EUR/USD Price Analysis: Retraces recent gains ahead of Fed decision, hovers below 1.0800

- EUR/USD halts its two-day winning streak ahead of monetary decisions from both economies.

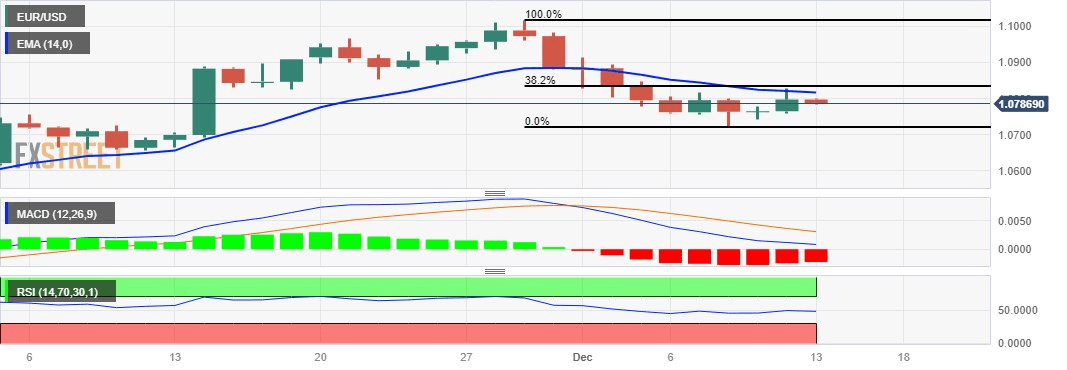

- Technical indicators suggest a potential revisit to the weekly low at 1.0741.

- A breakthrough above the 1.0800 level could lead the pair to reach the 14-day EMA at 1.0816.

EUR/USD halts to continue a two-day winning streak ahead of the monetary policy decisions from the United States (US) and the Eurozone on Wednesday and Thursday, respectively. The EUR/USD pair trades lower around 1.0790 during the Asian session on Wednesday.

The technical signals for the EUR/USD pair favor the ongoing downward movement. With the 14-day Relative Strength Index (RSI) staying below the 50 mark, there's a bearish sentiment suggesting a potential revisit to the major support at the 1.0750 level before the weekly low at 1.0741.

If the pair manages to break below the latter, it could put pressure on the EUR/USD pair to navigate the four-week low at the 1.0723 level followed by the psychological support region around the 1.0700 level.

Additionally, the Moving Average Convergence Divergence (MACD) suggests the weakening of the overall positive momentum as the MACD line is positioned above the centerline but exhibits divergence below the signal line. This shows a potential shift in the direction of the trend.

On the upside, the EUR/USD pair could find a key resistance around the psychological region at the 1.0800 level. A breakthrough above the barrier could reinforce the strength of the EUR/USD pair to explore the area around the 14-day Exponential Moving Average (EMA) at 1.0816 followed by the 38.2% Fibonacci retracement at 1.0833. If the EUR/USD pair surpasses these levels, the major level at 1.0850 could be tested as a further barrier.

EUR/USD: Daily Chart

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.