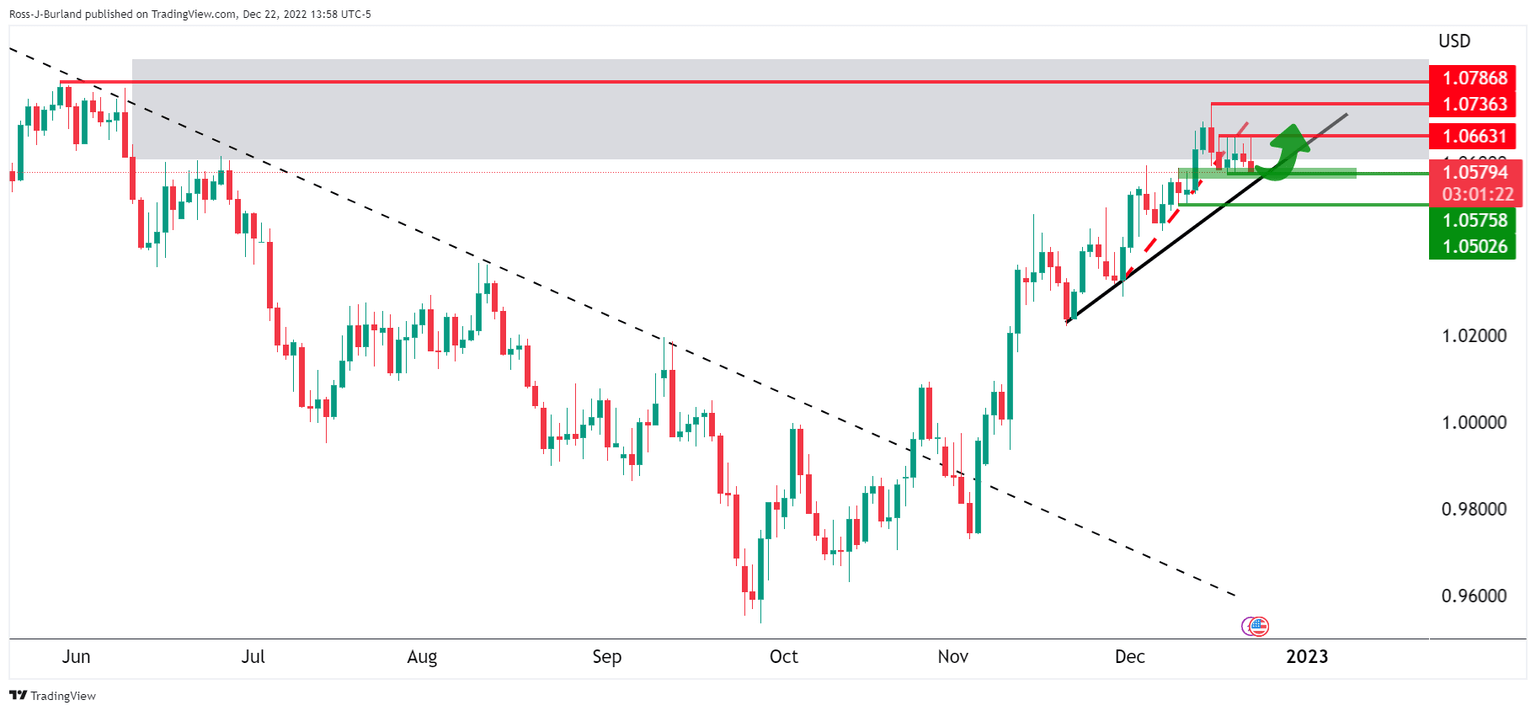

EUR/USD Price Analysis: Bears sink in their teeth to test bulls at a critical support structure

- EUR/USD is testing a critical support structure that guards a breakout.

- EUR/USD has otherwise supported within the bullish cycle with prospects of a bullish extension.

EUR/USD is moving in towards a price imbalance between 1.0580 and 1.0560 having already made a low of 1.0582. The price is coiled below the top of the bullish cycle up at 1.0763 and is breaking down the trend which leaves the bias to the downside. The following illustrates the prospects of an explosive move below trendline support and given the holidays, a narrow range could be the fuel for the same in the full trading days between Christmas and New Year.

EUR/USD daily charts

The breakout traders buying at the highs of the day are trapped following an inside day on Wednesday. The subsequent blow-off to the downside on Thursday is keeping longs trapped all the way to test the coil's lows. A break of 1.0575 opens the risk of a measured move near the Point of Control (Poc) of the bullish trend's swing lows of 1.0227 to cycle highs of 1.0736.

The PoC comes in at 1.0520. A full 100% range expansion comes in at 1.0493. If this scenario were to play out, an M-formation would be left on the chart and typically, the price would correct back towards the neckline for the restest of prior support prior to the next bearish impulse. In this case, 1.0450 will be eyed.

On the flip side:

The price remains in a bullish trend and there is every possibility that we could see a higher for days ahead, i.e. consolidation within the bullish trendline and horizontal support of 1.0575 or thereabouts followed by a surge in demand to target fresh cycle highs.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.