EUR/USD Price Analysis: Retreats from the weekly high to near 1.0770

- EUR/USD could approach the major support at 1.0750 following February’s low at 1.0694.

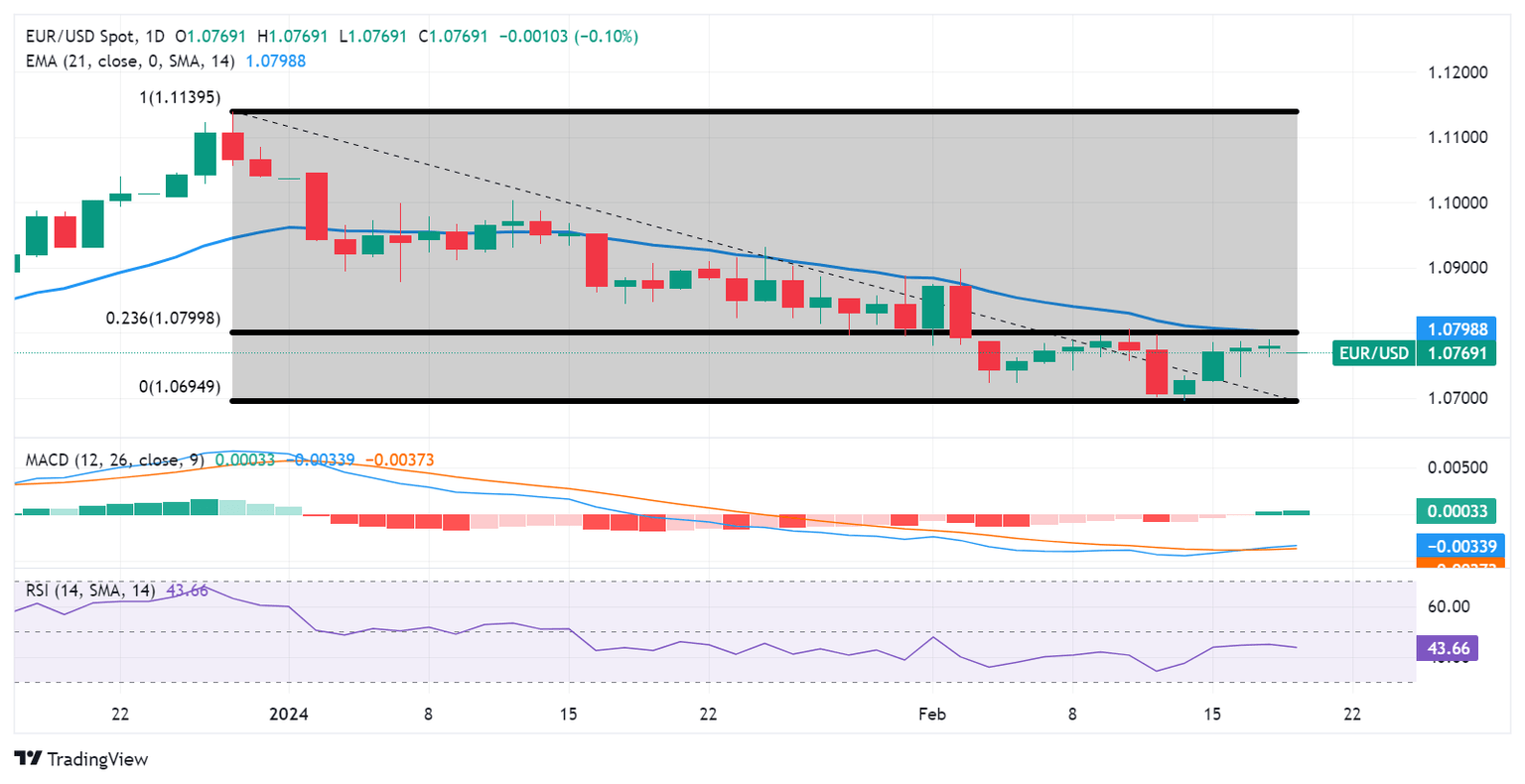

- The resistance zone could be found around the 21-day EMA at 1.0798 and the 23.6% Fibonacci retracement at 1.0799.

- Traders may await the lagging indicator MACD to confirm a directional trend.

EUR/USD retreats from the weekly high of 1.0789, which was recorded on Monday, snapping a four-day winning streak. The pair trades lower around 1.0770 during the Asian hours on Tuesday with positioning above the immediate support at the psychological level of 1.0750.

A break below the latter could put weight on the EUR/USD pair to navigate the further support region around the psychological level of 1.0700, in conjunction with February’s low at 1.0694, which was observed on February 14.

The EUR/USD pair could find the key resistance zone around the 21-day Exponential Moving Average (EMA) at 1.0798 lined up with the 23.6% Fibonacci retracement at 1.0799 and the psychological level of 1.0800.

A firm breakthrough above the resistance zone could exert upward support on the EUR/USD pair to explore the further major barrier at 1.0850, to revisit February’s high at 1.0897 aligned with the psychological level of 1.0900.

The technical analysis of the EUR/USD pair suggests a mixed outlook in the market. The 14-day Relative Strength Index (RSI) is below the 50 mark, indicating a bearish momentum. However, the lagging indicator Moving Average Convergence Divergence (MACD), although still below the centerline, is above the signal line, suggesting a tepid momentum in the market.

Given these conflicting signals, market participants may choose to await further confirmation from the MACD indicator on the directional trend for the EUR/USD pair.

EUR/USD: Daily Chart

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.