EUR/USD weakens after ECB policy meeting

- EUR/USD weakens as the ECB didn't deliver subsequent rate cuts.

- Fed Governor Christopher Waller stated that the US central bank is ‘getting closer’ to a rate cut.

- Firm Fed rate-cut prospects have weighed on the US Dollar.

EUR/USD declines to near 1.0920 in Thursday’s American session from a fresh four-month high near 1.0950 on Wednesday. The major currency pair drops after the European Central Bank (ECB) announced its July policy meeting. The ECB left key interest rates unchanged, as expected. The Main Refinancing Operations Rate and the Deposit Facility Rate remain steady at 4.25% and 3.75%, respectively.

ECB's decision of avoiding the delivery of subsequent rate cuts was expected as officials had been refraining from committing a pre-defined rate-cut path amid concerns over sticky inflation in the service sector, which is capable to reverse the disinflation process.

The ECB delivered its first rate cut in June after maintaining a restrictive interest rate framework for two years to tame hot inflationary pressures driven by coronavirus-pandemic-led stimulus. The reasoning behind unwinding the tight policy stance was the firm confidence of officials that risks to inflation and the economy are finely balanced and price pressures will return to the desired rate of 2%.

Currently, financial markets expect that the ECB will deliver two more rate cuts this year. The ECB is also expected to deliver its next rate-cut move in September.

Meanwhile, ECB President Christine Lagarde said in the policy statement, "The governing council is not pre-committing to a particular rate path." Lagarde added that the headline inflation is seen well-above the desired rate into next year. Over the interest rate outlook, Lagarde said, "We will continue to follow a data-dependent and meeting-by-meeting approach to determining the appropriate level and duration of restriction. In the press conference, when asked about expectations for subsequent rate cuts in September, Lagarde commented, "The question of September and what we do in September is wide open," Reuters reported.

Daily Digest Market Movers: EUR/USD declines as US Dollar bounces back

- EUR/USD corrects to near 1.0920 as the US Dollar (USD) gains ground after posting fresh lows near 103.70. While, the near-term outlook of the US Dollar remains vulnerable. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, finds a cushion near a more than three-month low at 103.70.

- The US Dollar could face selling pressure amid firm speculation that the Federal Reserve (Fed) will start reducing interest rates from the September meeting. Easing price pressures and cooling labor market conditions have prompted upbeat expectations for Fed rate cuts. June’s Consumer Price Index (CPI) report showed that annual headline and core inflationary pressures decelerated at a faster-than-expected pace.

- Fed’s Beige Book, released on Wednesday, showed that firms witnessed moderate growth and slower labor demand from late May through early July. Recent employment data also showed that the Unemployment Rate rose to 4.1%, the highest since December 2021.

- Recent inflation figures have also boosted the confidence of policymakers that inflation will return to the path of 2% target. On Wednesday, Fed Governor Christopher Waller communicated confidence over moderation in the job market and inflation. When asked about rate cuts, Waller said, “I do believe we are getting closer to the time when a cut in the policy rate is warranted," Reuters reported.

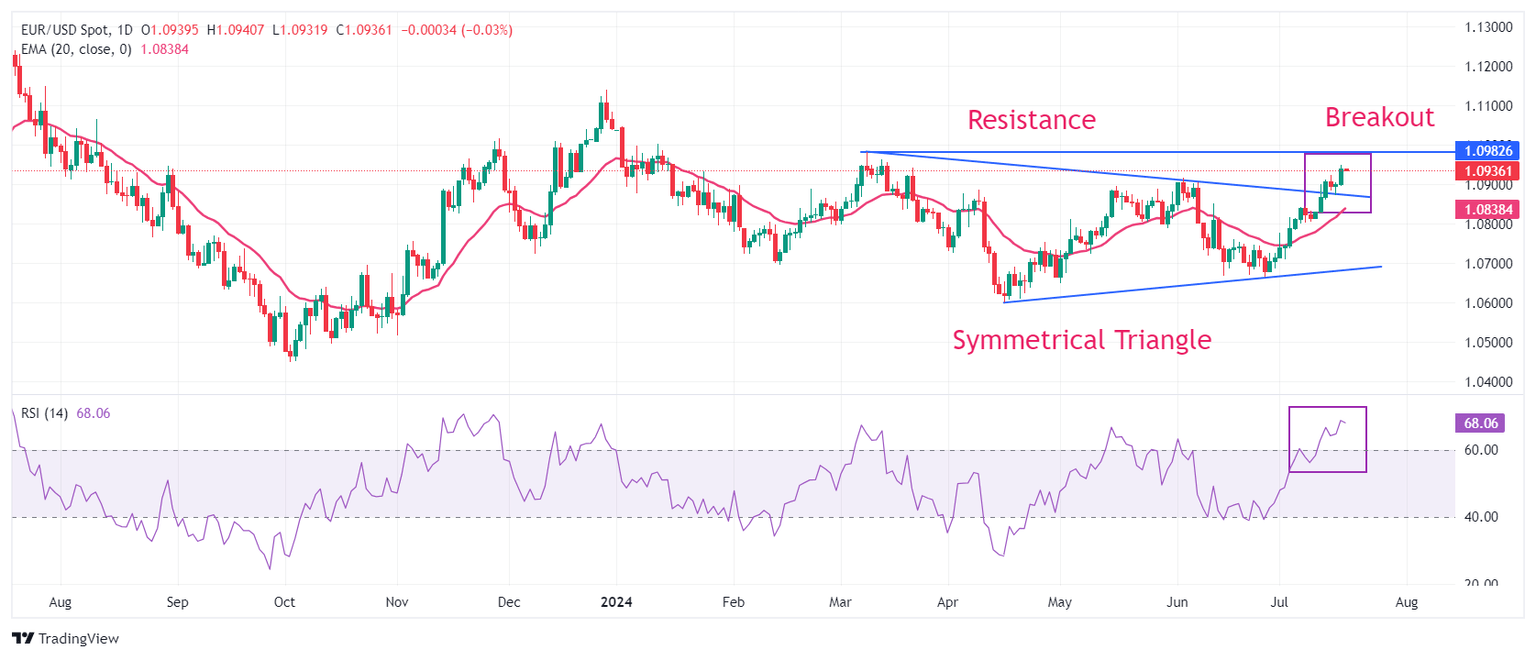

Technical Analysis: EUR/USD holds key support of 1.0900

EUR/USD slides to near 1.0920 and remains inside Wednesday’s trading range ahead of the ECB policy meeting. The major currency pair remains firm after a breakout of the Symmetrical Triangle formation on a daily timeframe. A breakout of the above-mentioned chart pattern results in wider ticks and heavy volume.

The near-term outlook of the major currency pair is bullish as the 20-day Exponential Moving Average (EMA) near 1.0816 is sloping higher.

The 14-day Relative Strength Index (RSI) shifts into the bullish range of 60.00-80.00, suggesting a strong upside momentum.

The shared currency pair is expected to extend its upside towards March 8 high near 1.0980. On the contrary, a downside move below the round-level support of 1.0800 could weaken the pair.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.