Euro maintains the bearish bias near 1.0970 amidst decent gains in the Dollar

- The Euro hovers around 1.0970 against the US Dollar.

- European stocks keep the positive performance midweek.

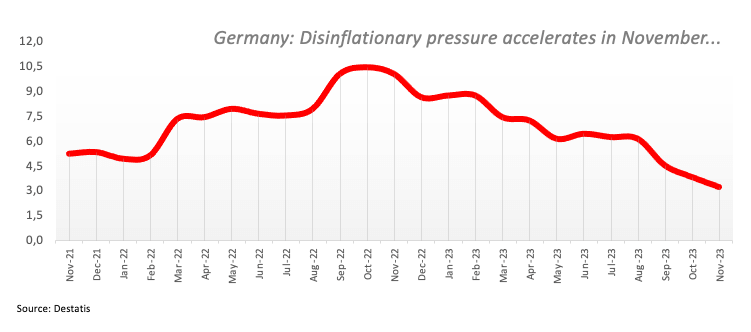

- Flash Germany’s CPI rose less than expected in November.

The Euro could not sustain another bout of strength past the 1.1000 mark against the US Dollar on Wednesday, prompting EUR/USD to recede to the 1.0970 region against the backdrop of the so-far decent rebound in the US Dollar.

Still around the Greenback, it manages to gather some fresh buying interest and approaches the key barrier at 103.00 the figure when measured by the USD Index (DXY) amidst the broad-based decline in US yields across different timeframes.

The current monetary policy landscape remains unchanged, with investors incorporating the possibility of future interest rate cuts by both the Federal Reserve (Fed) and the European Central Bank (ECB) in the spring of 2024.

On the euro docket, flash Inflation Rate in Germany showed the CPI rose 3.2% over the last twelve months in November and contracted 0.4% vs. the previous month.

Across the pond, the advanced Q3 GDP Growth Rate surprised to the upside after noting that the economy expanded 5.2% YoY, while preliminary Goods Trade Balance showed a $89.84B deficit in October and the usual Mortgage Applications tracked by MBA increased by 0.3% in the week to November 24. Later in the session, the Fed will publish its Beige Book.

In addition, Cleveland Fed Loretta Mester (2024 voter, hawk) is also due to speak.

Daily digest market movers: Euro comes under pressure on Dollar recovery

- The EUR meets some support near 1.0970 against the USD so far.

- US and German yields extend their march south midweek.

- Investors contemplate the Fed reducing its interest rates in Q2 2024.

- Markets expectations place the ECB cutting rates in H2 2024.

- ECB’s Luis De Guindos said banks are delaying passing higher rates to savers.

- ECB's Yannis Stournaras favoured an initial rate cut in mid-2024.

- BoJ’s Seiji Adachi said a positive wage-inflation cycle is needed to change stance.

Technical Analysis: Euro's next hurdle aligns at 1.1064

Further upside momentum lifted EUR/USD to new monthly highs near 1.1020 on Wednesday, although this bullish move have ran out of steam afterwards.

The November high of 1.1017 (November 29) is now the EUR/USD’s immediate target, followed by the August top of 1.1064 (August 10) and another weekly peak of 1.1149 (July 27), all of which precede the 2023 high of 1.1275. (July 18).

Meanwhile, any corrective declines should find first support around the crucial 200-day SMA at 1.0814, followed by the temporary 55-day SMA at 1.0671. The weekly low of 1.0495 (October 13) follows next, seconded by the 2023 low of 1.0448 (October 3).

Meanwhile, the bullish outlook for the pair remains unchanged as long as it trades above the 200-day SMA.

Euro FAQs

What is the Euro?

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

What is the ECB and how does it impact the Euro?

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

How does inflation data impact the value of the Euro?

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

How does economic data influence the value of the Euro?

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

How does the Trade Balance impact the Euro?

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.