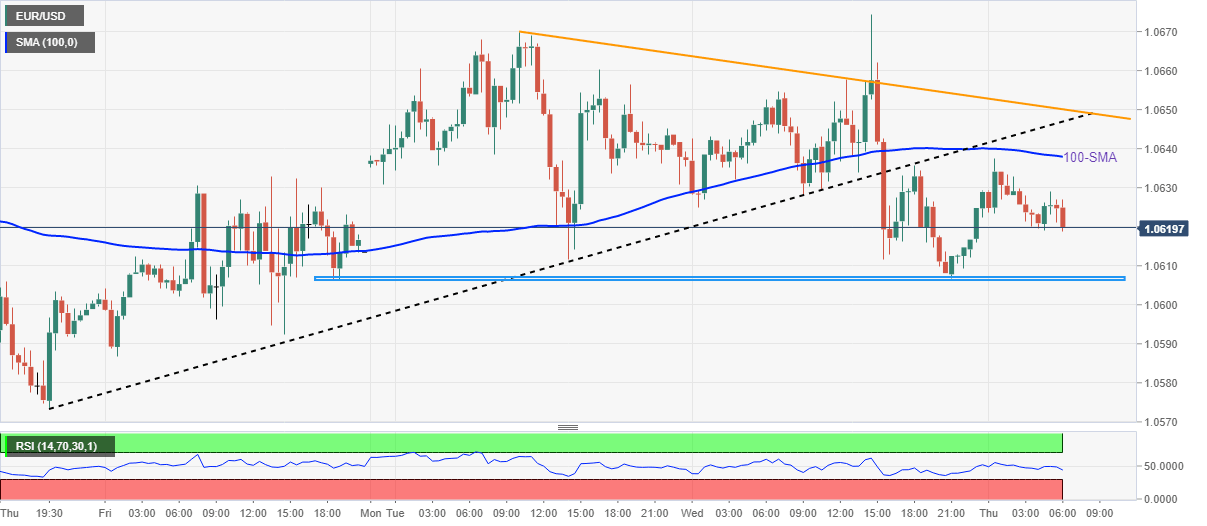

EUR/USD Price Analysis: Bearish bias remains intact below 1.0650 hurdle

- EUR/USD pares the first daily gains in three during sluggish session.

- Clear downside break of weekly support line, sustained trading below 100-SMA favor sellers.

- Descending trend line from Tuesday adds to the upside filters.

- Weekly horizontal support restricts immediate downside amid steady RSI.

EUR/USD takes offers to consolidate the first daily gains in three around 1.0620 heading into Thursday’s European session. Even so, the major currency pair prints 0.13% intraday gains by the press time.

That said, the quote broke a one-week-old ascending trend line, as well as the 100-Simple Moving Average (SMA), the previous day and favored the bears.

The following corrective bounce off the late Friday’s trough, however, failed to cross the aforementioned hurdles and join the steady RSI (14) to keep sellers hopeful.

As a result, EUR/USD bears are likely to revisit the weekly horizontal support zone surrounding 1.0600, a break of which could quickly drag the quote towards the previous weekly low near 1.0575.

It’s worth noting that the pair’s weakness past 1.0575 will highlight the 1.0440 support level, as well as the monthly low of 1.0393 for the EUR/USD sellers.

On the contrary, the 100-SMA level of 1.0640 precedes the previous support line, around 1.0645 at the latest, to restrict the short-term EUR/USD upside.

Following that, a downward-sloping trend line from Tuesday, close to 1.0650 by the press time, will gain the market’s attention.

In a case where the EUR/USD bulls manage to cross the 1.0650 hurdle, which is less expected, the quote is likely to refresh the monthly high, currently around 1.0735.

EUR/USD: 30-minute chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.