EUR/USD rebounds after sticky US inflation data

- EUR/USD rebounds above 1.0500 as the USD gives up some gains after the US inflation data release.

- The US inflation data grew in line with estimates in November.

- The ECB is expected to cut its Deposit Facility rate by 25 bps on Thursday for the third meeting in a row.

EUR/USD recovers intraday losses and returns above the psychological support of 1.0500 in Wednesday’s North American session after the release of the United States (US) Consumer Price Index (CPI) data for November, which showed signs of stickiness in price pressures. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, gives up intraday gains and slides below 106.50.

The US CPI report showed that price pressures rose expectedly. Annual headline inflation accelerated to 2.7%, as expected, from the October reading of 2.6%. In the same period, the core CPI – which excludes volatile food and energy prices – rose in line with estimates and the prior release of 3.3%. The month-on-month headline and core CPI rose expectedly by 0.3%.

Market expectations for the Federal Reserve’s (Fed) to cut interest rates by by 25 bps to 4.25%-4.50% in the policy meeting on December 18 remains firm after the US inflation data release. According to the CME FedWatch tool, the probability for the Fed to reduce interest rates by 25 bps next week remains close to 88%.

Daily digest market movers: EUR/USD stays broadly under pressure with ECB policy in focus

- EUR/USD remains under pressure broadly on firm expectations that the European Central Bank (ECB) will reduce its Deposit Facility rate by 25 basis points (bps) to 3% in the policy meeting on Thursday. As for the ECB, a rate cut would be the third straight one in a row and the fourth this year.

- A 25-bps interest rate reduction by the ECB is widely anticipated as policymakers are increasingly convinced that inflation is under control and increasing signs that Eurozone business activity is struggling. Meanwhile, a handful of ECB officials see risks of inflation undershooting the central bank’s target due to potential tariff threats by US President-elect Donald Trump and weak domestic demand.

- With traders pricing in an ECB rate cut on Thursday, investors will pay close attention to President Christine Lagarde’s comments in the press conference after the policy decision for fresh interest-rate guidance. Lagarde could deliver somewhat dovish remarks due to political instability in Germany and France and the potential adverse impact of Trump’s tariffs on the export sector.

- Meanwhile, German Chancellor Olaf Scholz is set to submit a request for a no-confidence vote on December 16, a necessary precursor for holding elections on February 23, 2025, Reuters report. German government collapsed after Olaf dismissed Finance Minister Christian Lindner, dissolving the three-party coalition.

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.16% | 0.26% | 0.47% | 0.05% | 0.34% | 0.34% | 0.04% | |

| EUR | -0.16% | 0.10% | 0.32% | -0.11% | 0.18% | 0.17% | -0.12% | |

| GBP | -0.26% | -0.10% | 0.19% | -0.21% | 0.08% | 0.08% | -0.23% | |

| JPY | -0.47% | -0.32% | -0.19% | -0.43% | -0.14% | -0.15% | -0.44% | |

| CAD | -0.05% | 0.11% | 0.21% | 0.43% | 0.29% | 0.29% | -0.02% | |

| AUD | -0.34% | -0.18% | -0.08% | 0.14% | -0.29% | -0.01% | -0.31% | |

| NZD | -0.34% | -0.17% | -0.08% | 0.15% | -0.29% | 0.00% | -0.30% | |

| CHF | -0.04% | 0.12% | 0.23% | 0.44% | 0.02% | 0.31% | 0.30% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

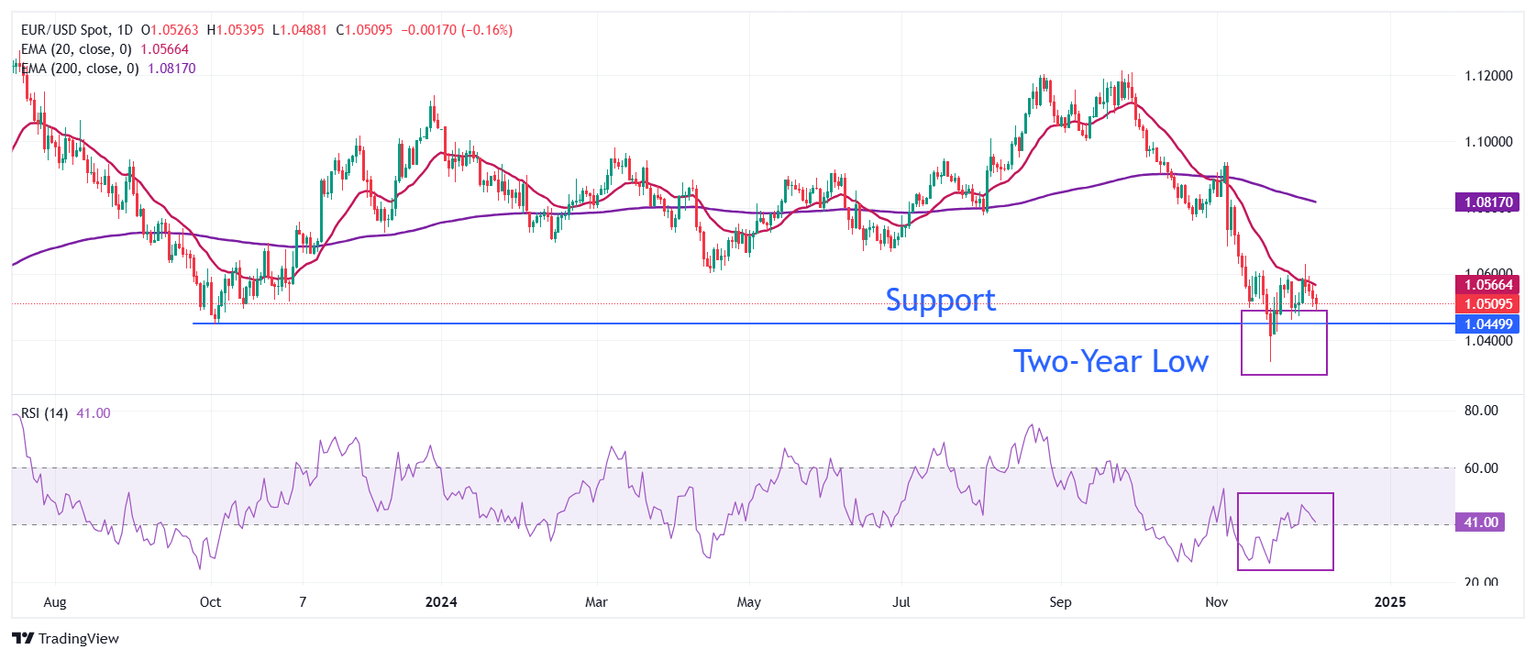

Technical Analysis: EUR/USD skates on thin ice near 1.0500

EUR/USD struggles near the psychological figure of 1.0500. The outlook of the major currency pair remains bearish as the 20-day EMA near 1.0565 acts as key resistance for the Euro (EUR) bulls.

The 14-day Relative Strength Index (RSI) wobbles near 40.00. Should the RSI fall below this level, a bearish momentum will trigger.

Looking down, the November 22 low of 1.0330 will be a key support. On the flip side, the 50-day EMA near 1.0700 will be the key barrier for the Euro bulls.

Economic Indicator

ECB Rate On Deposit Facility

One of the European Central Bank's three key interest rates, the rate on the deposit facility, is the rate at which banks earn interest when they deposit funds with the ECB. It is announced by the European Central Bank at each of its eight scheduled annual meetings.

Read more.Next release: Thu Dec 12, 2024 13:15

Frequency: Irregular

Consensus: 3%

Previous: 3.25%

Source: European Central Bank

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.