EUR/JPY Price Prediction: Decisive break above range could pave way for more gains

- EUR/JPY has broken above the ceiling of its multi-month range indicating it could be poised to move even higher.

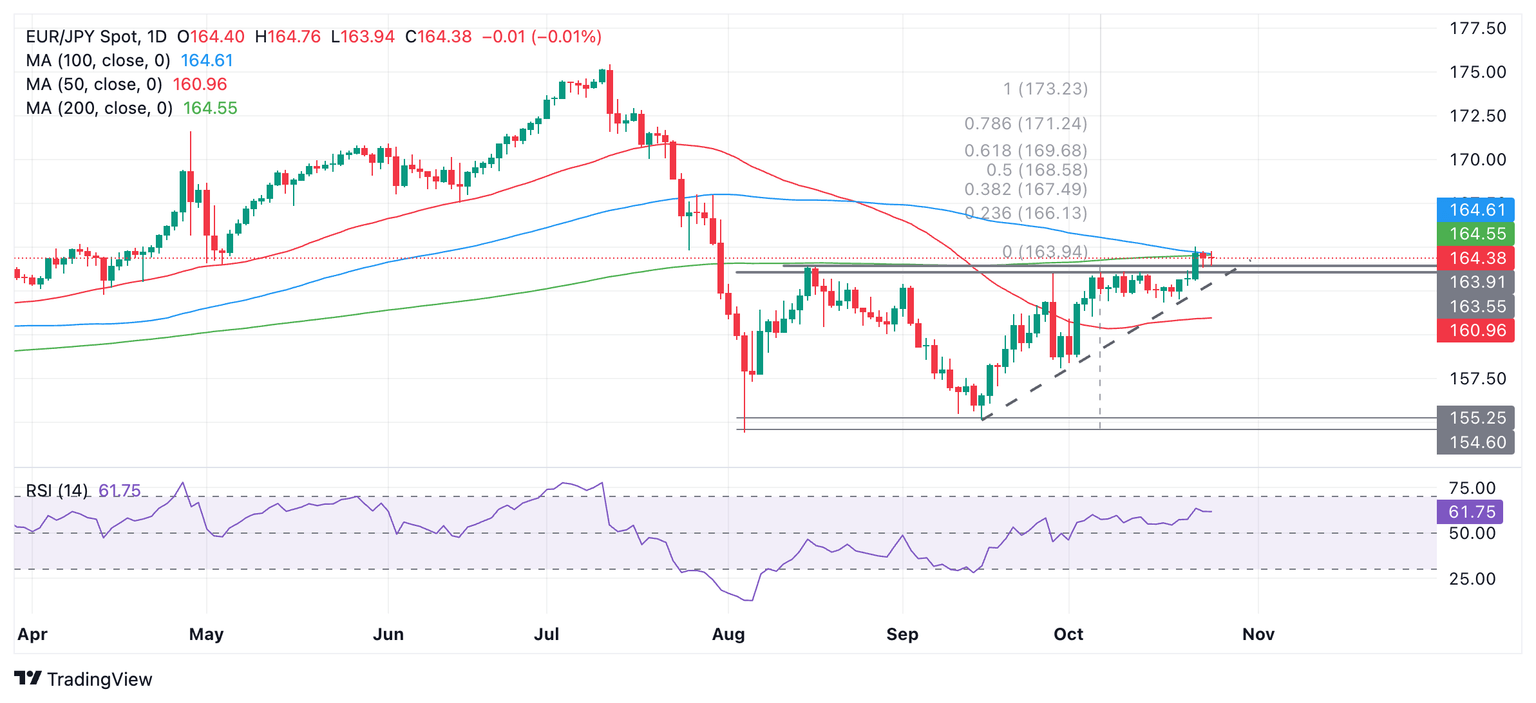

- Resistance from the 100 and 200-day SMA remains the last hurdle before bulls can run free.

EUR/JPY pierced cleanly through the ceiling of its multi-month range and appears to have established a foothold in the territory above.

Thursday’s mild withdrawal soon found support at the top of the range in the 163.80s suggesting resistance has metamorphosed into support. On Friday price has so far also remained above the range ceiling.

Lying immediately above price however is stiff resistance from a cluster of the (blue) 100 and (green) 200-day Simple Moving Averages (SMA).

EUR/JPY Daily Chart

The short and medium-term trends are bullish suggesting the odds favor more upside to come, however, the two SMAs are major obstacles that need to be traversed before bulls can be confident of following through higher.

A break above 164.90 would probably confirm a decisive break above these two SMAs and result in a move up to the minimum target for the breakout from the range at 169.68. This is the 61.8% Fibonacci extrapolation of the height of the range to the upside.

Alternatively, it is still also possible EUR/JPY could capitulate back inside the range. However, for this to be confirmed, price would have to break below 161.85 (October 17 swing low). This seems less likely given the decisive way in which price broke out of the ceiling of the range on Wednesday.

The Relative Strength Index (RSI) momentum indicator is not yet in the overbought zone (above 70) suggesting the pair has room to go higher.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.