EUR/USD comes under pressure amid caution ahead of FOMC minutes

- EUR/USD faces selling pressure as investors shift focus to the FOMC minutes.

- ECB policymakers are divided about continuing the dovish trend beyond the June meeting.

- Fed officials want to see inflation easing for months before lowering interest rates.

EUR/USD faces selling pressure and declines to 1.0820 in Wednesday’s New York session. The major currency pair trades cautiously ahead of the release of the Federal Open Market Committee (FOMC) minutes later in the day and the Eurozone/United States preliminary Purchasing Managers Index (PMI) data for May, which will be published on Thursday. The PMI data will provide cues about trends in demand, inflation and employment.

The Euro remains underpinned against the US Dollar as market participants doubt whether the European Central Bank (ECB) will extend the interest rate cuts beyond June. Few ECB policymakers, such as Bundesbank President Joachim Nagel, President of De Nederlandsche Bank Klaas Knot, Belgium Bank Governor Pierre Wunsch and Bank of Latvia Governor Martins Kazaks, believe that a rate-cut move in June is on the cards, but a follow-up move could be premature.

On the inflation outlook, ECB’s Nagel said, "There may well be months when inflation picks up a little, as some prices tend to fluctuate – energy prices in particular". Nagel added, "On the whole, I expect inflation to carry on declining towards our 2% target and to reach it in 2025."

Daily digest market movers: EUR/USD faces sell-off as US Dollar advances

- EUR/USD ticks down to 1.0840 as uncertainty over Federal Reserve (Fed) rate-cut timing has deepened. Fed officials support keeping interest rates at their current levels until they get evidence that inflation will sustainably return to the desired rate of 2%.

- The expected decline in the annual United States Consumer Price Index (CPI) data for April failed to build confidence among Fed policymakers that the progress in the disinflation process will continue. Given the strength of the US economy, officials are worried that the slowdown in price pressures will not last longer.

- On Tuesday, Cleveland Fed Bank President Loretta Mester said that she wants to see good inflation data for months in order to become comfortable with supporting a move to policy normalization. When asked about a concrete timeframe for rate cuts, Atlanta Federal Reserve President Raphael Bostic said he doesn’t expect them before the fourth quarter of this year. On the inflation outlook, Bostic commented that business owners have experienced a decline in pricing power but are confident about economic prospects.

- Going forward, investors will focus on the FOMC minutes of the May meeting, which will be published in Wednesday’s New York session. The impact of the FOMC minutes is expected to be light as Fed’s decision-making on interest rates was based on stubborn inflation data recorded in the January-March period.

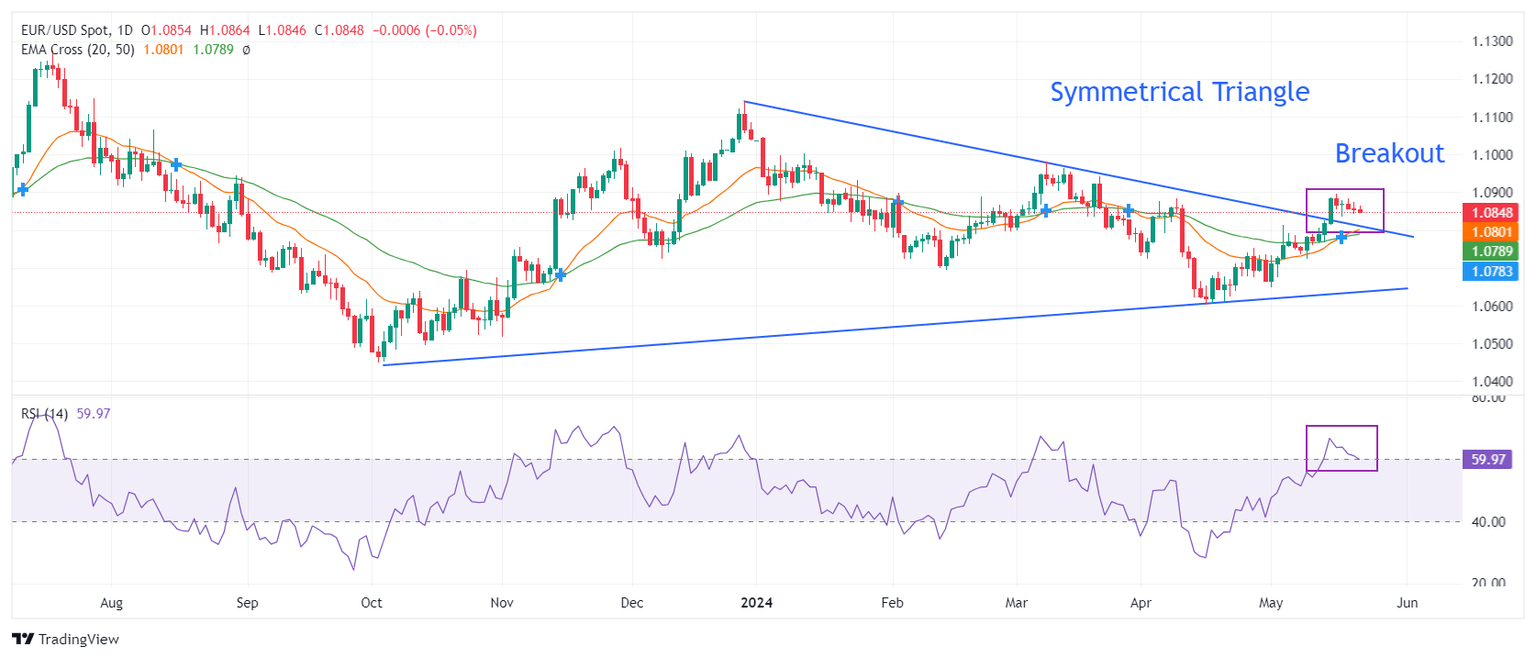

Technical Analysis: EUR/USD falls to test Triangle breakout region near 1.0800

EUR/USD slips to 1.0840 as investors await the FOMC minutes release for fresh guidance. The major currency pair declines toward the breakout region of the Symmetrical Triangle around 1.0810, formed on a daily timeframe. The near-term outlook of the shared currency pair is still strong as the 20-day and 50-day Exponential Moving Averages (EMAs) have delivered a bullish crossover around 1.0780.

The 14-period Relative Strength Index (RSI) has shifted comfortably into the bullish range of 60.00-80.00, suggesting that the momentum has leaned toward the upside.

ECB FAQs

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy for the region. The ECB primary mandate is to maintain price stability, which means keeping inflation at around 2%. Its primary tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will usually result in a stronger Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

In extreme situations, the European Central Bank can enact a policy tool called Quantitative Easing. QE is the process by which the ECB prints Euros and uses them to buy assets – usually government or corporate bonds – from banks and other financial institutions. QE usually results in a weaker Euro. QE is a last resort when simply lowering interest rates is unlikely to achieve the objective of price stability. The ECB used it during the Great Financial Crisis in 2009-11, in 2015 when inflation remained stubbornly low, as well as during the covid pandemic.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the European Central Bank (ECB) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the ECB stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive (or bullish) for the Euro.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.