EUR/USD advances toward 1.0900 as downbeat US ISM factory data weighs on US Dollar

- EUR/USD advances to 1.0870 after weak US ISM Manufcaturing PMI for May.

- The ECB is widely anticipated to announce interest rate cuts on Thursday.

- The US NFP will provide fresh cues about Fed rate-cut timing on Friday.

EUR/USD jumps to 1.0870 in Monday’s New York session. The major currency pair strengthened after the United States (US) Institute of Supply Management (ISM) reported that the Manufacturing PMI surprisingly dropped to 48.7 from the estimates of 49.8 and the former release of 49.2. A figure below the 50.0 threshold is itself considered a contraction in the sector. Other sub-components, such as Price Paid and New Orders indexes, missed estimates, suggesting a decline in input prices and a weak demand outlook, respectively.

This has put more pressure on the US Dollar. the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, tumbles to 104.26. The USD Index was already under stress due to slight improvement in market speculation for the Federal Reserve (Fed) to begin reducing interest rates from the September meeting.

The CME FedWatch tool shows that the probability of a rate cut by the Fed in the September meeting has increased to 52% from 49% recorded a week ago. Market speculation for the Fed reducing interest rates in September improved after the Personal Consumption Expenditures Price Index (PCE) report showed on Friday that the Personal Spending growth momentum slowed to 0.2% in April from the estimates of 0.3% and the prior reading of 0.7%. However, the core PCE inflation, the Fed’s preferred inflation gauge, rose expectedly by 2.8% on a year-over-year basis.

This week, the shared currency pair is expected to remain volatile as investors shift focus to the European Central Bank’s (ECB) interest rate decision, which will be announced on Thursday.

Daily digest market movers: EUR/USD recovers strongly after downbeat US ISM factory data

- EUR/USD exhibits a firm footing ahead of the ECB’s interest rate decision and the United States Nonfarm Payrolls (NFP) report for May, which will be released on Thursday and Friday, respectively. The labor market data will provide fresh cues about when the Federal Reserve (Fed) could start reducing interest rates.

- Financial markets anticipate the ECB will cut its key Main Refinancing Operations Rate by 25 basis points (bps) to 4.25%. Therefore, market participants remain more interested in cues for the rate-cut path beyond the June meeting. Expectations for the ECB to deliver subsequent rate cuts in the July meeting have waned after the Eurozone’s preliminary Harmonized Index of Consumer Prices (HICP) report for May showed that the journey towards achieving the 2% inflation is expected to remain bumpy.

- Eurostat reported on Friday that the annual preliminary Eurozone HICP grew at a faster pace than expected in May. Headline HICP rose by 2.6%, stronger than the estimates of 2.5% and April's reading of 2.4%. In the same period, the core HICP data – which excludes volatile components such as food, energy, alcohol and tobacco – accelerated to 2.9%, from expectations of 2.8% and the prior reading of 2.7%.

Technical Analysis: EUR/USD rises to 1.0870

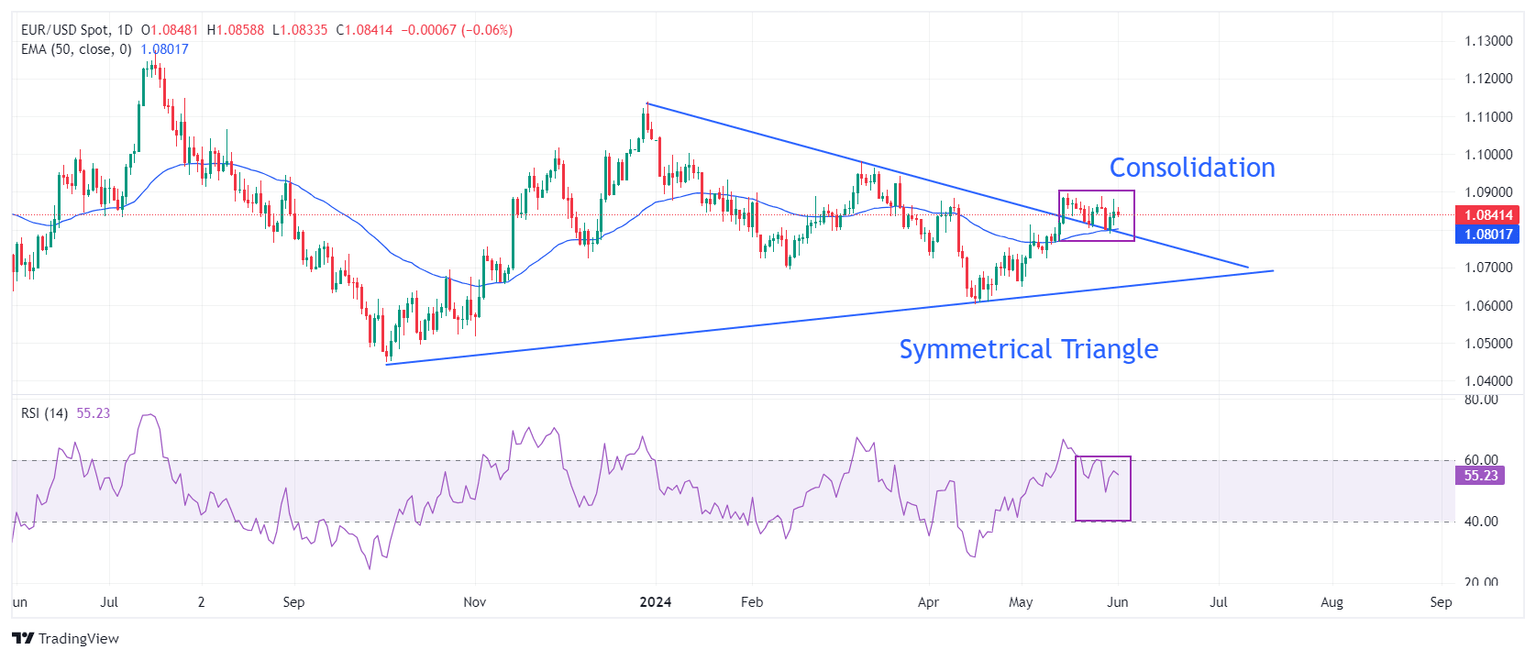

EUR/USD recovers sharply to 1.0870 and is expected to advance towards 1.0900. The major currency pair has been consolidating in a tight range of 1.0788-1.0900 in the last three weeks, suggesting a sharp volatility contraction. The asset holds the breakout move of the Symmetrical Triangle chart formation on a daily timeframe, indicating the upside bias is still intact.

The near-term outlook remains firm as the 50-day Exponential Moving Average (EMA) near 1.0800 is sloping higher.

The 14-period Relative Strength Index (RSI) has slipped into the 40.00-60.00 range, suggesting that the momentum, which was leaned toward the upside, has faded for now.

The major currency pair would strengthen if it recaptures a two-month high around 1.0900. A decisive break above this level would drive the asset towards the March 21 high, around 1.0950, and the psychological resistance of 1.1000. However, a downside move below the 200-day EMA at 1.0800 could push it further down.

Economic Indicator

ECB Main Refinancing Operations Rate

One of the three key interest rates set by the European Central Bank (ECB), the main refinancing operations rate is the interest rate the ECB charges to banks for one-week long loans. It is announced by the European Central Bank at its eight scheduled annual meetings. If the ECB expects inflation to rise, it will increase its interest rates to bring it back down to its 2% target. This tends to be bullish for the Euro (EUR), since it attracts more foreign capital inflows. Likewise, if the ECB sees inflation falling it may cut the main refinancing operations rate to encourage banks to borrow and lend more, in the hope of driving economic growth. This tends to weaken the Euro as it reduces its attractiveness as a place for investors to park capital.

Read more.Next release: Thu Jun 06, 2024 12:15

Frequency: Irregular

Consensus: 4.25%

Previous: 4.5%

Source: European Central Bank

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.