EUR/USD soars as soft US CPI report gives life to Fed rate-cut hopes for September

- EUR/USD recovers to 1.0830 after soft US Inflation report.

- Soft US CPI data has boosted Fed rate-cut expectations for the September meeting.

- ECB policymakers refrain from providing a specific interest-rate path.

EUR/USD jumps swiftly above the round-level resistance of 1.0800 in Wednesday’s New York session. The major currency pair strengthens after the United States (US) Consumer Price Index (CPI) report for May turned out to be softer than expected. This has boosted market speculation for the Federal Reserve (Fed) to start reducing interest rates from the September meeting. The CME FedWatch tool shows that the probability of the Fed cutting rates from September jumps to 55.4% from below 50% after the release of the CPI report.

US annual core inflation, which strips off volatile food and energy prices, decelerated to 3.4 from the estimates of 3.5% and April’s reading of 3.6%. In the same period, headline inflation grew at a slower pace of 3.3% against expectations and the prior release of 3.4%. Monthly headline CPI turned out to be stagnant while investors forecasted a nominal increase of 0.l%. The core inflation rose by 0.2%, slower than estimates and the former reading of 0.3%.

A higher-than-expected decline in US inflation data weighs heavily on the US Dollar. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, tumbles to near 104.50. 10-year US Treasury yields plunge below 4.30%.

Meanwhile, investors await the Federal Reserve’s (Fed) interest rate decision, which is scheduled for the late American session. Investors will pay close attention to US inflation data and the Fed’s dot plot, as it is widely expected that the central bank will leave interest rates unchanged in the range of 5.25%-5.50% for the seventh time in a row. The Fed’s dot plot indicates where policymakers see the federal funds rate heading in the medium and long-term time frames.

Currently, financial markets lean towards the Fed's decision to begin cutting interest rates at the September meeting after the inflation data. Earlier, traders pared their Fed rate-cut bets for September after the May US Nonfarm Payrolls (NFP) report indicated robust job demand and strong wage growth, which suggested a stubborn inflation outlook.

The new projections for the number of rate cuts are expected to show fewer rate cuts compared to the three predicted In March’s dot plot as officials lose confidence over progress in the disinflation process.

Daily digest market movers: EUR/USD surges as US Dollar plummets

- EUR/USD climbs above 1.0800 as the US Dollar has been hit hard due to a soft US inflation report for May. However, the Euro remains vulnerable against other currencies due to uncertainty surrounding the French elections. Political stability in the Eurozone shaked after French President Emmanuel Macron’s decision to call for a snap election after suffering a defeat by Jordan Bardella-led far-right National Rally, popularly known as Rassemblement National (RN).

- Exit polls on Monday showed that the RN party could win 235 to 265 seats, still short of the 289 needed for an absolute majority, Reuters reported. Analysts see Macron’s decision to call a snap election as a gamble that could further weaken the position of the Centralist alliance.

- Meanwhile, uncertainty over the European Central Bank’s (ECB) interest-rate path appears to be waning as policymakers are holding themselves back from committing to any specific rate-cut trajectory. ECB officials worry that inflation could remain sticky in the next few months due to steady wage growth, which fuels service inflation. In May, Eurozone service inflation rose to 4.1%, the highest in seven months.

- ECB policymaker and Governor of the French central bank Francois Villeroy de Galhau said on Tuesday that he is confident that price pressures will return to its 2% target next year but they have to pass through some bumps in monthly data. "This 'noise' is not very meaningful, and hence we are still more 'outlook driven' and will look still more closely at the inflation forecast,” Villeroy added, according to Reuters.

EUR/USD Price Today:

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the US Dollar.

| EUR | USD | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| EUR | 0.95% | 0.09% | 0.12% | 0.38% | -0.44% | -0.27% | 0.25% | |

| USD | -0.95% | -0.88% | -0.81% | -0.54% | -1.37% | -1.23% | -0.72% | |

| GBP | -0.09% | 0.88% | 0.06% | 0.32% | -0.50% | -0.33% | 0.16% | |

| JPY | -0.12% | 0.81% | -0.06% | 0.24% | -0.58% | -0.43% | 0.08% | |

| CAD | -0.38% | 0.54% | -0.32% | -0.24% | -0.82% | -0.65% | -0.18% | |

| AUD | 0.44% | 1.37% | 0.50% | 0.58% | 0.82% | 0.17% | 0.68% | |

| NZD | 0.27% | 1.23% | 0.33% | 0.43% | 0.65% | -0.17% | 0.50% | |

| CHF | -0.25% | 0.72% | -0.16% | -0.08% | 0.18% | -0.68% | -0.50% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

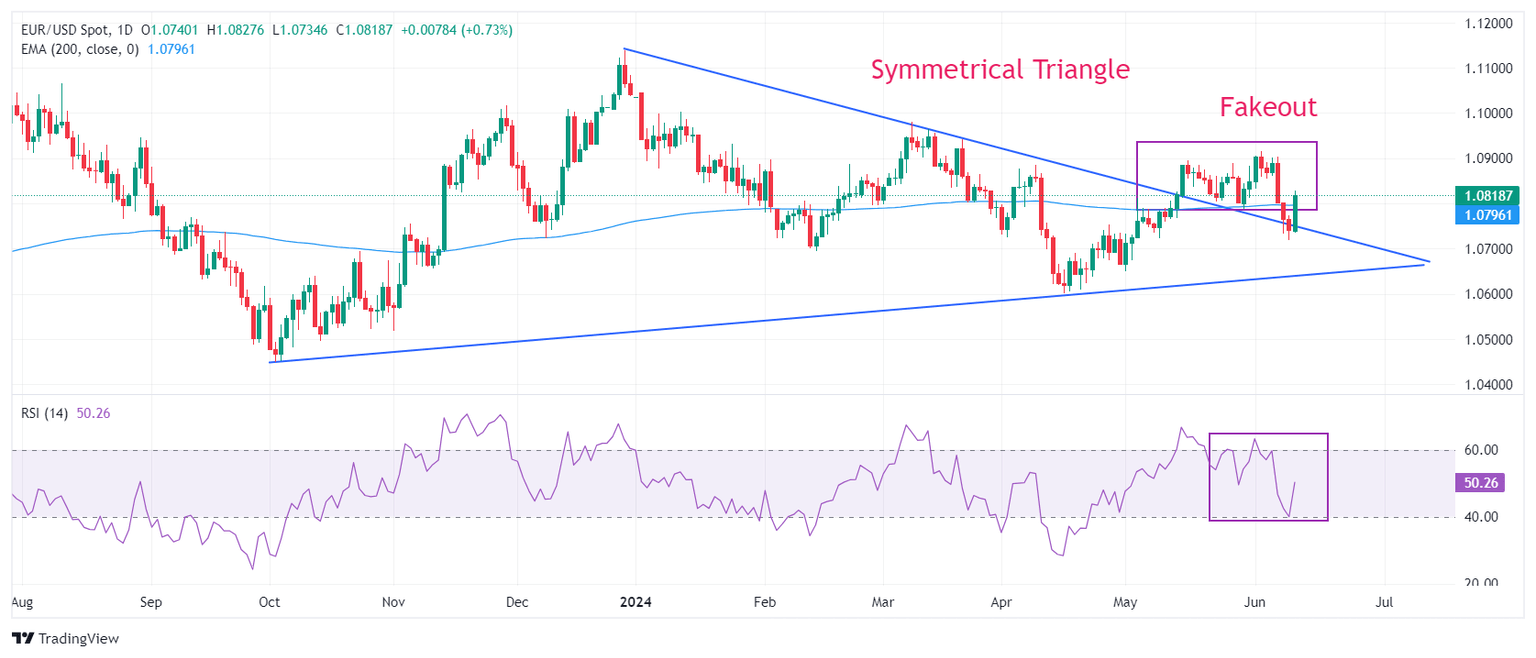

Technical Analysis: EUR/USD breaks above triangle formation

EUR/USD delivers V-shape recovery after sliding to an almost five-week low near 1.0710. The near-term outlook of the major currency pair improves as it rises above the Symmetrical Triangle chart formation on a daily time frame. The shared currency pair approaches a two-month high near 1.0900.

The long-term outlook of the shared currency pair has turned positive after rebounding above the 200-day Exponential Moving Average (EMA), which trades around 1.0800.

The 14-period Relative Strength Index (RSI) finds a cushion near 40.00 and is expected to remain sideways.

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.