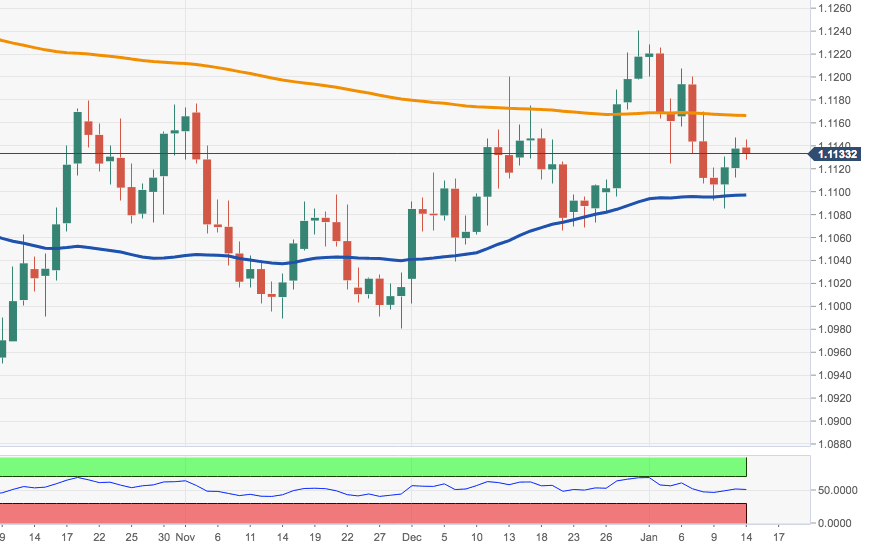

EUR/USD Price Analysis: Focus remains on the 200-day SMA near 1.1140

- EUR/USD meets expected resistance in the 1.1140 region.

- The outlook stays positive above the 55-day SMA (1.1093).

The ongoing recovery in EUR/USD has so far struggled to overcome the key barrier at the 1.1140 region, home of the key 200-day SMA.

Above this area, the buying pressure is seen regaining strength with the immediate targets then at 1.1186 (Fibo retracement) ahead of late December peaks near 1.1240.

In case sellers return to the market, then the 55-day SMA in the 1.1090 region should re-emerge on the horizon.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.