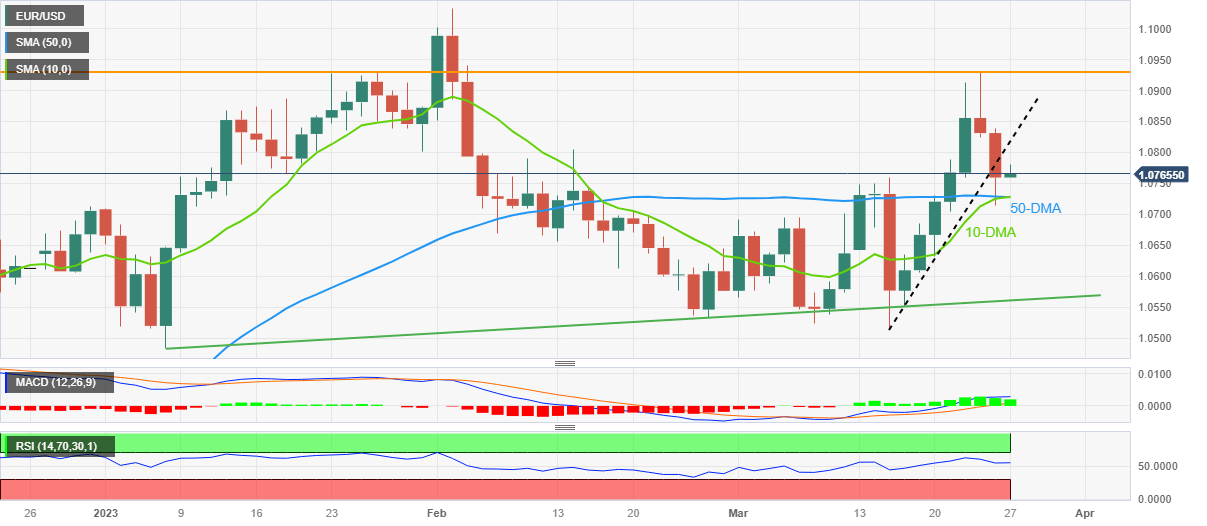

EUR/USD Price Analysis: Retreats towards 1.0730 support confluence

- EUR/USD eases from intraday high, pares the first daily gain in three.

- Clear downside break of short-term ascending trend line, steady RSI keeps sellers hopeful.

- Convergence of 50-DMA, 10-DMA challenges Euro bears amid bullish MACD signals.

EUR/USD takes a U-turn from the intraday high while declining to 1.0770 during the mid-Asian session on Monday.

In doing so, the major currency pair consolidation the first daily gains in three while justifying the previous day’s downside break of a one-week-old ascending trend line amid steady RSI (14) line.

However, a convergence of the 50-DMA and the 10-DMA, around 1.0730, appears a tough nut to crack for the EUR/USD bears, especially amid bullish MACD signals.

Even if the quote drops below 1.0730, tops marked during early March around 1.690 could challenge the pair sellers before directing them to an upward-sloping support line from early January, around 1.0560 by the press time.

Meanwhile, the EUR/USD buyers remain off the table unless the quote remains below the previous support line, around 1.0820 by the press time.

Even so, multiple tops marked around 1.0930 becomes crucial for the bulls to tackle before eyeing the yearly high surrounding 1.1033.

Overall, EUR/USD is likely to grind lower but an area between the aforementioned DMA convergence and the support-turned-resistance line appears the key for the pair traders to watch.

EUR/USD: Daily chart

Trend: Limited downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.