EUR/USD slides on ECB dovish bets, US inflation in focus

- EUR/USD drops to near 1.0520 as investors await key events including US inflation and the ECB policy meeting.

- The ECB is widely anticipated to cut its Deposit Facility Rate by 25 bps to 3% on Thursday.

- Economists expect US annual core CPI to have grown steadily by 3.3% in November.

EUR/USD slides to near 1.0520 in Tuesday’s North American session as investors turn cautious ahead of the European Central Bank (ECB) monetary policy meeting, which will be announced on Thursday. Traders have priced in a 25-basis points (bps) reduction in the Deposit Facility Rate to 3%. This would be the third interest rate cut decision by the ECB in a row.

Market experts assume that a slew of factors, including Donald Trump’s victory in the United States (US) Presidential elections, political turmoil in France and Germany, and a sharp slowdown in the Eurozone business activity compelled financial market participants to factor in an interest rate reduction in the policy meeting on Thursday.

The fallout of the government in France and instability in Germany and France could have a direct impact on the Eurozone economic growth, which will weigh on price pressures, as these two are the largest economies of the trading bloc. The impact of Trump’s tariffs on Eurozone inflation when he reaches the White House is still uncertain.

ECB policymakers are divided over whether the impact of Trump tariffs will be inflationary or deflationary on the Eurozone economy. A handful of ECB policymakers assume that Trump’s tariffs will weaken the Euro (EUR) against the USD significantly, a scenario that will make imports costlier for individuals and boost price pressures. On the contrary, a few officials forecast risks of inflation undershooting the bank’s target as higher tariffs will dampen the Eurozone’s export sector.

Daily digest market movers: EUR/USD slides as US Dollar gains with US inflation taking center stage

- EUR/USD drops as the US Dollar (USD) rises, with investors awaiting the US Consumer Price Index (CPI) data release for November, which is scheduled for Wednesday. The inflation report is expected to show that the annual headline CPI rose at a faster pace of 2.7% from the prior release of 2.6%. The core CPI – which excludes volatile food and energy prices – is expected to rise steadily by 3.3%.

- The inflation data is less likely to influence Federal Reserve (Fed) interest rate expectations for the policy meeting on December 18 unless the data deviates from expectations significantly.

- According to the CME FedWatch tool, the probability for the Fed to reduce interest rates by 25 bps to 4.25%-4.50% is almost 90%. Analysts at Macquire agree with Fed rate cut market expectations for next week but expect the central bank to deliver a slightly hawkish interest rate guidance.

- “The recent slowdown in the pace of US disinflation, a lower Unemployment Rate than what the Fed projected in September, and exuberance in US financial markets are contributing to this more hawkish stance,” analysts at Macquarie said.

- Meanwhile, Q3 Unit Labor Costs data has come in weaker than expected. The Unit Labor Cost data rose by 0.8%, less than half the pace estimated and the prior release of 1.9%.

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.20% | -0.11% | 0.36% | -0.02% | 0.70% | 0.83% | 0.13% | |

| EUR | -0.20% | -0.30% | 0.14% | -0.23% | 0.50% | 0.64% | -0.07% | |

| GBP | 0.11% | 0.30% | 0.45% | 0.08% | 0.81% | 0.94% | 0.23% | |

| JPY | -0.36% | -0.14% | -0.45% | -0.37% | 0.35% | 0.47% | -0.21% | |

| CAD | 0.02% | 0.23% | -0.08% | 0.37% | 0.72% | 0.86% | 0.16% | |

| AUD | -0.70% | -0.50% | -0.81% | -0.35% | -0.72% | 0.13% | -0.53% | |

| NZD | -0.83% | -0.64% | -0.94% | -0.47% | -0.86% | -0.13% | -0.69% | |

| CHF | -0.13% | 0.07% | -0.23% | 0.21% | -0.16% | 0.53% | 0.69% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

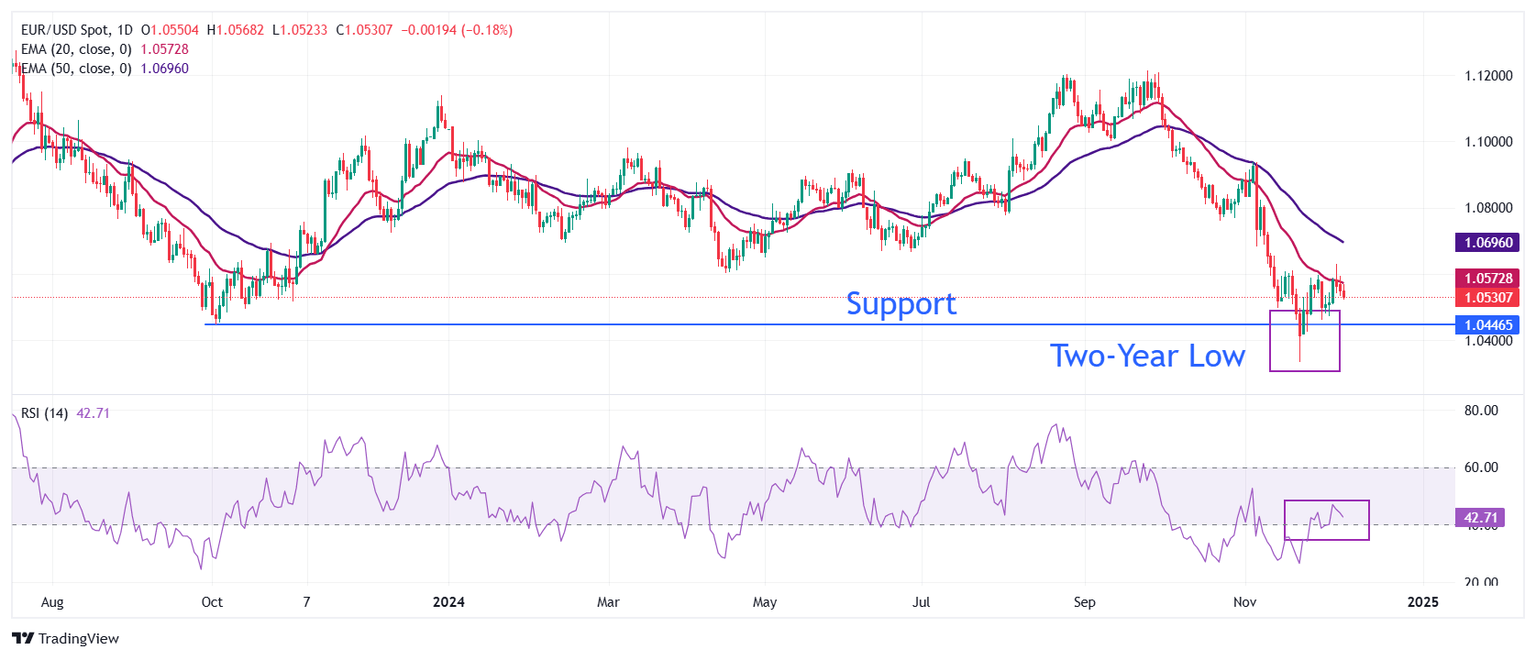

Technical Analysis: EUR/USD retreats from 20-day EMA

EUR/USD wobbles above the psychological figure of 1.0500. The outlook of the major currency pair remains bearish as the 20-day EMA near 1.0573 acts as key resistance for the Euro (EUR) bulls.

The 14-day Relative Strength Index (RSI) rebounded after conditions turned oversold and climbed above 40.00, suggesting that the bearish momentum has faded. However, the broader bearish trend for the pair doesn’t seem to be over yet.

Looking down, the November 22 low of 1.0330 will be a key support. On the flip side, the 50-day EMA near 1.0700 will be the key barrier for the Euro bulls.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.