.6500 level, and a quiet data docket for the Antipodeans means the Aussie is likely to remain stuck near recent lows. AUD/USD fell over 7% top-to-bottom from September’s highs near 0.6940, and Aussie bulls are struggling to develop meaningful momentum.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.