EUR/GBP Price Forecast: Returns to comfort of the range

- EUR/GBP has returned to the range it has been trading in since the end of September.

- It will probably continue oscillating there until it breaks out either higher or lower.

- The false downside break at the start of November, suggests the range floor may be vulnerable.

EUR/GBP continues trading in a range. The pair is probably now in a sideways trend and given the principle of technical analysis that “the trend is your friend” it will probably continue oscillating until it makes a decisive breakout one way or another.

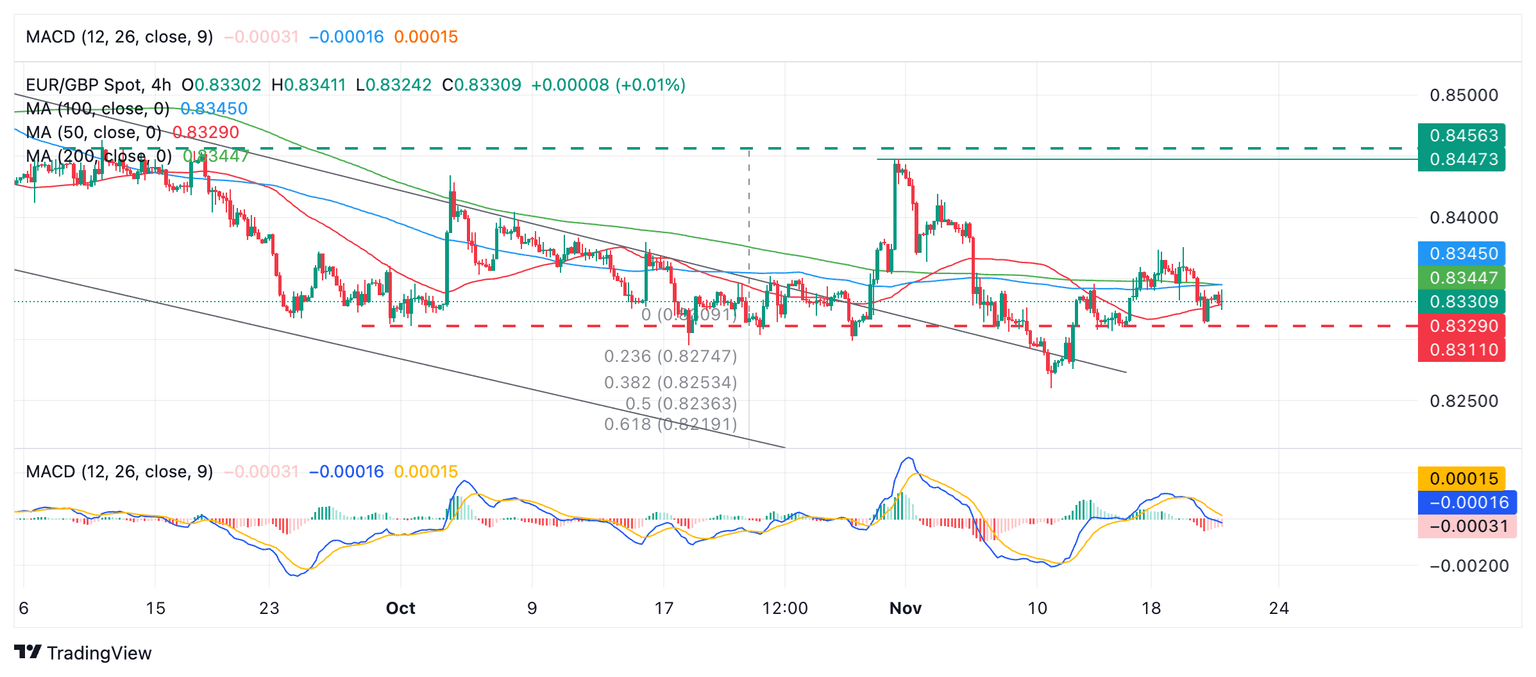

EUR/GBP 4-hour Chart

The pair made a false break on November 8 when it fell to a two-and-a-half year low of 0.8260. However, rather than continuing down to the target generated from the range, EUR/GBP recovered back inside where it now trades.

Because it is in a sideways trend, however, the odds favor a continuation sideways, which suggests the possibility of a recovery from the current level near the range floor, and the unfolding of a leg up towards the ceiling at around 0.8450.

It is too early to say with any confidence whether EUR/GBP will indeed rise up to the top of the range. Further, the false break may be a sign of weakness and be followed by another break lower, thus complicating the picture and adding a bearish tone to the chart.

Assuming a break lower, it is possible the pair could fall to the target established by the range, at 0.8219 – the 61.8% Fibonacci extension.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.